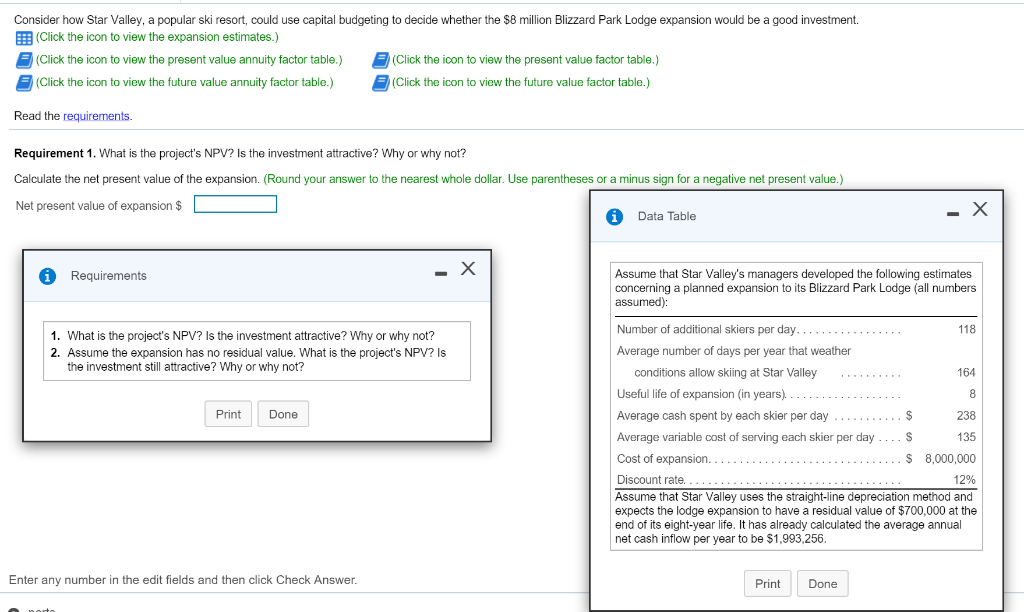

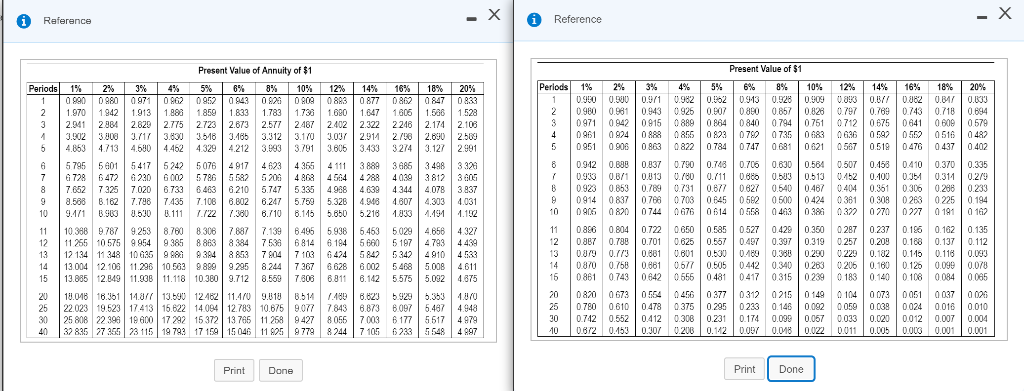

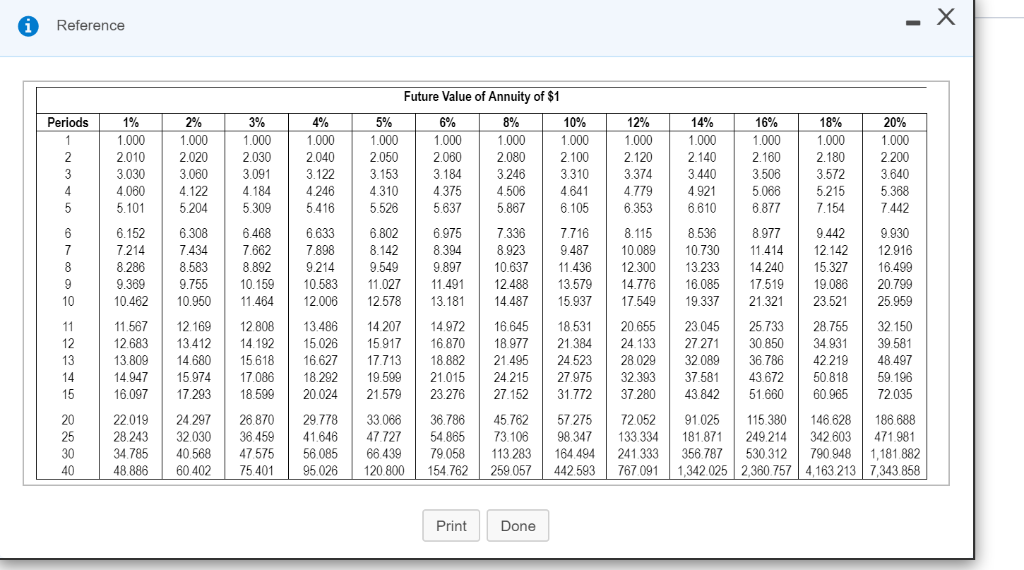

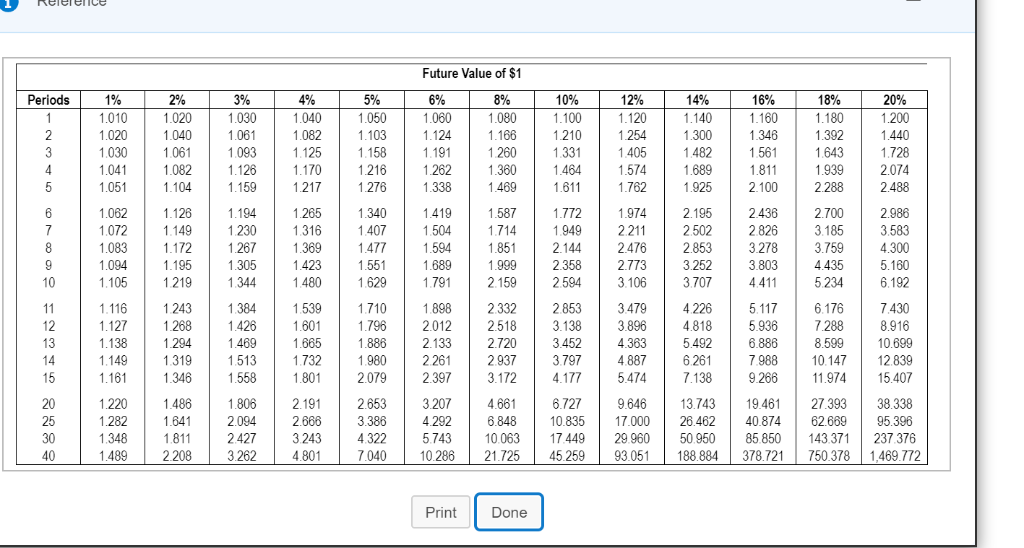

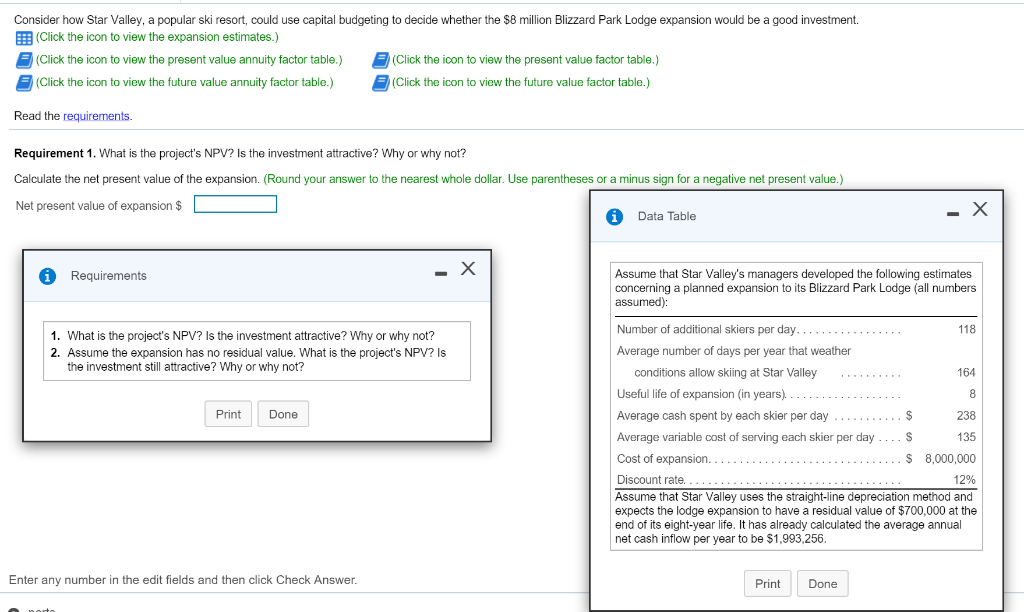

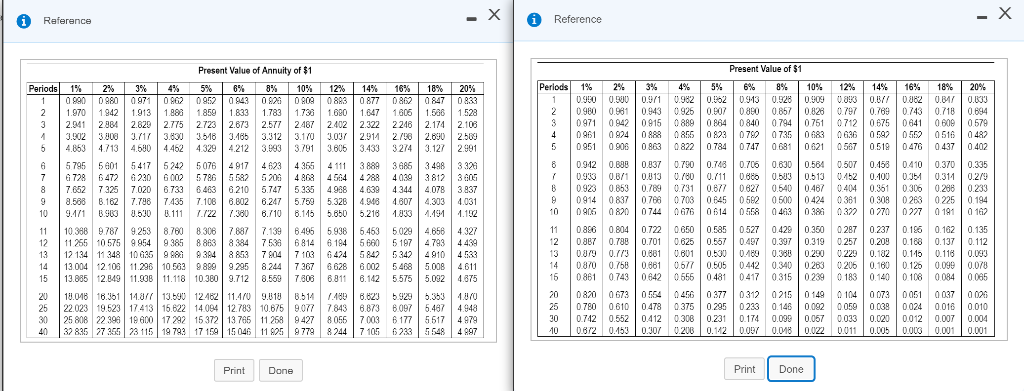

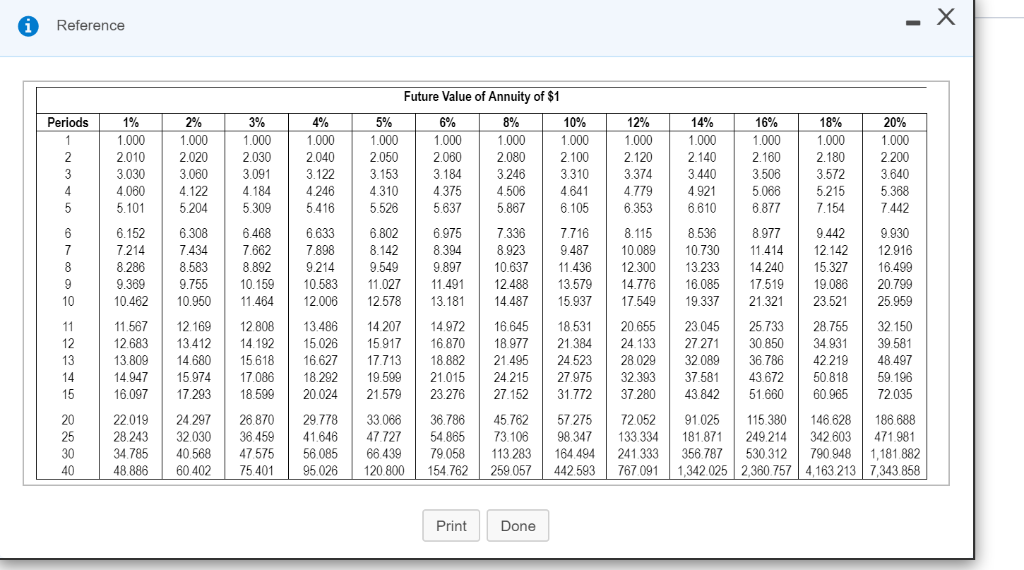

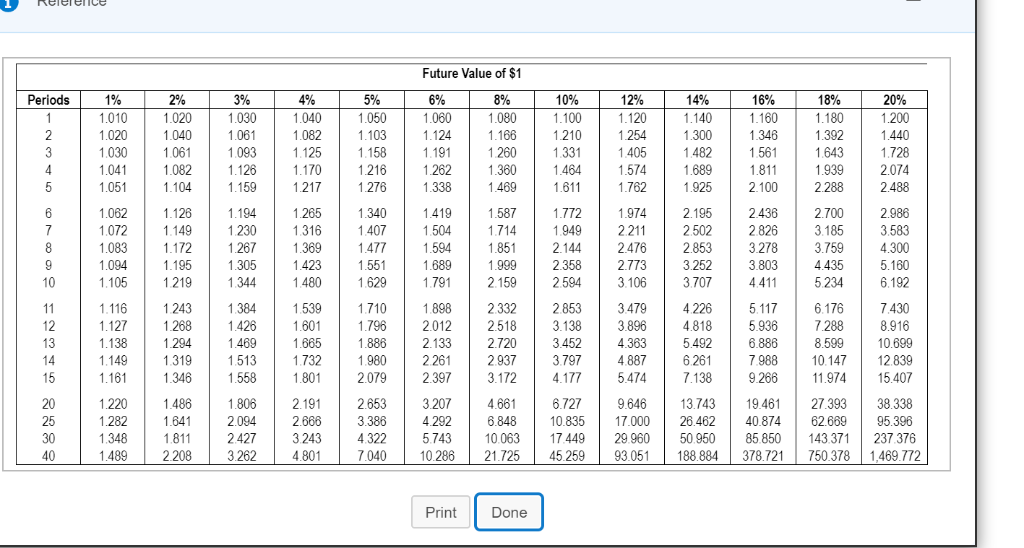

Consider how Star Valley, a popular ski resort, could use capital budgeting to decide whether the $8 million Blizzard Park Lodge expansion would be a good investment. (Click the icon to view the expansion estimates.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the future value factor table.) Read the requirements. Requirement 1. What is the project's NPV? Is the investment attractive? Why or why not? Calculate the net present value of the expansion. (Round your answer to the nearest whole dollar. Use p Net present value of expansion $ or a minus sign for a negative net present value.) Data Table Assume that Star Valley's managers developed the following estimates concerning a planned expansion to its Blizzard Park Lodge (all numbers Requirements Number of additional skiers per day 118 1. What is the project's NPV? ls