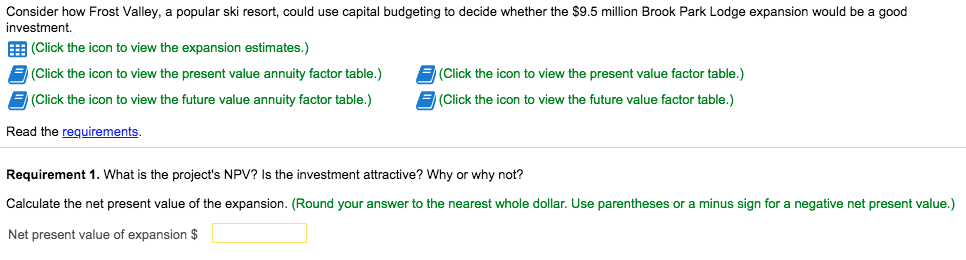

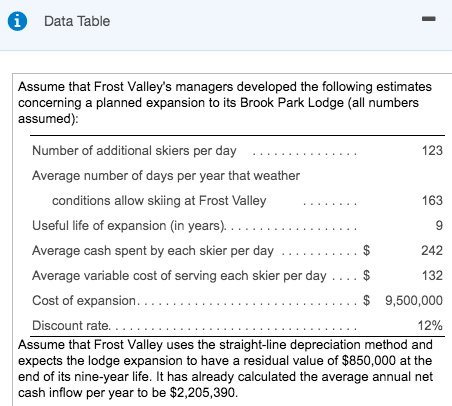

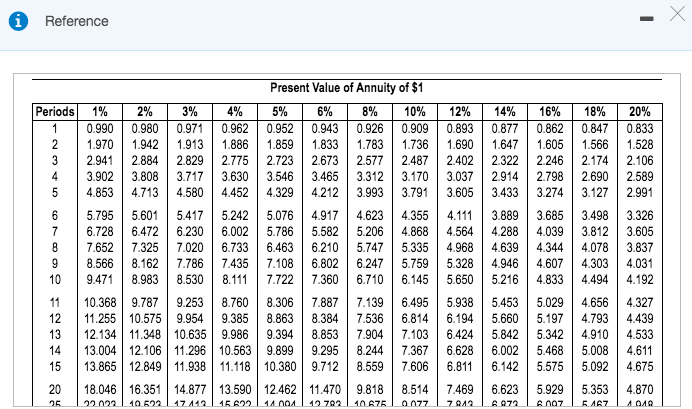

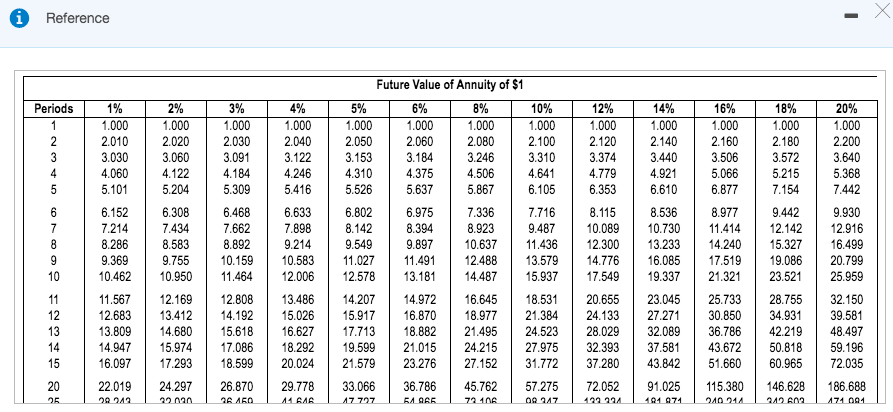

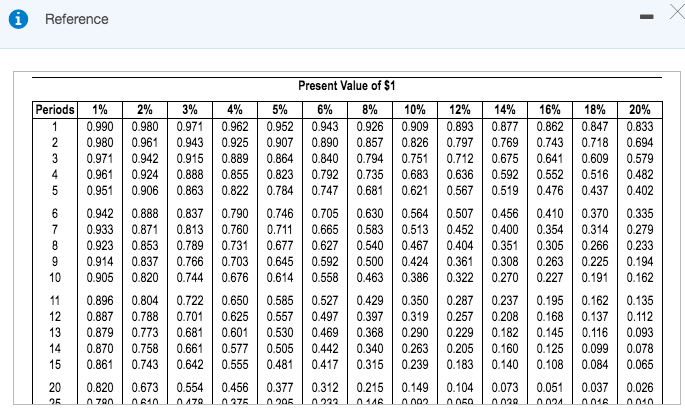

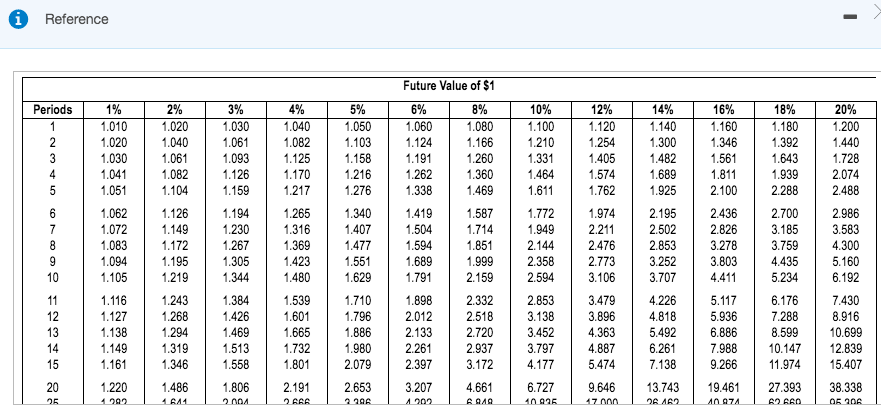

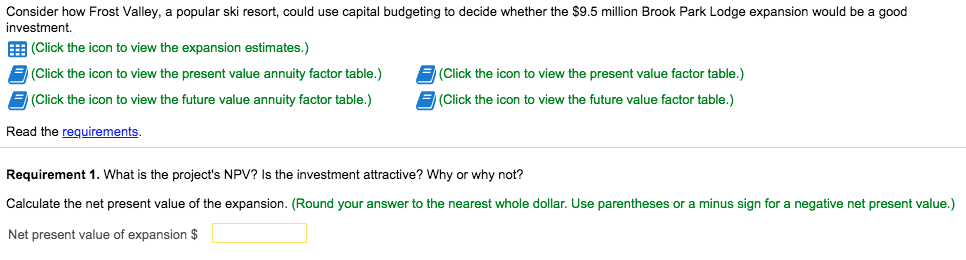

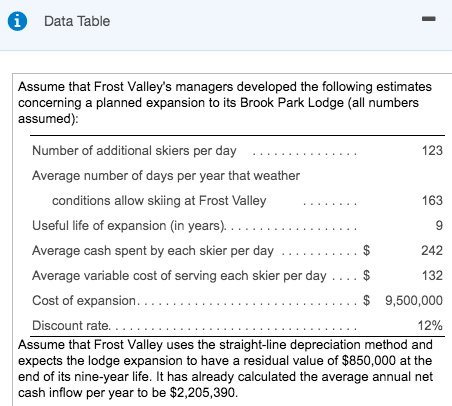

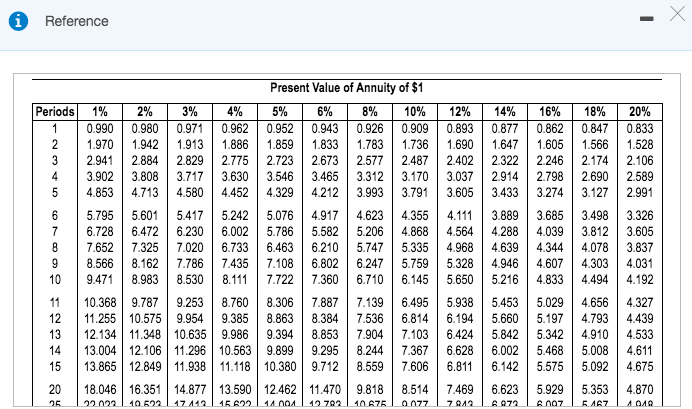

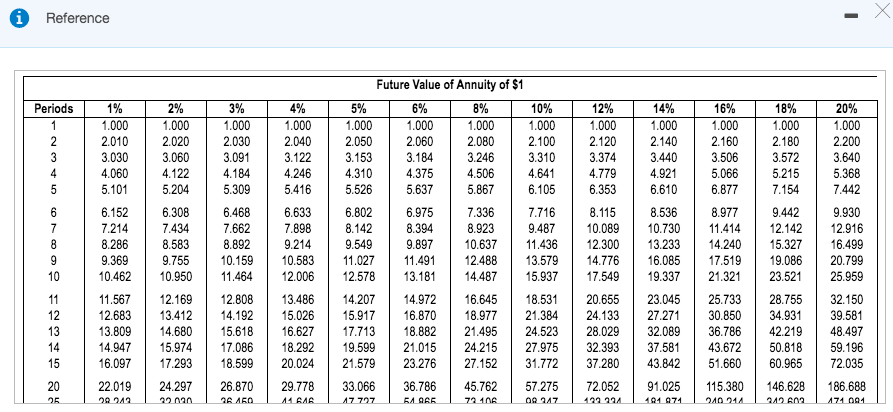

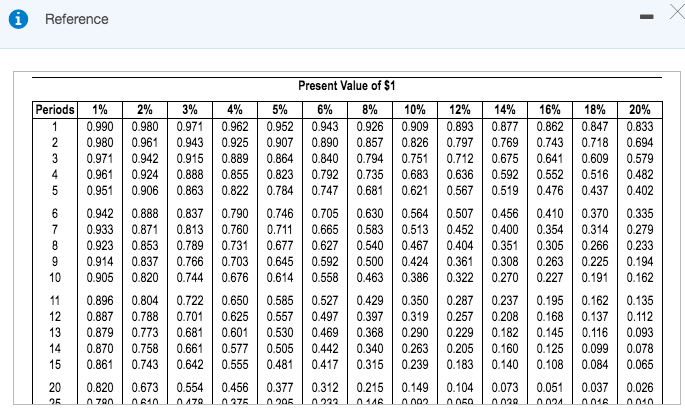

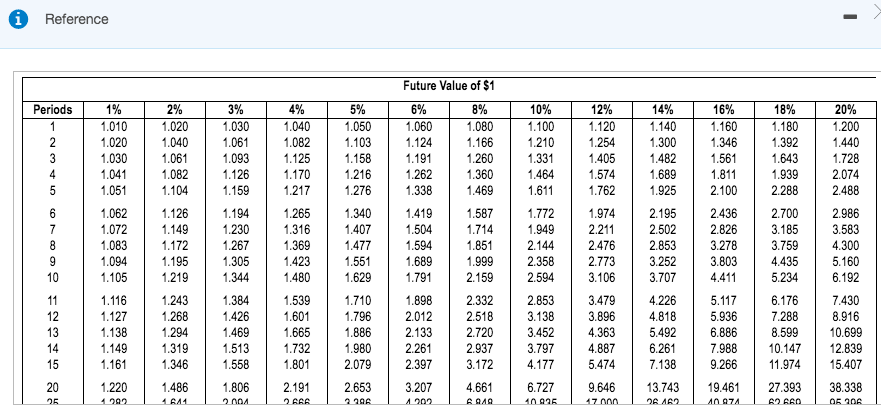

Consider how Frost Valley, a popular ski resort, could use capital budgeting to decide whether the $9.5 million Brook Park Lodge expansion would be a good investment. (Click the icon to view the expansion estimates.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the future value factor table.) Read the requirements. Requirement 1. What is the project's NPV? Is the investment attractive? Why or why not? Calculate the net present value of the expansion. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) Net present value of expansion $ Data Table Assume that Frost Valley's managers developed the following estimates concerning a planned expansion to its Brook Park Lodge (all numbers assumed) 123 Number of additional skiers per day Average number of days per year t .. . . . . . . . . . . . . hat weather 163 conditions allow skiing at Frost Valley 242 $ Average cash spent by each skier per day . . . . . Average variable cost of serving each skier per day . 