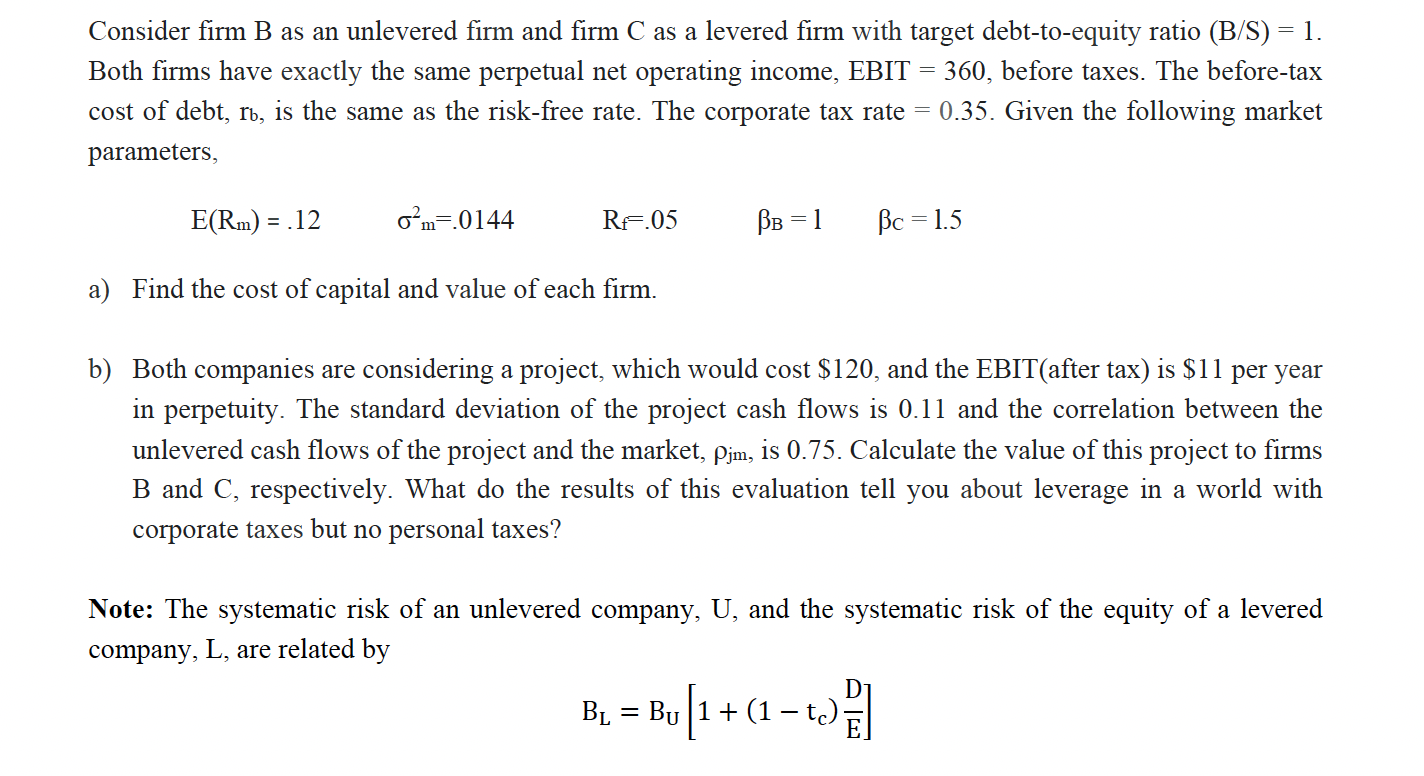

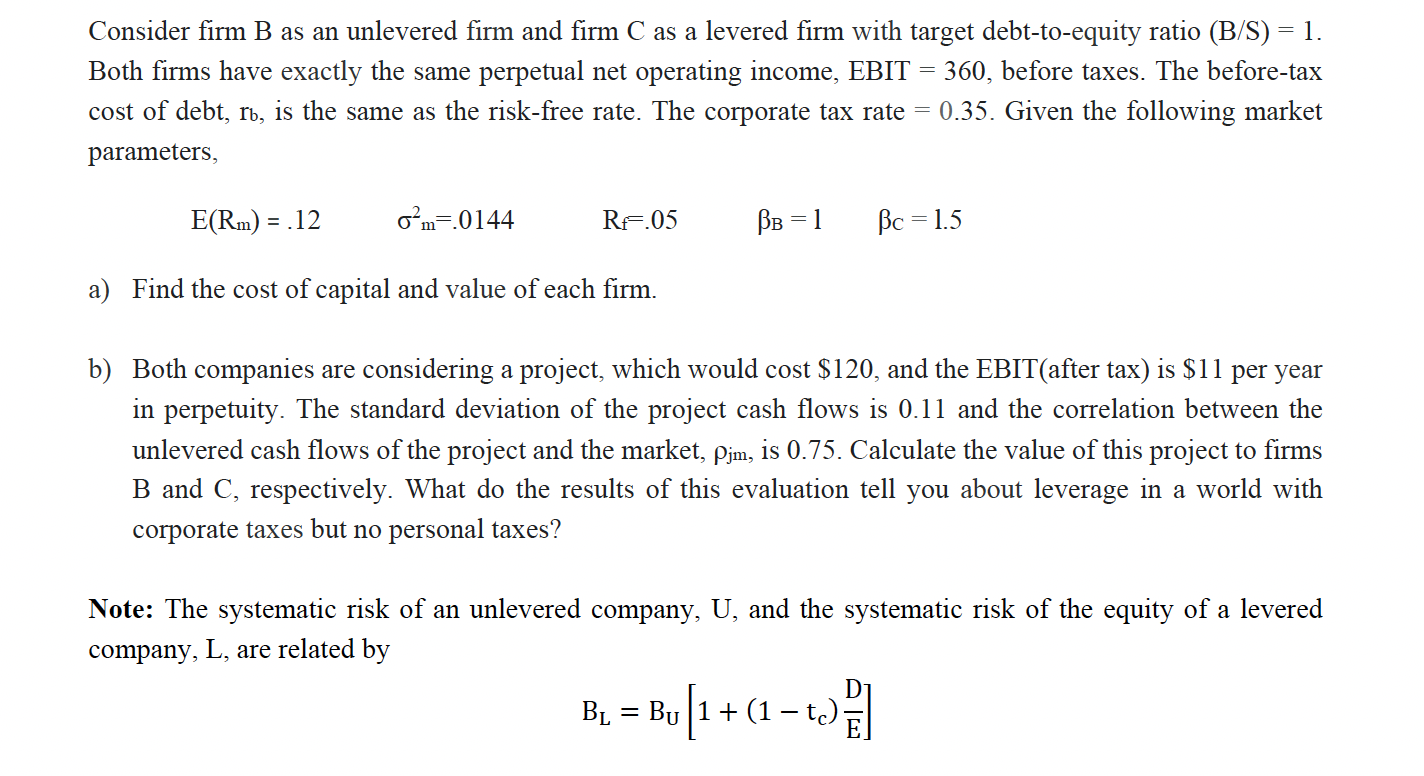

Consider firm B as an unlevered firm and firm C as a levered firm with target debt-to-equity ratio (B/S) = 1. Both firms have exactly the same perpetual net operating income, EBIT = 360, before taxes. The before-tax cost of debt, rb, is the same as the risk-free rate. The corporate tax rate = 0.35. Given the following market parameters, om=.0144 E(Rm) = .12 a) Find the cost of capital and value of each firm. R.05 BB=1 b) Both companies are considering a project, which would cost $120, and the EBIT(after tax) is $11 per year in perpetuity. The standard deviation of the project cash flows is 0.11 and the correlation between the unlevered cash flows of the project and the market, pjm, is 0.75. Calculate the value of this project to firms B and C, respectively. What do the results of this evaluation tell you about leverage in a world with corporate taxes but no personal taxes? Bc 1.5 = Note: The systematic risk of an unlevered company, U, and the systematic risk of the equity of a levered company, L, are related by B = Bu [1 + (1 1-t | Consider firm B as an unlevered firm and firm C as a levered firm with target debt-to-equity ratio (B/S) = 1. Both firms have exactly the same perpetual net operating income, EBIT = 360, before taxes. The before-tax cost of debt, rb, is the same as the risk-free rate. The corporate tax rate = 0.35. Given the following market parameters, om=.0144 E(Rm) = .12 a) Find the cost of capital and value of each firm. R.05 BB=1 b) Both companies are considering a project, which would cost $120, and the EBIT(after tax) is $11 per year in perpetuity. The standard deviation of the project cash flows is 0.11 and the correlation between the unlevered cash flows of the project and the market, pjm, is 0.75. Calculate the value of this project to firms B and C, respectively. What do the results of this evaluation tell you about leverage in a world with corporate taxes but no personal taxes? Bc 1.5 = Note: The systematic risk of an unlevered company, U, and the systematic risk of the equity of a levered company, L, are related by B = Bu [1 + (1 1-t |