the investment attractive? Why or why not? 2. Assume the expansion has no residual value. What is the project's NPV? Is age number of days per year that weather the investment still attractive? Why or why not? 164 conditions allow skiing at Star Valley Useful life of expansion (in years). Average cash spent by each skier per day Average variable cost of serving each skier per day Cost of expansion. Discount rate Print Done 238 135 S 8,000,000 12% Assume that Star Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $700,000 at the S end of its eight-year life. It has already calculated the average annual net cash inflow per year to be $1,993,256. Enter any number in the edit fields and then click Check Answer Print Done Periode 1% 2% 13% 4% | 5% | 6% 8% | 10% 12%| 14%| 16% 18%|20% LW | 0.50 | 0.911 | 09e2 | 0.to2 | 0913 | 0.928 0.909 | UW | 0.B// | 038 2 | 0. M, 0.B33 2 0980 0910943 92 007 08000828T 0.709 0743 018 0694 0971 0942 0915 8890864 0840 07940751 712 0675 0641060 0579 0961 0824 | 0888 | 0855 | 0823 | 07g0 | 0735 | 0683 | 0636 | 0507 | 0552 | 0516 | 0482 0951 090863 0822 0784 0747 0631 0621 567 051 0476 04370.402 8 0912 0880.8370.T0 074 0706 0.630 