Question

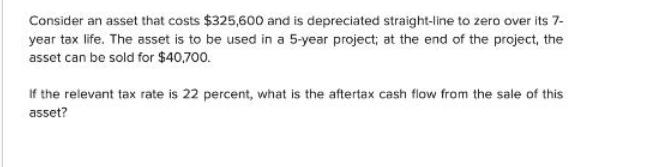

Consider an asset that costs $325,600 and is depreciated straight-line to zero over its 7- year tax life. The asset is to be used

Consider an asset that costs $325,600 and is depreciated straight-line to zero over its 7- year tax life. The asset is to be used in a 5-year project; at the end of the project, the asset can be sold for $40,700. If the relevant tax rate is 22 percent, what is the aftertax cash flow from the sale of this asset?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can analyze and solve the problem in the image The problem states that an asset costs 325600 and is depreciated straightline to zero over its 7year tax life It is then used in a 5year project a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Stephen M. Ross, Randolph W Westerfield, Robert R. Dockson, Bradford D Jordan

12th edition

007353062X, 73530628, 1260153592, 1260153590, 978-1260153590

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App