Consider an investor, Yuna, who is based in Tokyo. The annual interest rates in Japan, the U.S., and New Zealand respectively are iJP = 1%, iUS = 4%, iNZ = 7%. The ex- change rates of Japanese Yen (JPY) and New Zealand Dollar against the USD respectively are 1JP Y = 0.01U SD and 1N ZD = 0.70U SD (note that these exchange rates are being quoted in the USD numeriare). We assume that there are neither bid/ask spreads nor arbitrage opportuni- ties. 1a/ From Yunas perspective and for one-year horizon: Is USD traded at a forward premium or a forward discount against JPY? Is NZD traded at a forward premium or a forward discount against JPY? (Hint: to answer this question, you need to compute the one-year forward exchange rates of USD and NZD against JPY).

1a/ From Yunas perspective and for one-year horizon: Is USD traded at a forward premium or

a forward discount against JPY? Is NZD traded at a forward premium or a forward discount

against JPY? (Hint: to answer this question, you need to compute the one-year forward exchange rates of

USD and NZD against JPY).

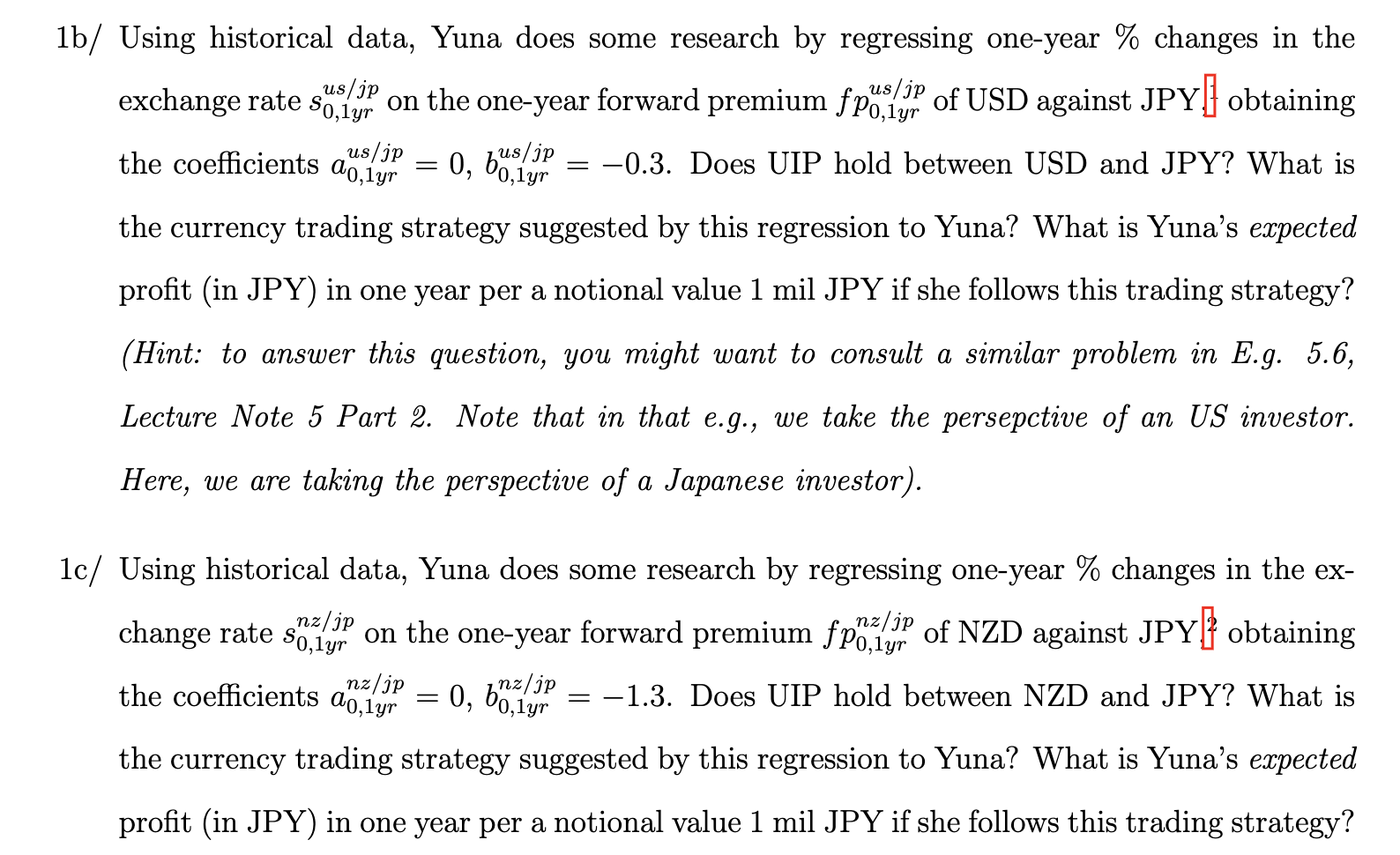