0.564 0.5070.450410 0.370 0.335 0933 | 0.6M 0013 | U./80 | 0.111 | 0.660 | 0.53 0.513 | 0.452 | 0.100 | 0.35 0.314 0.279 8 0923 0853 0.789 0731027 0540 0467 0404 0.361 0306 0206 0.233 0914 0837076 0703 0645052 0500 0424 361 030026302250.194 0 0906 0820 0744 676 0614 558 046383 0277 1162 100000 00000 00000 0000 5% 16% 8% | 10% | 12% | 14% 16% 900 1 hgg0 | 0980 | 0971 | 0g62 0952 | g43 | 0g26 | 0A00 | 08A3 | 0877 0862 | 847 | 0833 970 1942 1913 850 1.833 783 173601.647 1605 1.536 1528 2884 2.82 2.775 27232.873 2.577 2487 2402 2.322 2246 2.174 2.108 3.302303.130 3518 3.485 3.312 3.10 303 2.914 2 2 2589 6 | 43 | 4713 | 4.580 | 4.462 4329 4212 | 3.963 | 3.791 | 3.606 | 3.433 3274 | 3.127 | 2.991 360 250 250 6 5795 501 5417 5242 076 4917 4 623 4 355 4111 3 889 3685 3498 3328 64726230 | 6002 | 5786 582 | 5200 | 4868 | 4564 | 4788 4039 | 3812 | 30Ni 8 7.652 7325 7.020 6733 64636210 5747 5335 4988 4639 4344 4078 3 837 9 8.588 8.1627.798T435 .1066.802 6.2475.759 5.328 44 460T 4.303 4.031 10 | 9.471 | Bsis3 | .530 | B.111 1.722 | /.380 | 6./10 | 6.115 | 5.650 | 5.218 1.933 | 4.491 | 1.102 11 10368 9787 9.253 8.760 83067887 7.139 6495 5938 6.463 50294656 4.327 12 