Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider each scenario below, and classify each type of lease from the perspective of the lessor: Case A On 15 March 2023, Edaby Ine. (Lessor)

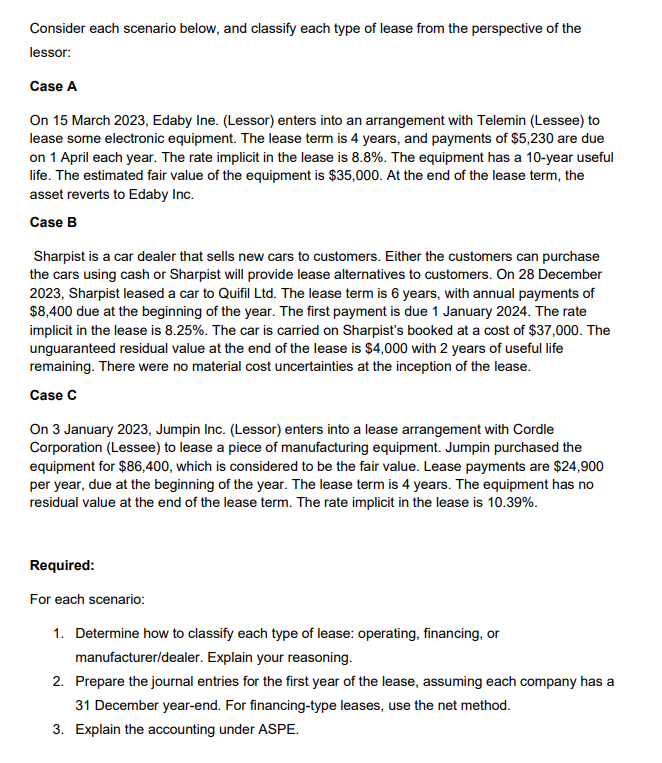

Consider each scenario below, and classify each type of lease from the perspective of the lessor: Case A On 15 March 2023, Edaby Ine. (Lessor) enters into an arrangement with Telemin (Lessee) to lease some electronic equipment. The lease term is 4 years, and payments of $5,230 are due on 1 April each year. The rate implicit in the lease is 8.8%. The equipment has a 10 -year useful life. The estimated fair value of the equipment is $35,000. At the end of the lease term, the asset reverts to Edaby Inc. Case B Sharpist is a car dealer that sells new cars to customers. Either the customers can purchase the cars using cash or Sharpist will provide lease alternatives to customers. On 28 December 2023 , Sharpist leased a car to Quifil Ltd. The lease term is 6 years, with annual payments of $8,400 due at the beginning of the year. The first payment is due 1 January 2024 . The rate implicit in the lease is 8.25%. The car is carried on Sharpist's booked at a cost of $37,000. The unguaranteed residual value at the end of the lease is $4,000 with 2 years of useful life remaining. There were no material cost uncertainties at the inception of the lease. Case C On 3 January 2023, Jumpin Inc. (Lessor) enters into a lease arrangement with Cordle Corporation (Lessee) to lease a piece of manufacturing equipment. Jumpin purchased the equipment for $86,400, which is considered to be the fair value. Lease payments are $24,900 per year, due at the beginning of the year. The lease term is 4 years. The equipment has no residual value at the end of the lease term. The rate implicit in the lease is 10.39%. Required: For each scenario: 1. Determine how to classify each type of lease: operating, financing, or manufacturer/dealer. Explain your reasoning. 2. Prepare the journal entries for the first year of the lease, assuming each company has a 31 December year-end. For financing-type leases, use the net method. 3. Explain the accounting under ASPE

Consider each scenario below, and classify each type of lease from the perspective of the lessor: Case A On 15 March 2023, Edaby Ine. (Lessor) enters into an arrangement with Telemin (Lessee) to lease some electronic equipment. The lease term is 4 years, and payments of $5,230 are due on 1 April each year. The rate implicit in the lease is 8.8%. The equipment has a 10 -year useful life. The estimated fair value of the equipment is $35,000. At the end of the lease term, the asset reverts to Edaby Inc. Case B Sharpist is a car dealer that sells new cars to customers. Either the customers can purchase the cars using cash or Sharpist will provide lease alternatives to customers. On 28 December 2023 , Sharpist leased a car to Quifil Ltd. The lease term is 6 years, with annual payments of $8,400 due at the beginning of the year. The first payment is due 1 January 2024 . The rate implicit in the lease is 8.25%. The car is carried on Sharpist's booked at a cost of $37,000. The unguaranteed residual value at the end of the lease is $4,000 with 2 years of useful life remaining. There were no material cost uncertainties at the inception of the lease. Case C On 3 January 2023, Jumpin Inc. (Lessor) enters into a lease arrangement with Cordle Corporation (Lessee) to lease a piece of manufacturing equipment. Jumpin purchased the equipment for $86,400, which is considered to be the fair value. Lease payments are $24,900 per year, due at the beginning of the year. The lease term is 4 years. The equipment has no residual value at the end of the lease term. The rate implicit in the lease is 10.39%. Required: For each scenario: 1. Determine how to classify each type of lease: operating, financing, or manufacturer/dealer. Explain your reasoning. 2. Prepare the journal entries for the first year of the lease, assuming each company has a 31 December year-end. For financing-type leases, use the net method. 3. Explain the accounting under ASPE Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started