Answered step by step

Verified Expert Solution

Question

1 Approved Answer

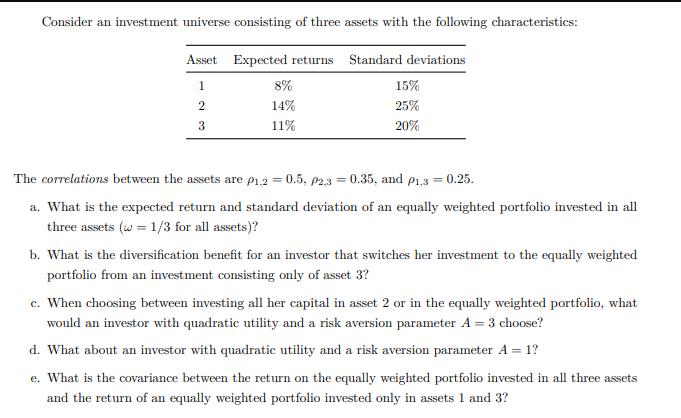

Consider an investment universe consisting of three assets with the following characteristics: Asset Expected returns Standard deviations 1 2 3 8% 14% 11% 15%

Consider an investment universe consisting of three assets with the following characteristics: Asset Expected returns Standard deviations 1 2 3 8% 14% 11% 15% 25% 20% The correlations between the assets are p1.2 = 0.5, P2.3 0.35, and p1,3 = 0.25. a. What is the expected return and standard deviation of an equally weighted portfolio invested in all three assets (w= 1/3 for all assets)? b. What is the diversification benefit for an investor that switches her investment to the equally weighted portfolio from an investment consisting only of asset 3? c. When choosing between investing all her capital in asset 2 or in the equally weighted portfolio, what would an investor with quadratic utility and a risk aversion parameter A = 3 choose? d. What about an investor with quadratic utility and a risk aversion parameter A = 1? e. What is the covariance between the return on the equally weighted portfolio invested in all three assets and the return of an equally weighted portfolio invested only in assets 1 and 3?

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To solve the given problem well use the given expected returns standard deviations and correlations between the assets a Expected return and standard deviation of an equally weighted portfolio investe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started