11 255 10 5759954 9385 8863 8384 7533 6814 6194 5601974793 4439 12 134 | 11 348 | 10635| 9g66394 | 8853 | 7g04 | 7103 | 6424 | 5842 5342 | 4910 | 4533 14 13004 2011296 10.539899.295 8.244 7367 66286.002 5468 5008 4611 15 13.885 12.849 1138 11.118 10.380 9.712 8.559 7808 68116.142 5575 5.092 4.875 1 | 6728 | 223 34445 65566 6677 10886 0804 0722 0650 0585 0527 04280350287 0237 016 0.162 0.135 12 0887 0.780.7010625 057047 0.3970.319 0.257 0.200188 0.137 0.112 00| 0.1/3 | 0.881 | 0.001 | 0.530 | 0M89 | 0.3813 | 0.290 | 0.229 | 0.102 | 0.115 | 0.118 | 0,003 14 08700.758 0.881 60.50504420.3400283206 0.180012 009 0.078 6 0861 0743 0642 65 0481 0417 0315 0239 1830140010 0084 0065 01233 45566 77788 9011 70 0870 673 0554 56 0377 0312 0215 0149 104 0073 0051 03700 29 76 20 1.048 16.361 1.8 13.50 12482 11.4r0 9.81 8.514 6.623b929.330 25 22.023 19.523 17413 15.622 14.094 12.783 10.675 907 843 6873 6097 6.4674948 30 25808 2239 19 600 17 2 15 372 13765 11 258 9427 8055 7003 61775517 4979 40 132835| 27355|73115|19 793 17150| 1fi046|1g25| 9779 | 8244 I 7105 6233 1 548 | 4R97 08 22 25 0720 0.610 0478 0375 0.295 0233 0.14 0.082 0059 0.039 0024 0.0160.010 30 0742 0.552 