Answered step by step

Verified Expert Solution

Question

1 Approved Answer

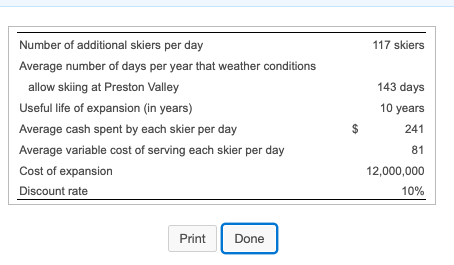

Consider how Preston Valley RiverRiver Park Lodge could use capital budgeting to decide whether the $12,000,000 River Park Lodge expansion would be a good investment.

Consider how

Preston

Valley

RiverRiver

Park Lodge could use capital budgeting to decide whether the

$12,000,000

River

Park Lodge expansion would be a good investment. Assume

Preston

Valley's managers developed the following estimates concerning the expansion:

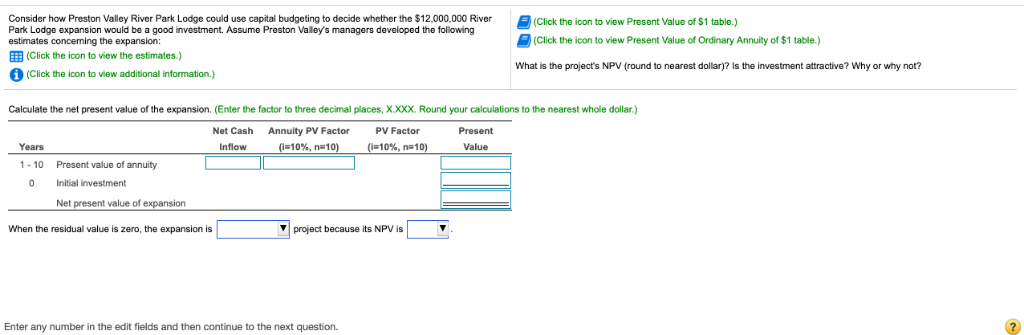

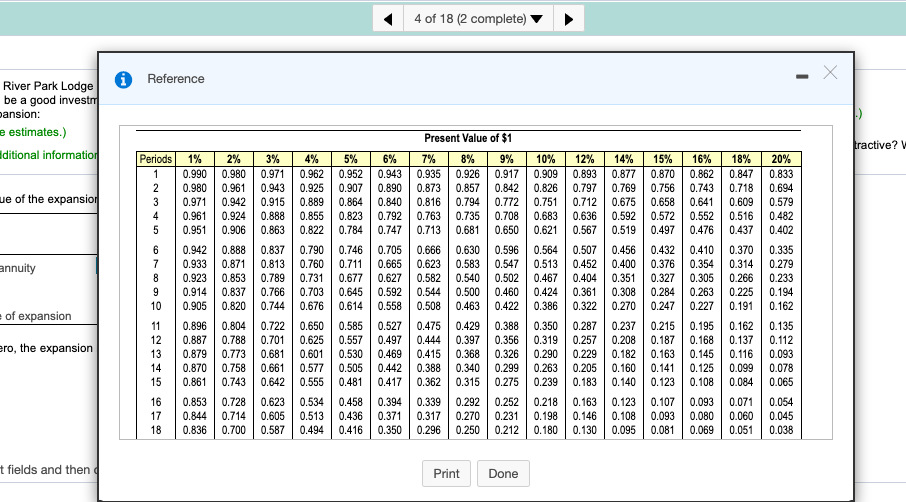

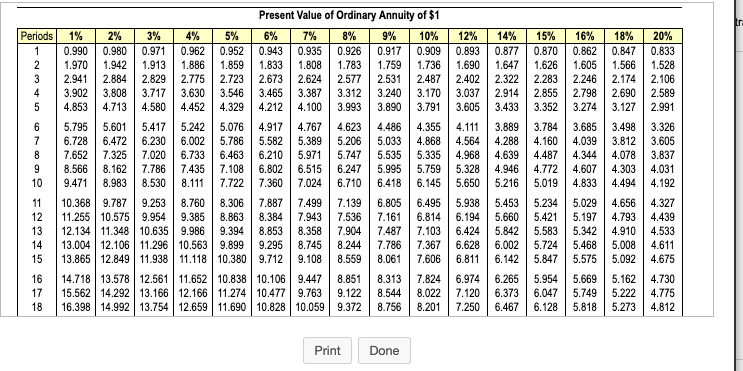

117 skiers Number of additional skiers per day Average number of days per year that weather conditions allow skiing at Preston Valley Useful life of expansion (in years) Average cash spent by each skier per day Average variable cost of serving each skier per day Cost of expansion Discount rate 143 days 10 years 241 81 12,000,000 10% Print Done (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Consider how Preston Valley River Park Lodge could use capital budgeting to decide whether the $12,000,000 River Park Lodge expansion would be a good investment. Assume Preston Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) (Click the icon to view additional information.) What is the project's NPV (round to nearest dollar)? Is the investment attractive? Why or why not? Calculate the nel present value of the expansion. (Enter the factor to three decimal places, X.XXX. Round your calculations to the nearest whole dollar.) Net Cash Inflow Annuity PV Factor (=10%, n=10) PV Factor (=10%, n=10) Present Value Years 1 - 10 0 Present value of annuity Initial investment Net present value of expansion When the residual value is zero, the expansion is project because its NPV is . Enter any number in the edit fields and then continue to the next question. 4 of 18 (2 complete) i Reference River Park Lodge be a good invest pansion: e estimates.) Editional information tractive? ue of the expansion Periods 1% 0.990 | 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 18 | 0.836 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 annuity 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 5% 6% 0.952 0.943 0.907 0.890 0.864 0.840 0.823 0.792 0.784 0.747 0.746 0.705 0.711 0.665 0.677 0.627 0.6450.592 0.614 0.558 0.585 0.527 0.557 0.497 0.530 0.469 0.505 0.442 0.481 0.417 0.458 0.394 0.436 0.371 0.416 0.350 Present Value of $1 