Rad's Bar and Grill a popular hangout among U of F students, operates in the midtown area of Gainesville Florida. Rad's runs a regular

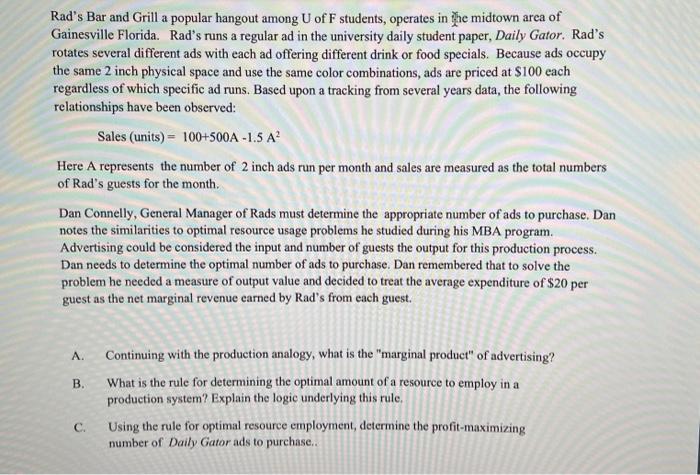

Rad's Bar and Grill a popular hangout among U of F students, operates in the midtown area of Gainesville Florida. Rad's runs a regular ad in the university daily student paper, Daily Gator. Rad's rotates several different ads with each ad offering different drink or food specials. Because ads occupy the same 2 inch physical space and use the same color combinations, ads are priced at $100 each regardless of which specific ad runs. Based upon a tracking from several years data, the following relationships have been observed: Sales (units) = 100+500A -1.5 A Here A represents the number of 2 inch ads run per month and sales are measured as the total numbers of Rad's guests for the month. Dan Connelly, General Manager of Rads must determine the appropriate number of ads to purchase. Dan notes the similarities to optimal resource usage problems he studied during his MBA program. Advertising could be considered the input and number of guests the output for this production process. Dan needs to determine the optimal number of ads to purchase. Dan remembered that to solve the problem he needed a measure of output value and decided to treat the average expenditure of $20 per guest as the net marginal revenue earned by Rad's from each guest. A. B. C. Continuing with the production analogy, what is the "marginal product" of advertising? What is the rule for determining the optimal amount of a resource to employ in a production system? Explain the logic underlying this rule. Using the rule for optimal resource employment, determine the profit-maximizing number of Daily Gator ads to purchase..

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A The marginal product of advertising is the additional number of guests that Rads will serve for ea...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started