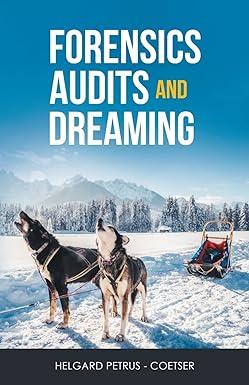

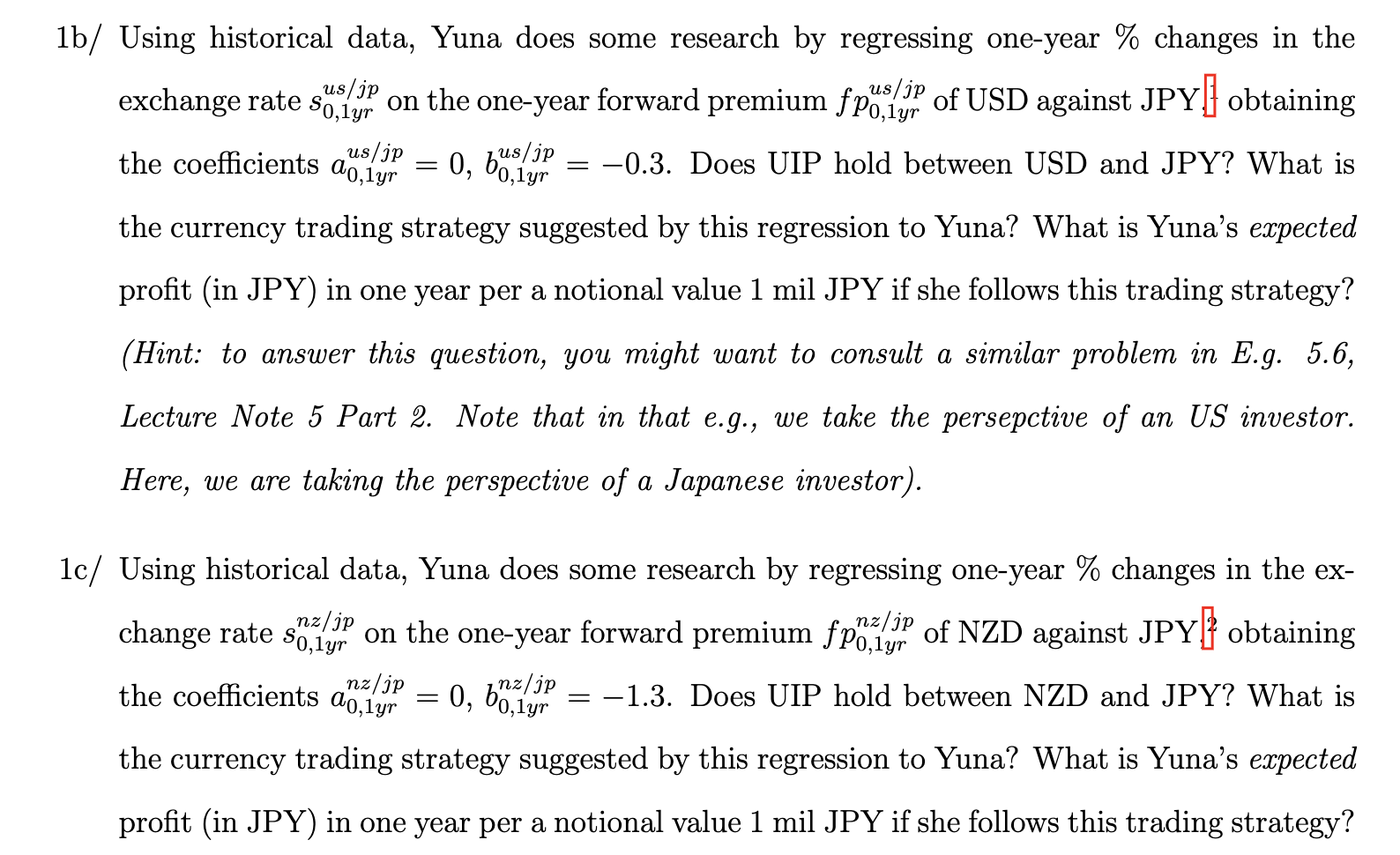

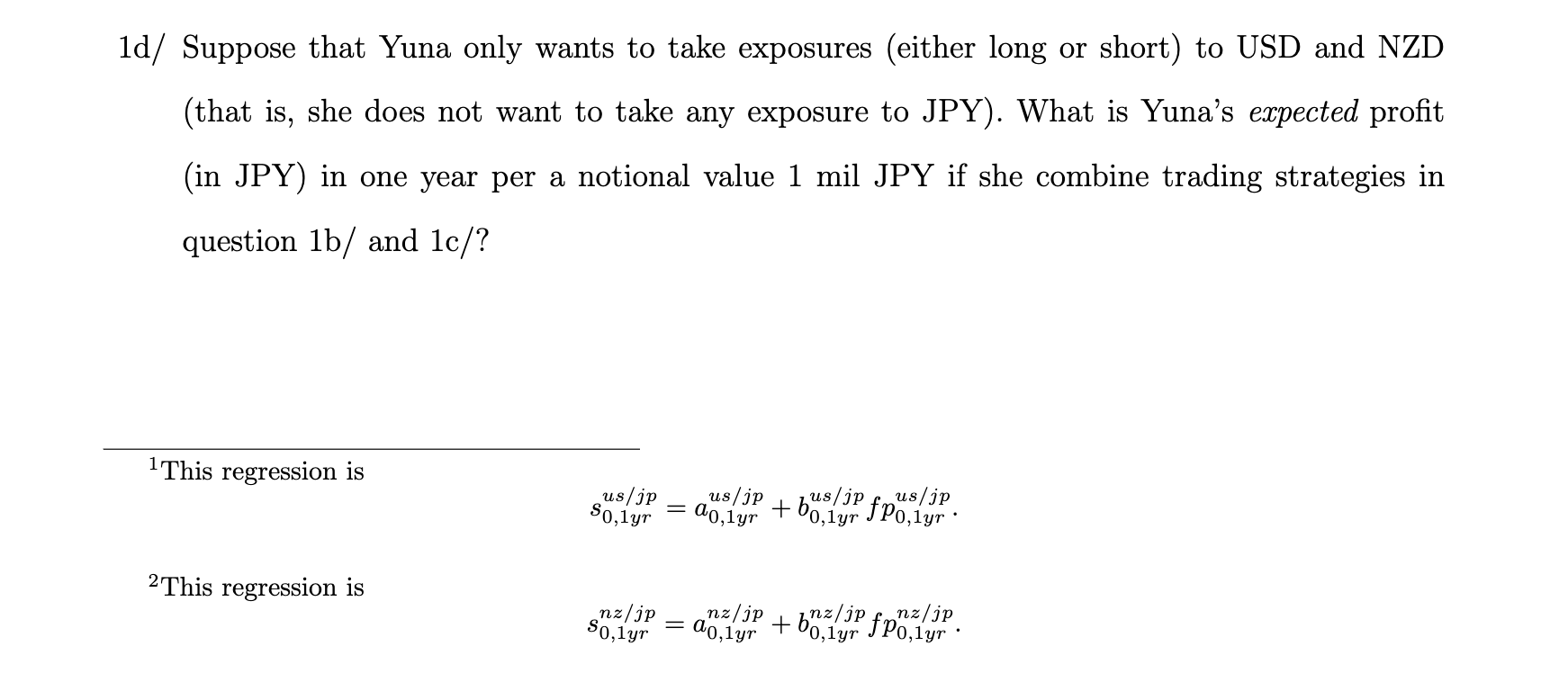

/jp So, = o, bo,lyr 1b/ Using historical data, Yuna does some research by regressing one-year % changes in the us/ exchange rate sulup on the one-year forward premium fpoljp of USD against JPY] obtaining the coefficients do,iyr us/jp hus/jp = -0.3. Does UIP hold between USD and JPY? What is the currency trading strategy suggested by this regression to Yuna? What is Yuna's expected profit (in JPY) in one year per a notional value 1 mil JPY if she follows this trading strategy? (Hint: to answer this question, you might want to consult a similar problem in E.g. 5.6, Lecture Note 5 Part 2. Note that in that e.g., we take the persepctive of an US investor. Here, we are taking the perspective of a Japanese investor). So,iyr 1c/ Using historical data, Yuna does some research by regressing one-year % changes in the ex- change rate sljp on the one-year forward premium fp7.jp of NZD against JPY} obtaining nz/ nz/ , the coefficients a0,1yr nz/jp inz/jp -1.3. Does UIP hold between NZD and JPY? What is the