0412 0.308 0.231 0.174 0.000.057 0.033 0.020 0012 0.0070.004 10 062 0.4530.30 0.200 0.12 009 0.0M 0U22 DU11 00O5 0UG 0.001 0.001 01234 5667 B. 8990-1611 01234 56786 90122 6927| Reference Future Value of Annuity of $1 10% 1.000 12% 1.000 16% 1.000 18% 1.000 Periods 20% 1.000 2.010 2.0202.030 2.040 2.0502.0602.080 2.100 2.1202.1402.160 2.180 2.200 3.506 3572 3.640 5.066 5.2155.368 5.101 5.204 5.309 5416 5.526 5.63758676.105 6.353 6.610 6.877154 7.442 8.9779442 9.930 7.214 7.4347.6627.898 8.1428.3948.923 9487 10.089 10.73011.414 12.142 12916 8.286 8.5838.892 9.214 9.5499.89710.637 11.436 12.300 13.23314.240 5.327 16.499 9.755 0.15910.583 11.027 11.49112.48813.579 14.776 16.08517.51919.086 20.799 0.462 0.95011.464 2.006 12.578 13.18114.487 5.937 17.54919.33721.321 23.521 25.959 11567 12.16912.808 13.486 14.20714.97216 645 18.531 20.6552304525.733 28.755 32.150 2.683 1341214.19 15.026 5917 1687018977 21.384 24.1332727130.850 34.931 39.581 13.80914680 15.618 16.627 17.713 1888221.495 24.523 28.02932.08936.786 42219 48.497 4.9475974 7.086 18292 9599 21.01524215 27.975 3239337.58143.672 50818 59.196 6097 17.293 18599 20.024 21.579 23.276 27.152 31.772 37.28043.84251.660 