Answered step by step

Verified Expert Solution

Question

1 Approved Answer

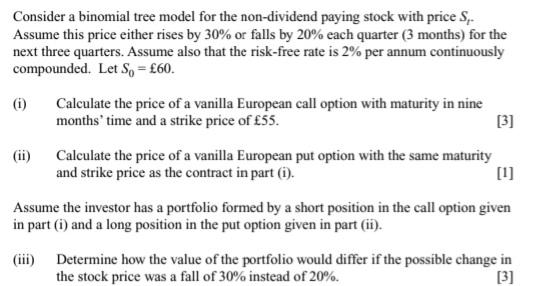

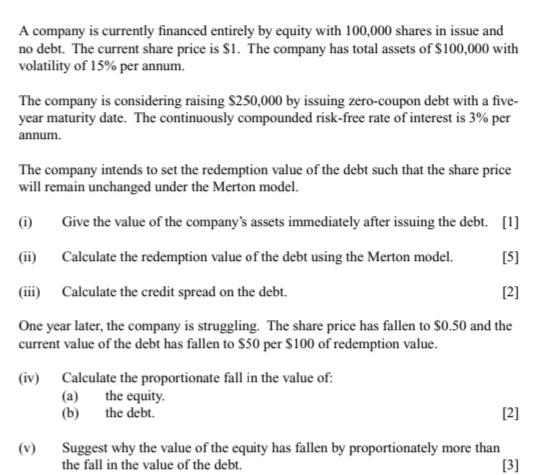

Consider a binomial tree model for the non-dividend paying stock with price S,. Assume this price either rises by 30% or falls by 20%

Consider a binomial tree model for the non-dividend paying stock with price S,. Assume this price either rises by 30% or falls by 20% each quarter (3 months) for the next three quarters. Assume also that the risk-free rate is 2% per annum continuously compounded. Let S = 60. (i) Calculate the price of a vanilla European call option with maturity in nine months' time and a strike price of 55. [3] (ii) Calculate the price of a vanilla European put option with the same maturity and strike price as the contract in part (1). [1] Assume the investor has a portfolio formed by a short position in the call option given in part (1) and a long position in the put option given in part (ii). (iii) Determine how the value of the portfolio would differ if the possible change in the stock price was a fall of 30% instead of 20%. [3] A company is currently financed entirely by equity with 100,000 shares in issue and no debt. The current share price is $1. The company has total assets of $100,000 with volatility of 15% per annum. The company is considering raising $250,000 by issuing zero-coupon debt with a five- year maturity date. The continuously compounded risk-free rate of interest is 3% per annum. The company intends to set the redemption value of the debt such that the share price will remain unchanged under the Merton model. (1) Give the value of the company's assets immediately after issuing the debt. [1] (ii) Calculate the redemption value of the debt using the Merton model. [5] (iii) Calculate the credit spread on the debt. [2] One year later, the company is struggling. The share price has fallen to $0.50 and the current value of the debt has fallen to $50 per $100 of redemption value. (iv) Calculate the proportionate fall in the value of: the equity. the debt. (a) (b) [2] Suggest why the value of the equity has fallen by proportionately more than the fall in the value of the debt. [3]

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the price of a vanilla European call option with a maturity of nine months and a strike price of 55 we can use the binomial tree model Given Initial stock price S 60 Upward movement fac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started