Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an European Put option within a binomial tree model. The Put expires in 5 months and has strike K = 100. Today's stock

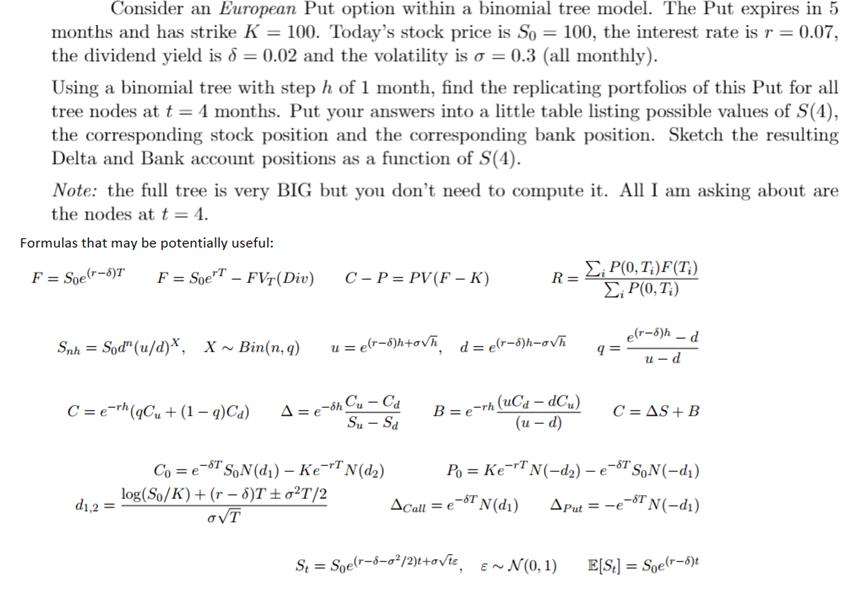

Consider an European Put option within a binomial tree model. The Put expires in 5 months and has strike K = 100. Today's stock price is So = 100, the interest rate is r = 0.07, the dividend yield is 8 = 0.02 and the volatility is o = 0.3 (all monthly). Using a binomial tree with step h of 1 month, find the replicating portfolios of this Put for all tree nodes at t = 4 months. Put your answers into a little table listing possible values of S(4), the corresponding stock position and the corresponding bank position. Sketch the resulting Delta and Bank account positions as a function of S(4). Note: the full tree is very BIG but you don't need to compute it. All I am asking about are the nodes at t = 4. Formulas that may be potentially useful: E, P(0, T;)F(T;) E P(0, T;) F = Soer-syr F = SoeT FVr(Div) C -P = PV(F - K) R = elr-5)h d Snh = Sod" (u/d)x, X~ Bin(n, q) = e(r-6)h+ovh d= er-5)h-aVh u - d C = e-rh(qCu+ (1 4)Ca) A = e-6h Cu Ca Su - Sa B = e-rh (uCa dC,) (u - d) C = AS + B Co = e-8T S,N(d) KeTN(d2) log(So/K) +(r- 8)T 0T/2 oVT Po = Ker"N(-d2) e-ST. "SoN(-di) d1,2 ACall = e-8T N(d1) APut = -e-8T N(-d1) S = Soe(r-8-o*/2)ttovie, E N(0, 1) E[S.] = Soe(r-s)t %3D

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

nd given doda so 1oD total T 5 Month ofe oftHem Selutiona AS lhe Prices are chaoging om bass Hond ly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started