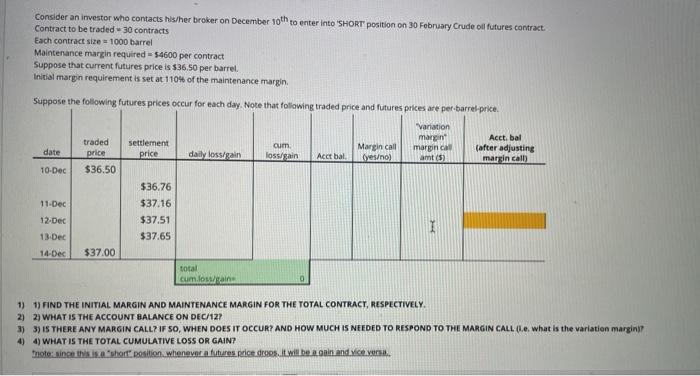

Consider an investor who contacts his/her broker on December 10th to enter into 'SHORT position on 30 February Crude oil futures contract. Contract to be traded 30 contracts Each contract size - 1000 barrel Maintenance margin required - $4600 per contract Suppose that current futures price is $36.50 per barrel Initial margin requirement is set at 110% of the maintenance margin Suppose the following futures prices occur for each day. Note that following traded price and futures prices are per-barrel price cum traded price $36.50 date "variation marin marginal amt (5) settlement price Acct. bal (after adjusting margin call daily loss/gain lossgain Margin call yeso) Acct bal 10-Dec 11-Dec 12 Dec $36.76 $37.16 $37.51 $37.65 I 13 Dec 14-Dec $37.00 total cum.logine 1) 1) FIND THE INITIAL MARGIN AND MAINTENANCE MARGIN FOR THE TOTAL CONTRACT, RESPECTIVELY. 2) 2) WHAT IS THE ACCOUNT BALANCE ON DEC/12? 3) 3) IS THERE ANY MARGIN CALL? IF SO, WHEN DOES IT OCCUR? AND HOW MUCH IS NEEDED TO RESPOND TO THE MARGIN CALL (e. what is the variation margin 4) 4) WHAT IS THE TOTAL CUMULATIVE LOSS OR GAIN? Inote since this short position whenever a futures predeces. It will be on and vice versa Consider an investor who contacts his/her broker on December 10th to enter into 'SHORT position on 30 February Crude oil futures contract. Contract to be traded 30 contracts Each contract size - 1000 barrel Maintenance margin required - $4600 per contract Suppose that current futures price is $36.50 per barrel Initial margin requirement is set at 110% of the maintenance margin Suppose the following futures prices occur for each day. Note that following traded price and futures prices are per-barrel price cum traded price $36.50 date "variation marin marginal amt (5) settlement price Acct. bal (after adjusting margin call daily loss/gain lossgain Margin call yeso) Acct bal 10-Dec 11-Dec 12 Dec $36.76 $37.16 $37.51 $37.65 I 13 Dec 14-Dec $37.00 total cum.logine 1) 1) FIND THE INITIAL MARGIN AND MAINTENANCE MARGIN FOR THE TOTAL CONTRACT, RESPECTIVELY. 2) 2) WHAT IS THE ACCOUNT BALANCE ON DEC/12? 3) 3) IS THERE ANY MARGIN CALL? IF SO, WHEN DOES IT OCCUR? AND HOW MUCH IS NEEDED TO RESPOND TO THE MARGIN CALL (e. what is the variation margin 4) 4) WHAT IS THE TOTAL CUMULATIVE LOSS OR GAIN? Inote since this short position whenever a futures predeces. It will be on and vice versa