Question

Consider Elena who wants to invest $100,000 for a span of 2 years. After the end of two years, Elena will use this money (both

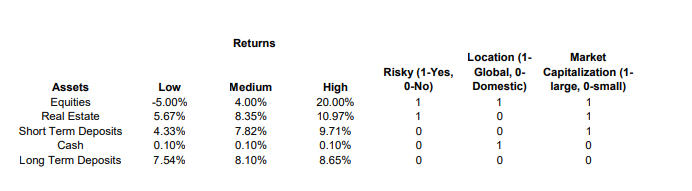

Consider Elena who wants to invest $100,000 for a span of 2 years. After the end of two years, Elena will use this money (both the principal and interest) to pay for her sons college tuition. She has hired you to help her invest this money in the following set of assets: Equities, Real Estate, Short-Term Deposits, Cash and Long-Term Deposits. Based on past historical trends, the returns are as follows:

Before investing, Elena is uncertain on what return she would get from each asset. She believes that the return could be low with 33% chance, medium with 34% chance and high with 33% chance. For instance, if the returns turn out to be low, then Elena loses 5% in equities, gains 5.67% in real estate and so on.

After investing, Elena realizes the return from each asset at the end of the first year. At this point of time, she may rearrange her portfolio if she wishes to do so. Specifically, if she had invested 20,000 dollars in equities in the first year, she may choose to increase/decrease her investments in the equities for the second year based upon the realized returns.

Each asset is further categorized with respect to the risk level, whether the asset is traded domestically or globally, and the market capitalization. For instance, real estate is a risky asset, is only traded domestically and has a large market capitalization. Elena has asked you to make sure that, every time investments are made, it must be the case that:

A. The investments in risky category be at most 60% of the total invested amount.

B. The investments in the global category be at least 20% of the total invested amount.

C. The investments in the large market capitalization category be at least 40% of the total invested amount.

Use this info in order to answer the questions below and please show your work and complete in excel:

Question 1. (Wait and See) Suppose that Elena does not invest any amount in the first year and waits to see the returns before investing in the second year. Use excel to find the optimal solution under this Wait and See Approach? Does this solution make sense? In expectation, how much would Elena get at the end of the second year?

Question 2. (Here and Now) Suppose now that Elena makes her investment decisions in the first year based on her likelihoods of different return scenarios and then second year decisions based on realized returns. What is the optimal solution under this Here and Now approach? What is Elenas expected return?

Returns Location (1 Market Risky (1-Yes, Global, 0 Capitalization (1 0-No) High 20.00% 10.97% 9.71% 0.10% 8.65% Domestic) large, o-small) Assets Equities Real Estate Short Term Deposits Cash Long Term Deposits Low -5.00% 5.67% 4.33% 0.10% 7.54% Medium 4.00% 8.35% 7.82% 0.10% 8.10% Returns Location (1 Market Risky (1-Yes, Global, 0 Capitalization (1 0-No) High 20.00% 10.97% 9.71% 0.10% 8.65% Domestic) large, o-small) Assets Equities Real Estate Short Term Deposits Cash Long Term Deposits Low -5.00% 5.67% 4.33% 0.10% 7.54% Medium 4.00% 8.35% 7.82% 0.10% 8.10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started