1. Prepare an income statement for the year ended December 31, 2023. 2.Prepare a statement of changes inequity for the year ended December 31, 2023.

- 1. Prepare an income statement for the year ended December 31, 2023.

- 2.Prepare a statement of changes inequity for the year ended December 31, 2023.

- 3.Prepare an balance sheet for the year ended December 31, 2023.

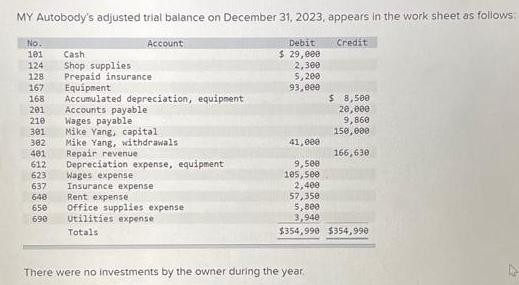

MY Autobody's adjusted trial balance on December 31, 2023, appears in the work sheet as follows: Debit No. 101 $ 29,000 124 2,300 128 Prepaid insurance 167 Equipment 168 Accumulated depreciation, equipment 201 210 301 382 481 612 623 637 648 650 690 Cash Shop supplies Account Accounts payable Wages payable Mike Yang, capital Mike Yang, withdrawals Repair revenue Depreciation expense, equipment Wages expense Insurance expense Rent expense Office supplies expense Utilities expense Totals 5,200 93,000 Credit There were no investments by the owner during the year. $ 8,500 20,000 9,860 150,000 41,000 9,500 105,500 2,400 57,350 5,800 3,940 $354,990 $354,990 166,630

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Income Statement for the year ended December 31 2023 Revenue Repair Revenue 166630 This is the total revenue generated from repair services during the year Expenses Depreciation Expense Equipment 95...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started