Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider each of the following requirements independently: PART 1 : A large discount store has approached the owner of Goyette Limited about buying 1 2

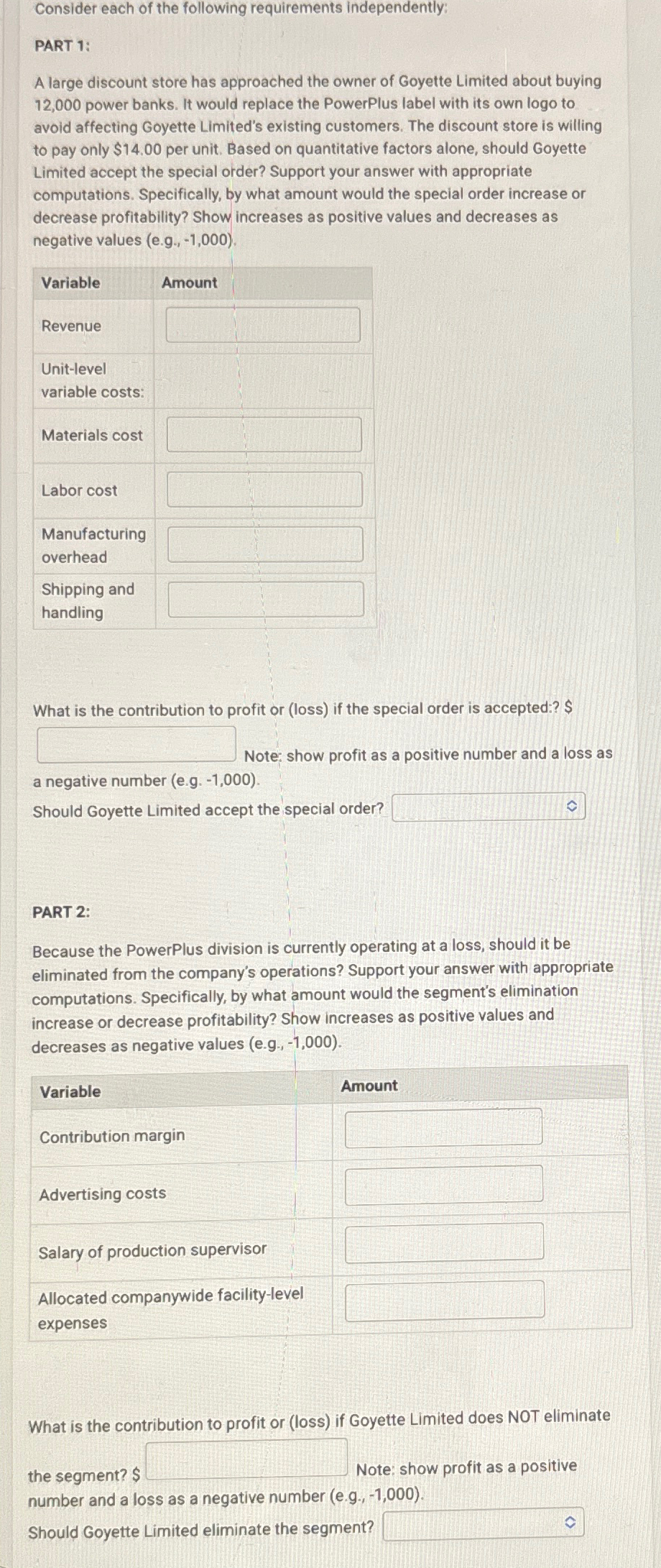

Consider each of the following requirements independently:

PART :

A large discount store has approached the owner of Goyette Limited about buying power banks. It would replace the PowerPlus label with its own logo to avoid affecting Goyette Limited's existing customers. The discount store is willing to pay only $ per unit. Based on quantitative factors alone, should Goyette Limited accept the special order? Support your answer with appropriate computations. Specifically, by what amount would the special order increase or decrease profitability? Show increases as positive values and decreases as negative values eg

tableVariableAmountRevenuetableUnitlevelvariable costs:Materials costLabor costtableManufacturingoverheadtableShipping andhandling

What is the contribution to profit or loss if the special order is accepted:? $

Note: show profit as a positive number and a loss as a negative number eg

Should Goyette Limited accept the special order?

PART :

Because the PowerPlus division is currently operating at a loss, should it be eliminated from the company's operations? Support your answer with appropriate computations. Specifically, by what amount would the segment's elimination increase or decrease profitability? Show increases as positive values and decreases as negative values eg

tableVariable AmountContribution marginAdvertising costsSalary of production supervisorAllocated companywide facilitylevelexpenses

What is the contribution to profit or loss if Goyette Limited does NOT eliminate the segment? & Note: show profit as a positive number and a loss as a negative number eg

Should Goyette Limited eliminate the segment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started