60.965 72.035 22.01924.29726.870 29.778 3306636.786 45.762 57.275 72.052 91.025 115.380 46.628 186688 28.24332.030 36.459 41646 47.72754865 73.106 98 347 133 334 181.871 249.214 342603 471.981 1% 1.000 4% 1.000 5% 1.000 8% 1.000 14% 1.000 1.000 1.000 1.000 3.030 | 3.000 | 3.091 | 3.122 | 3.153 | 3.184 | 3.246 | 3.310 | 3.374 | 3440 4.921 060 4.122 4.246 4.779 4.184 4.310 4.375 4.506 4.641 6.152 6.308 6468 6.633 6.802 6.9757.336 7.716 8.115 8.536 9.369 12 13 14 15 25 34.785405684757556.085 66439 79.058 113 283 164494 241.333 356.787530.312 790948 1,181.882 48.88660402 754095.026 120800 154.762 259 057 442.5937670911,342.025 2,360.757 4,163 213 7,343 858 40 Print Done 24704 95311 49 11122 23456 78025 38 95 220 46 4 2 3 11112 23345 678 0 1 %666 11 00 0 4887 284 1 4%-140 300 400 999 005 195 ,, 202 or 220 013 400 201 198 as 002 980 004 73 198 79 ses ses on eas 000 980 per 2% 120 250 400 STA rez ona 201 4163 746 % 00 10 3 6 1 29489 38277 27 9 01234 2 075 5% 80 198 250 360 4 87 14 51 999 59 32 18 20 997 72 001 age 003 125-| | on 6 10 2 1 8 2 6 4% 990 002 125 170 201 26 $15 999 $25 400 $30 001 005 750 001 195 000 as 001 8 rio-2345 67891 12345 20 25 30 40