Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an Australian investor who has a 10 year investment horizon and no liquidity needs over this investment horizon. Based on the risk aversion level,

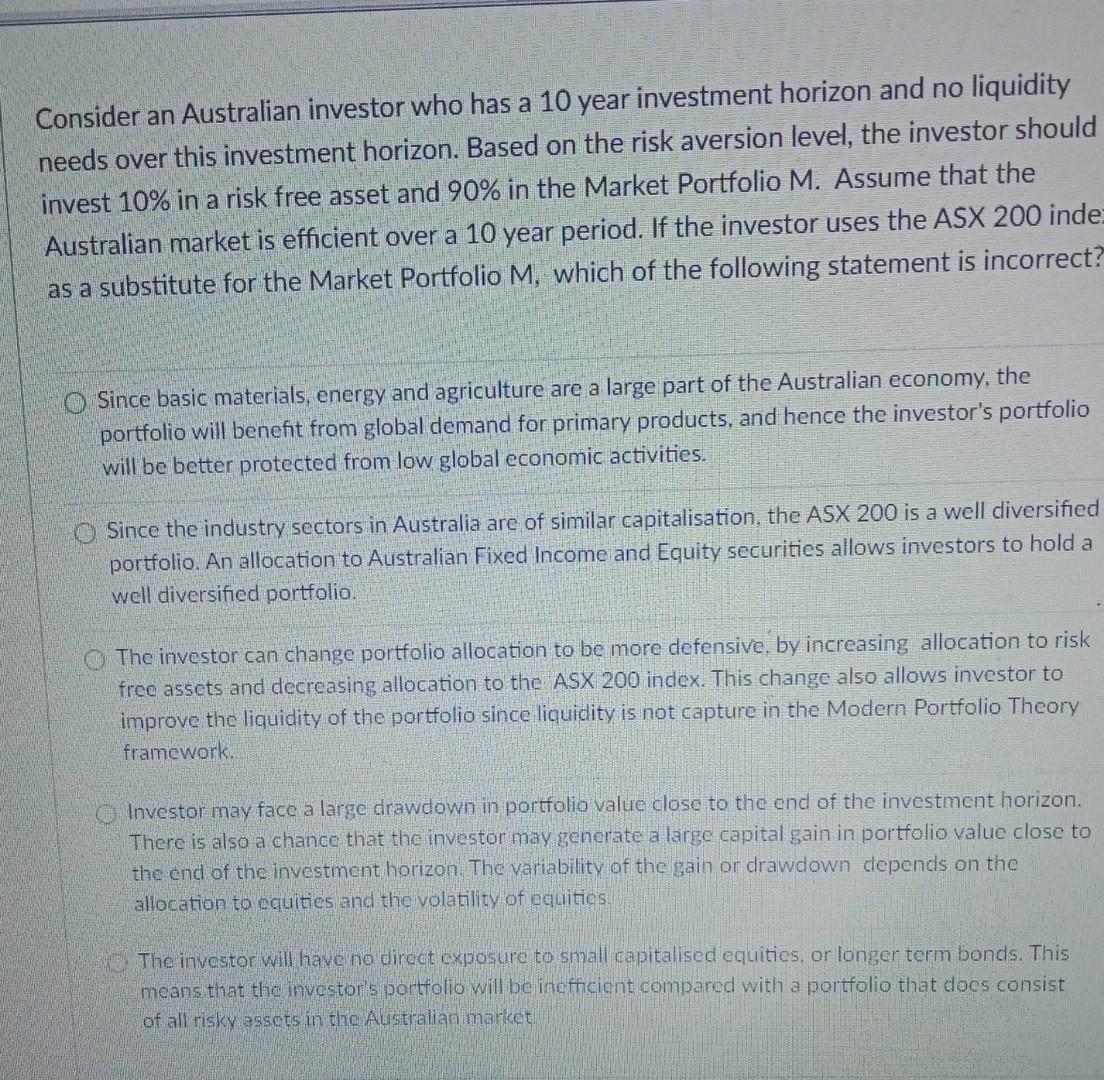

Consider an Australian investor who has a 10 year investment horizon and no liquidity needs over this investment horizon. Based on the risk aversion level, the investor should invest 10% in a risk free asset and 90% in the Market Portfolio M. Assume that the Australian market is efficient over a 10 year period. If the investor uses the ASX 200 inde: as a substitute for the Market Portfolio M, which of the following statement is incorrect? Since basic materials, energy and agriculture are a large part of the Australian economy, the portfolio will benefit from global demand for primary products, and hence the investor's portfolio will be better protected from low global economic activities. Since the industry sectors in Australia are of similar capitalisation, the ASX 200 is a well diversified portfolio. An allocation to Australian Fixed Income and Equity securities allows investors to hold a well diversified portfolio. The investor can change portfolio allocation to be more defensive, by increasing allocation to risk free assets and decreasing allocation to the ASX 200 index. This change also allows investor to improve the liquidity of the portfolio since liquidity is not capture in the Modern Portfolio Theory framework. Investor may face a large drawdown in portfolio value close to the end of the investment horizon. There is also a chance that the investor may generate a large capital gain in portfolio value close to the end of the investment horizon. The variability of the gain or drawdown depends on the allocation to cquities and the volatility of equities The investor will have no direct exposure to small capitalised equities, or longer term bonds. This means that the investor's portfolio will be inefficient compared with a portfolio that does consist of all risky assets in the Australian market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started