132 $ 12% Discount rate Assume that Frost Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $850,000 at the end of its nine-year life. It has already calculated the average annual net cash inflow per year to be $2,205,390 1 Reference Present Value of Annuity of $1 Periods 1% | 2% | 3% | 4% | 5% | 6% | 8% | 10% | 12% | 14% | 16% | 18% | 20% 2 0.990 0.980 0.971 0.9620.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 2 1.970 1.942 1.913 1.8861.8591.833 1.783 1.736 1.690 1.647 1.605 1.566 1.528 3 2.941 2.884 2.829 2.7752.7232.673 2.577 2487 2.402 2.322 2.246 2.174 2.106 4 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.798 2.690 2.589 54.853 4.713 4.580 4.4524.3294.212 3.9933.791 3.605 | 3.433 3.274 3.127 2.991 6 5.795 5.601 5.417 5.2425.0764.917 4.623 4.3554.111 3.889 3.685 3.498 3.326 7 6.728 6.472 6.230 6.0025.7865.582 5.206 4.868 4.564 4.288 4.039 3.812 3.605 8 7.652 7.325 7.020 6.7336.4636.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837 98.566 8.162 7.786 7.4357.1086.802 6.2475.759 5.328 4.946 4.607 4.303 4.031 10 9.4718.983 8.530 8.1117.7227.3606.710 6.145 5.650 5.216 4.833 4.494 4.192 11 10.368 9.787 9.253 8.760 8.3067.887 7.139 6.495 5.938 5.453 5.029 4.656 4.327 12 11.255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 5.660 5.197 4.793 4.439 13 12.134 11.348 10.635 9.9869.394 8.853 79047.103 6.424 5.842 5.342 4.910 4.533 14 13.004 12.106 11.296 10.5639.8999.2958.2447.367 6.628 6.002 5.468 5.008 4.611 15 13.865 12.849 11.938 11.118 10.3809.7128.559 7.606 6.811 6.142 5.575 5.092 4.675 20 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7469 