Question

Consider only pension disclosure (not postretirement benefits) for all of Disneys pension plans , domestic and international. (Exclude postretirement benefits). A. What is the amount

Consider only pension disclosure (not postretirement benefits) for all of Disneys pension plans, domestic and international. (Exclude postretirement benefits).

A. What is the amount of the projected benefit obligation (PBO) and the plan assets on the balance sheet date, 9/30/17?

B. Are the pension plans over or under funded and by how much?

C. What is the amount of pension expense for the year ended 9/30/17?

D. Did Disney's plan assets earn more or less than the amount expected? How do you determine this answer?

E. Where is this amount recorded? (Hint: it is not in net income.)

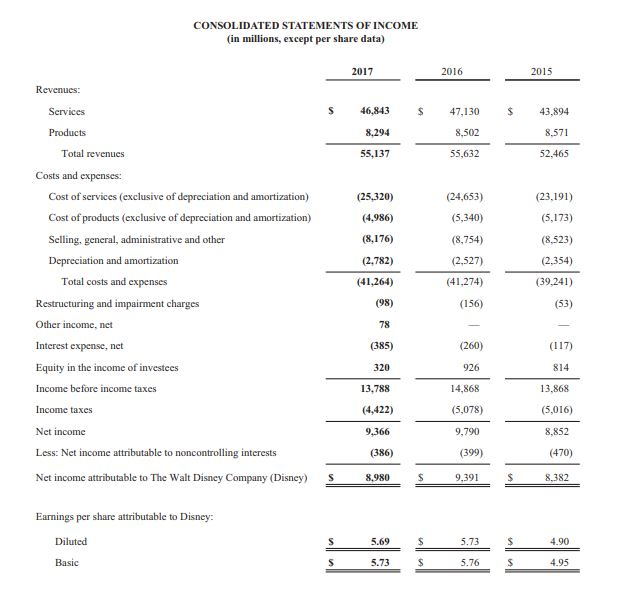

CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data) 2017 2016 2015 S 46,843 47,130 43,894 8.571 52.465 Services 8.294 8,502 Total revenues 55,137 55,632 Costs and expenses: Cost of services (exclusive of depreciation and amortization) (24,653) (5,340) (8,754) (2,527) (41,274) (156) (23,191) (5,173) (8,523) (2,354) (39,241) (53) (25.320) Cost of products (exclusive of depreciation and amortization) (4,986) Selling, general, administrative and other (8,176) Depreciation and amortization (2,782) Total costs and expenses 41,264) (98) Restructuring and impairment charges Other income, net Interest expense, net Equity in the income of Income before income taxes Income taxes Net income Less: Net income attributable to noncontrolling interests 78 (260) 926 14,868 (5,078) 9,790 (399) (117) 814 13.868 (5,016) 8,852 (470) (385) investees 320 13.788 (4,422) 9,366 (386) Net income attributable to The Walt Disney Company (Disney) S8980 9.391S 8.382 share attributable to Disney: Earnings per Diluted Basic 5.69 4.90 5.73 5.76 4.95Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started