Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an investor with logarithmic VNM utility and initial wealth Wo. The investor chooses a portfolio at date 0 to maximize the expected utility

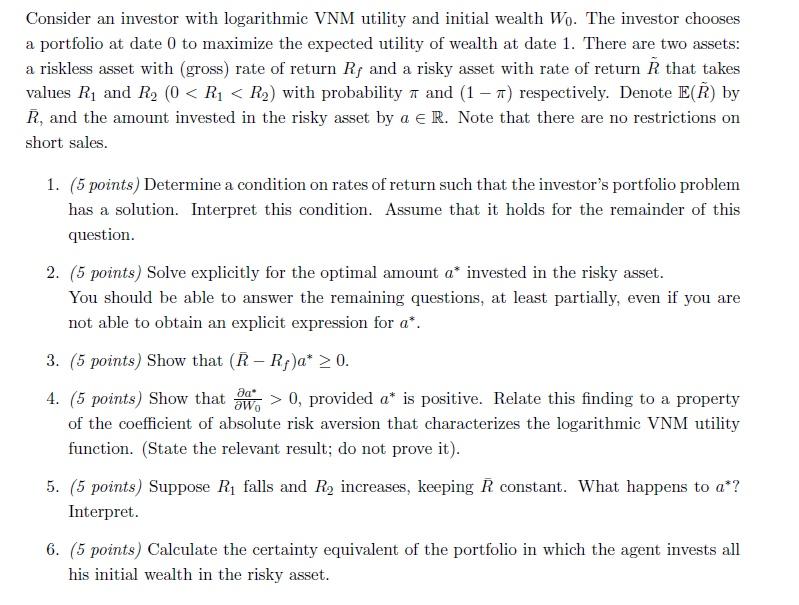

Consider an investor with logarithmic VNM utility and initial wealth Wo. The investor chooses a portfolio at date 0 to maximize the expected utility of wealth at date 1. There are two assets: a riskless asset with (gross) rate of return Rf and a risky asset with rate of return that takes values R and R (0 < R < R) with probability and (1-7) respectively. Denote E(R) by R, and the amount invested in the risky asset by a R. Note that there are no restrictions on short sales. 1. (5 points) Determine a condition on rates of return such that the investor's portfolio problem has a solution. Interpret this condition. Assume that it holds for the remainder of this question. 2. (5 points) Solve explicitly for the optimal amount a* invested in the risky asset. You should be able to answer the remaining questions, at least partially, even if you are not able to obtain an explicit expression for a*. 3. (5 points) Show that (R-Rf)a* 0. 4. (5 points) Show that w > 0, provided a* is positive. Relate this finding to a property of the coefficient of absolute risk aversion that characterizes the logarithmic VNM utility function. (State the relevant result; do not prove it). 5. (5 points) Suppose R falls and R increases, keeping R constant. What happens to a*? Interpret. 6. (5 points) Calculate the certainty equivalent of the portfolio in which the agent invests all his initial wealth in the risky asset.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Explanation 1 To determine a condition for a solution to the investors portfolio problem we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started