7% 8% 9% 0.935 0.926 0.917 0.873 0.857 0.842 0.816 0.794 0.772 0.763 0.735 0.708 0.713 0.681 0.650 0.6660.630 0.596 0.623 0.583 0.547 0.582 0.540 0.502 0.544 0.500 0.460 0.508 0.463 0.422 0.475 0.429 0.388 0.444 0.397 0.356 0.415 0.368 0.326 0.388 0.340 0.299 0.362 0.315 0.275 0.3390.292 0.252 0.317 0.270 0.231 0.296 0.250 0.212 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 12% 14% 0.893 0.877 0.797 0.769 0.712 0.675 0.636 0.592 0.567 0.519 0.507 0.456 0.452 0.400 0.404 0.351 0.361 0.308 0.322 0.270 0.287 0.237 0.257 0.208 0.229 0.182 0.205 0.160 0.183 0.140 0.163 0.123 0.146 0.108 0.130 | 0.095 15% 16% 18% 20% 0.870 0.862 0.847 0.833 0.756 0.743 0.7180.694 0.658 0.641 0.609 0.579 0.572 0.552 0.516 0.482 0.497 0.476 0.437 0.402 0.432 0.410 0.370 0.376 0.354 0.314 0.327 0.305 0.266 0.284 0.263 0.225 0.247 0.227 0.191 0.162 0.215 0.195 0.162 0.187 0.168 0.137 0.112 0.163 0.145 0.116 0.093 0.141 0.125 0.099 0.078 0.123 0.108 0.084 0.065 0.1070.093 0.071 0.093 0.080 0.060 0.045 0.081 | 0.069 | 0.051 | 0.038 OOOO 0.194 0.820 =of expansion 0.135 ero, the expansion 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.054 t fields and then Print Done Present Value of Ordinary Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% | 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 1.970 1.942 1.913 1.886 1.859 1.8331.808 1.783 1.759 1.736 1.6901.6471.626 2.9412.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 4.853 4.713 4.580 4.452 | 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.889 3.784 6.728 6.4726.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 8.5668.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.946 4.772 9.471 8.9838.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 5.019 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5.234 11.255 10.575 9.954 9.3858.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.421 12.134 11.348 10.635 9.986 9.3948.853 8.358 7.904 7.487 7.103 6.424 5.842 5.583 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.7861 7.367 6.6286.002 5.724 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 6.811 6.142 5.847 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.9746.265 5.954 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.1206.373 6.047 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 6.128 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.669 5.749 5.818 18% 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 5.092 5.162 5.222 5.273 Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started