Consider an investor's choice of a farm unit in the Corn Belt, one in the California Central Valley, or the one in the Great

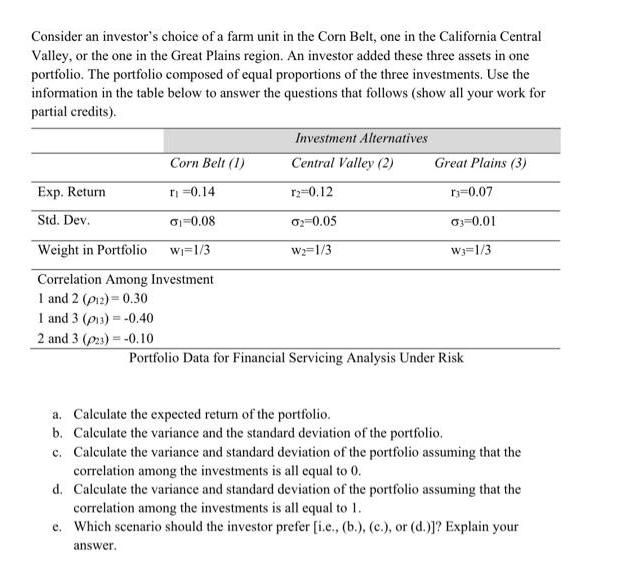

Consider an investor's choice of a farm unit in the Corn Belt, one in the California Central Valley, or the one in the Great Plains region. An investor added these three assets in one portfolio. The portfolio composed of equal proportions of the three investments. Use the information in the table below to answer the questions that follows (show all your work for partial credits). Exp. Return Std. Dev. Corn Belt (1) T = 0.14 0 0.08 Weight in Portfolio W=1/3 Correlation Among Investment 1 and 2 (P12) = 0.30 1 and 3 (p13) = -0.40 2 and 3 (23) = -0.10 Investment Alternatives Central Valley (2) r2=0.12 02-0.05 W=1/3 Great Plains (3) r=0.07 03-0.01 W3 1/3 Portfolio Data for Financial Servicing Analysis Under Risk a. Calculate the expected return of the portfolio. b. Calculate the variance and the standard deviation of the portfolio. c. Calculate the variance and standard deviation of the portfolio assuming that the correlation among the investments is all equal to 0. d. Calculate the variance and standard deviation of the portfolio assuming that the correlation among the investments is all equal to 1. e. Which scenario should the investor prefer [i.e., (b.), (c.), or (d.)]? Explain your answer.

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started