Question

Consider an investor with a portfolio consisting only of Advtech shares. The Treasury bill rate in 2014 was 3.06% in South Africa. Using dividend yield

Consider an investor with a portfolio consisting only of Advtech shares. The Treasury bill rate in 2014 was 3.06% in South Africa. Using dividend yield as (returns). Calculate the Sharpe ratio for Advtech.

Hi please help with the above question.

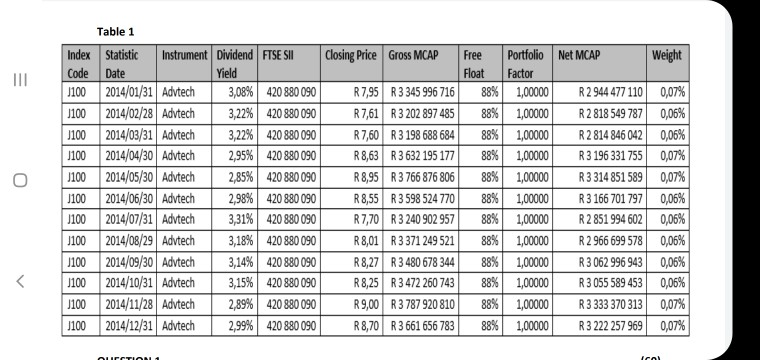

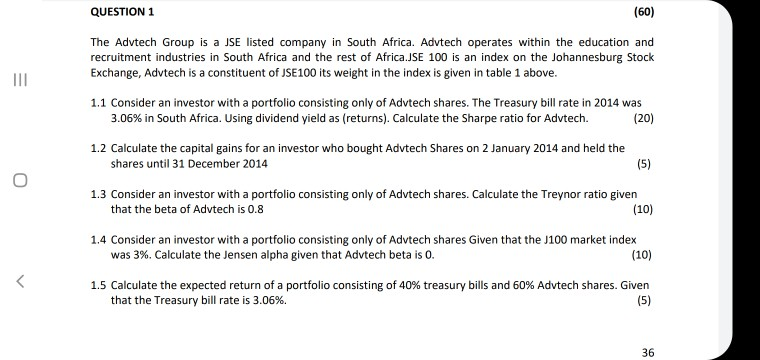

The Advtech Group is a JSE listed company in South Africa. Advtech operates within the education and recruitment industries in South Africa and the rest of Africa.JSE 100 is an index on the Johannesburg Stock Exchange, Advtech is a constituent of JSE100 its weight in the index is given in table 1 above. 1.1 Consider an investor with a portfolio consisting only of Advtech shares. The Treasury bill rate in 2014 was 3.06% in South Africa. Using dividend yield as (returns). Calculate the Sharpe ratio for Advtech. (20) 1.2 Calculate the capital gains for an investor who bought Advtech Shares on 2 January 2014 and held the shares until 31 December 2014 (5) 1.3 Consider an investor with a portfolio consisting only of Advtech shares. Calculate the Treynor ratio given that the beta of Advtech is 0.8 (10) 1.4 Consider an investor with a portfolio consisting only of Advtech shares Given that the J100 market index was 3%. Calculate the Jensen alpha given that Advtech beta is 0. (10) 1.5 Calculate the expected return of a portfolio consisting of 40% treasury bills and 60% Advtech shares. Given that the Treasury bill rate is 3.06%. (5)

0 III 0 Table 1 Index Statistic Instrument Dividend FTSE SI Code Date Yield J100 2014/01/31 Advtech 3,08% 420 880 090 1100 2014/02/28 Advtech 3,22% 420 880 090 J100 2014/03/31 Advtech 3,22% 420 880 090 1100 2014/04/30 Advtech 2,95% 420 880 090 1100 2014/05/30 Advtech 2,85% 420 880 090 1100 2014/06/30 Advtech 2,98% 420 880 090 J100 2014/07/31 Advtech 3,31% 420 880 090 J100 2014/08/29 Advtech 3,18% 420 880 090 J100 2014/09/30 Advtech 3,14% 420 880 090 1100 2014/10/31 Advtech 3,15% 420 880 090 J100 2014/11/28 Advtech 2,89% 420 880 090 J100 2014/12/31 Advtech 2,99% 420 880 090 Closing Price Gross MCAP Free Portfolio Net MCAP Weight Float Factor R 7,95 R3 345 996 716 88% 1,00000 R2 944 477 110 0,07% R7,61 R3 202 897 485 88% 1,00000 R2 818 549 787 0,06% R7,60 R3 198 688 684 88% 1,00000 R2 814 846 042 0,06% R 8,63 R3632 195 177 88% 1,00000 R3 196 331 755 0,07% R 8,95 R3 766 876 806 88% 1,00000 R3 314 851 589 0,07% R 8,55 R3 598 524 770 88% 1,00000 R3 166 701 797 0,06% R7,70 R3 240 902 957 88% 1,00000 R2 851 994 602 0,06% R8,01 R3 371 249 521 88% 1,00000 R2 966 699 578 0,06% R8,27 R3 480 678 344 88% 1,00000 R3 062 996 943 0,06% R8,25 R3472 260 743 88% 1,00000 R3055 589 453 0,06% R 9,00 R3787 920 810 88% 1,00000 R3 333 370 313 0,07% R8,70 R3 661 656 783 88% 1,00000 R3 222 257 969 0,07% AUCTION icol QUESTION 1 (60) The Advtech Group is a JSE listed company in South Africa. Advtech operates within the education and recruitment industries in South Africa and the rest of Africa.JSE 100 is an index on the Johannesburg Stock Exchange, Advtech is a constituent of JSE 100 its weight in the index is given in table 1 above. III 1.1 Consider an investor with a portfolio consisting only of Advtech shares. The Treasury bill rate in 2014 was 3.06% in South Africa. Using dividend yield as (returns). Calculate the Sharpe ratio for Advtech. (20) 1.2 Calculate the capital gains for an investor who bought Advtech Shares on 2 January 2014 and held the shares until 31 December 2014 (5) 0 1.3 Consider an investor with a portfolio consisting only of Advtech shares. Calculate the Treynor ratio given that the beta of Advtech is 0.8 (10) 1.4 Consider an investor with a portfolio consisting only of Advtech shares Given that the J100 market index was 3%. Calculate the Jensen alpha given that Advtech beta is 0. (10) 1.5 Calculate the expected return of a portfolio consisting of 40% treasury bills and 60% Advtech shares. Given that the Treasury bill rate is 3.06%. (5) 36

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started