Question

Consider Companies U and L which are identical in every respect except that U is unlevered while L has $150 million of 6% bonds outstanding.

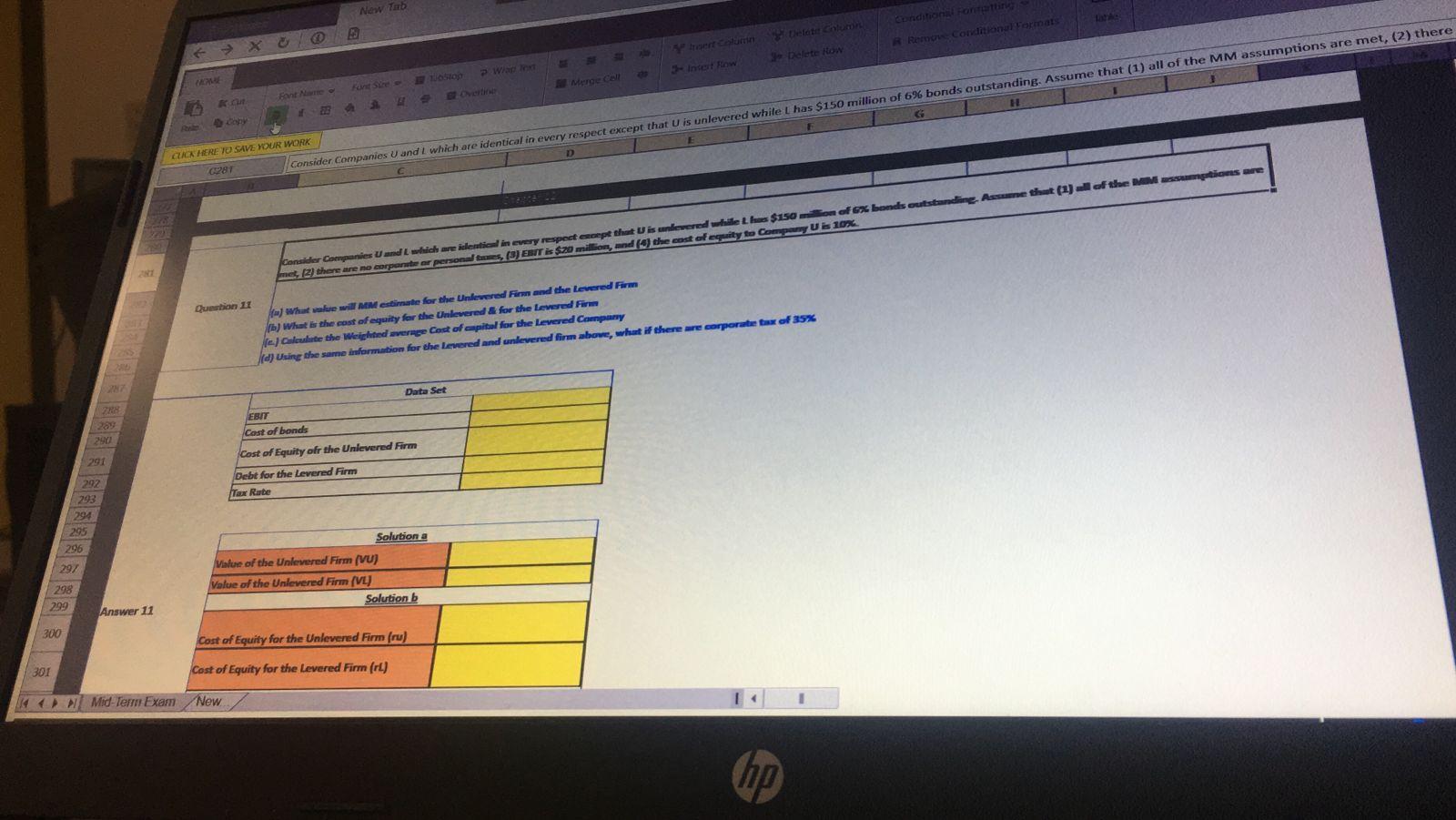

Consider Companies U and L which are identical in every respect except that U is unlevered while L has $150 million of 6% bonds outstanding. Assume that (1) all of the MM assumptions are met, (2) there are no corporate or personal taxes, (3) EBIT is $20 million, and (4) the cost of equity to company U is 10%.

(a) what value will MM estimate for the unlevered firm and levered firm

(b) what is the cost of equity for the unlevered & for the levered firm

(c) calculate the weighted average cost of capital for the levered company

(d) using the same information for the levered and unlevered firm above, what if there are corporate tax of 35%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started