Question

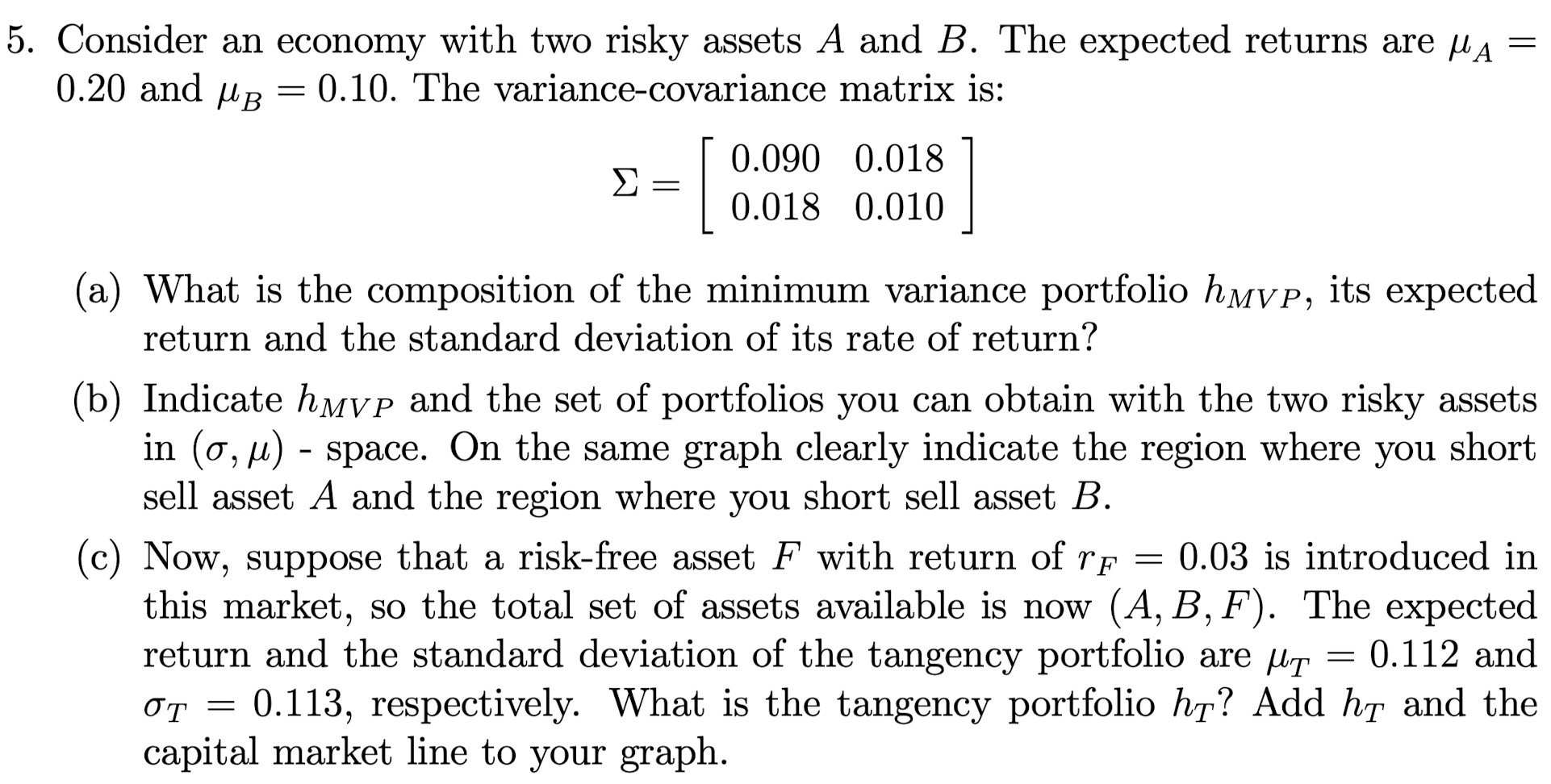

Consider an economy with two risky assets A and B . The expected returns are mu _(A)= 0.20 and mu _(B)=0.10 . The variance-covariance

Consider an economy with two risky assets

Aand

B. The expected returns are

\\\\mu _(A)=\ 0.20 and

\\\\mu _(B)=0.10. The variance-covariance matrix is:\

\\\\Sigma =[[0.090,0.018],[0.018,0.010]]\ (a) What is the composition of the minimum variance portfolio

h_(MVP), its expected\ return and the standard deviation of its rate of return?\ (b) Indicate

h_(MVP)and the set of portfolios you can obtain with the two risky assets\ in

(\\\\sigma ,\\\\mu )- space. On the same graph clearly indicate the region where you short\ sell asset

Aand the region where you short sell asset

B.\ (c) Now, suppose that a risk-free asset

Fwith return of

r_(F)=0.03is introduced in\ this market, so the total set of assets available is now

(A,B,F). The expected\ return and the standard deviation of the tangency portfolio are

\\\\mu _(T)=0.112and\

\\\\sigma _(T)=0.113, respectively. What is the tangency portfolio

h_(T)? Add

h_(T)and the\ capital market line to your graph.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started