Answered step by step

Verified Expert Solution

Question

1 Approved Answer

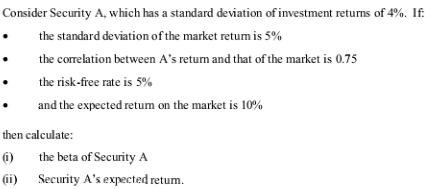

Consider Security A, which has a standard deviation of investment returns of 4%. If: the standard deviation of the market retum is 5% the

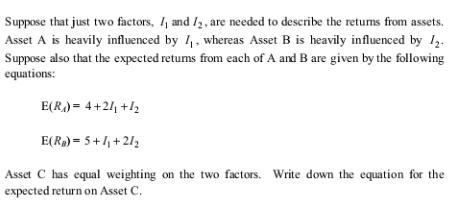

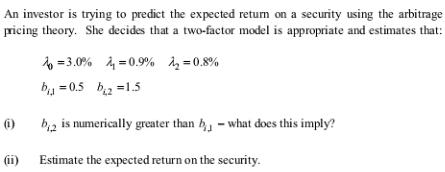

Consider Security A, which has a standard deviation of investment returns of 4%. If: the standard deviation of the market retum is 5% the correlation between A's return and that of the market is 0.75 the risk-free rate is 5% and the expected retum on the market is 10% then calculate: (1) (ii) the beta of Security A Security A's expected retum. Suppose that just two factors, I, and I2, are needed to describe the returns from assets. Asset A is heavily influenced by 1, whereas Asset B is heavily influenced by 1. Suppose also that the expected retums from each of A and B are given by the following equations: E(R) = 4+24 +1 E(R) = 5+4 +21 Asset C has equal weighting on the two factors. Write down the equation for the expected return on Asset C. An investor is trying to predict the expected return on a security using the arbitrage pricing theory. She decides that a two-factor model is appropriate and estimates that: =0.8% (i) 13.0% b = 0.5 b =1.5 b2 is numerically greater than b, what does this imply? = 0.9% (ii) Estimate the expected return on the security.

Step by Step Solution

★★★★★

3.27 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the beta of Security A we can use the formula Beta CovarianceAs return Market return Va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started