currency trading strategy suggested by this regression to Yuna? What is Yuna's expected profit (in JPY) in one year per a notional value 1 mil JPY if she follows this trading strategy? = 0, bo,lyr 1d/ Suppose that Yuna only wants to take exposures (either long or short) to USD and NZD (that is, she does not want to take any exposure to JPY). What is Yuna's expected profit (in JPY) in one year per a notional value 1 mil JPY if she combine trading strategies in question 1b/ and lc/? 1 This regression is us/jp us/jp us/jp So,iyr us/jp + 20,1yr fpolyr 2 This regression is nz/jp nz/jp So, 1yr nz/jp +607.jp! f polyp" 20,1yr /jp So, = o, bo,lyr 1b/ Using historical data, Yuna does some research by regressing one-year % changes in the us/ exchange rate sulup on the one-year forward premium fpoljp of USD against JPY] obtaining the coefficients do,iyr us/jp hus/jp = -0.3. Does UIP hold between USD and JPY? What is the currency trading strategy suggested by this regression to Yuna? What is Yuna's expected profit (in JPY) in one year per a notional value 1 mil JPY if she follows this trading strategy? (Hint: to answer this question, you might want to consult a similar problem in E.g. 5.6, Lecture Note 5 Part 2. Note that in that e.g., we take the persepctive of an US investor. Here, we are taking the perspective of a Japanese investor). So,iyr 1c/ Using historical data, Yuna does some research by regressing one-year % changes in the ex- change rate sljp on the one-year forward premium fp7.jp of NZD against JPY} obtaining nz/ nz/ , the coefficients a0,1yr nz/jp inz/jp -1.3. Does UIP hold between NZD and JPY? What is the currency trading strategy suggested by this regression to Yuna? What is Yuna's expected profit (in JPY) in one year per a notional value 1 mil JPY if she follows this trading strategy? = 0, bo,lyr 1d/ Suppose that Yuna only wants to take exposures (either long or short) to USD and NZD (that is, she does not want to take any exposure to JPY). What is Yuna's expected profit (in JPY) in one year per a notional value 1 mil JPY if she combine trading strategies in question 1b/ and lc/? 1 This regression is us/jp us/jp us/jp So,iyr us/jp + 20,1yr fpolyr 2 This regression is nz/jp nz/jp So, 1yr nz/jp +607.jp! f polyp" 20,1yr