6.623 5.929 5.353 4.870 8 7 1 22 02 0.12 Reference Future Value of Annuity of $1 Periods 10% 14% 5.309424631532061000 6.802 8.142 9.549 10.15910.583 11.027 11.49112.48 5.526437532421000 5.867 1.000 2.010 1.000 2.020 3.060 1.000 1.000 2.040 1.000 2.050 1.000 2.060 1.000 2.080 1.000 1.000 1.000 2.140 3.440 1.000 1.000 2.180 2.200 3.640 5.368 7.442 1.000 3.374 4.779 6.353 8.115 3.572 5.215 3.506 5.066 4.060 4.310 4.506 4.641 4.375 5.637 5.204 6.308 6.610 5.416 975 7.336 8.394 9.897 6.468 7.662 8.892 9.930 10.08910.730 11.414 12.14212.916 0.63711.436 12.300 13.23314.240 15.327 16.499 813.579 14.776 16.08517.51919.086 20.799 8.536 8.977 9442 7.214 8.286 9.369 8.923 9487 8.583 9.755 9.214 10.462 10.95011.464 12.006 12.578 13.18114.487 15.937 17.549 19.337 21.32123.52125.959 11.567 12.16912.808 13.486 14.20714.97216.645 18.531 20.655 23.045 25.73328.755 32.150 12.683 13.41214.192 15.026 15.917 16.8708.977 21.384 24.133 27.271 30.850 34.93139.581 13.80914.68015.618 16.627 17.71318.88221.495 24.523 28.029 32.089 36.78642.219 48.497 4.94715.97417.086 18.292 19.599 21.01524.215 27.975 32.393 37.581 43.67250.818 59.196 16.097 17.29318.599 20.024 21.579 23.27627.152 31.772 37.280 43.842 51.66060.965 72.035 22.019 24.297 26.870 29.778 33.066 36.78645.76257.275 72.052 91.025 115.380146.628 186.688 12 13 14 15 20 174 094 R 242 47 1 Reference Present Value of $1 Periods 1% | 2% | 3% | 4% | 5% | 6% | 8% | 10% | 12% | 14% | 16% | 18% | 20% 2 0.990 0.980 0.971 0.9620.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 2 0.980 0.961 0.943 0.9250.907 0.8900.857 0.826 0.797 0.769 0.743 0.718 0.694 3 0.971 0.942 0.915 0.8890.8640.8400.7940.751 0.712 0.675 0.641 0.609 0.579 4 0.9610.924 0.888 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482 5 0.951 0.906 0.863 0.8220.7840.747 0.6810.621 0.567 0.519 0.476 0.437 0.402 6 0.942 0.888 0.837 0.7900.746 0.705 0.6300.564 0.507 0.456 0.410 0.370 0.335 7 0.933 0.871 0.813 0.7600.710.665 0.583 0.513 0.452 0.400 0.3540.314 0.279 80.923 0.853 0.789 0.7310.6770.627 0.540 0.467 0.404 0.351 0.305 0.266 0.233 90.914 0.837 0.766 0.7030.6450.592 0.500 0.424 0.361 0.308 0.263 0.225 0.194 10 0.905 0.820 0.7440.676 0.614 0.5580.463 0.386 0.322 0.270 0.227 0.191 0.162 11 0.896 0.804 0.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.135 12 0.887 0.788 0.701 0.625 0.557 0.497 0.397 0.319 0.257 0.208 0.168 0.137 0.112 13 0.879 0.773 0.681 0.6010.530 04690.368 0.290 0.229 0.182 0.145 0.116 0.093 14 0.870 0.758 0.661 0.5770.505 0442 0.340 0.263 0.205 0.160 0.125 0.099 0.078 15 0.861 0.743 0.642 0.555 0.481 0417 0.315 0.239 0.183 0.140 0.108 0.084 0.065 20 0.820 0.673 0.554 0.456 0.377 0.312 0.215 0.149 0.1040.073 0.051 0.037 0.026 2 9 1 0 A4 479 2 4 11 4968 2 2-11-22 23456 78 10 12 15 23345 678 10 11 %66610 62731 1688 -11-12 22334 55679 19 an %40295 92557 68268 43 15827 6 %24546 74 1776 79674 46 212 %, 0 0 3 6 1 24484 38297 346 2223 4 24 9 6 3 90489 82369 4 tu %-06 12 ut-69 0 1 1 2 3 45567 80123 6 7 6 507 5693 6% 0 0 2 1 2 23328 56 66 73 80 9 06325 94 4455 8 83 94 05 16 27 8 0 12345 1 2 3 4 5 6789