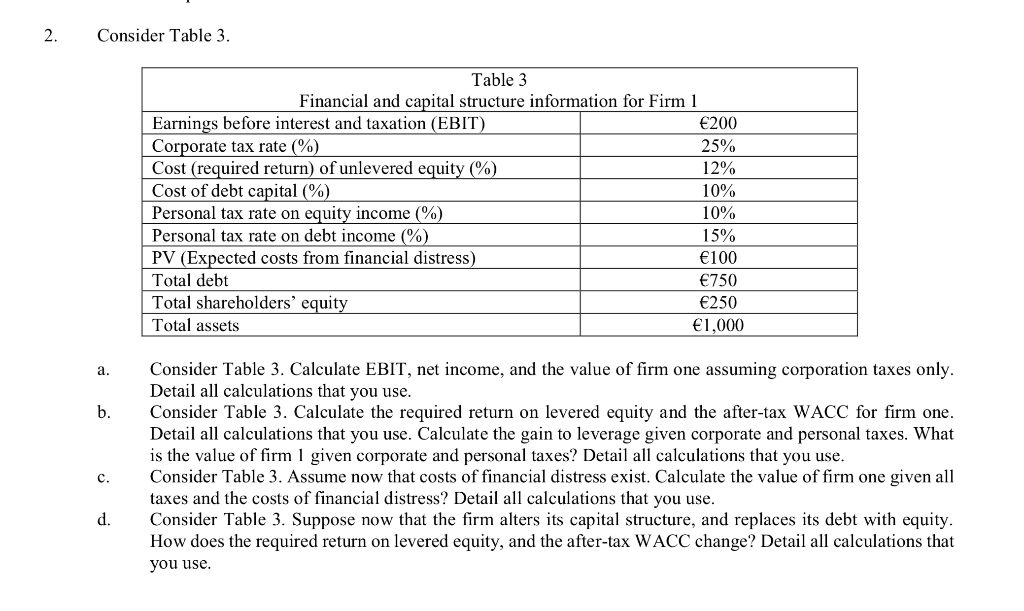

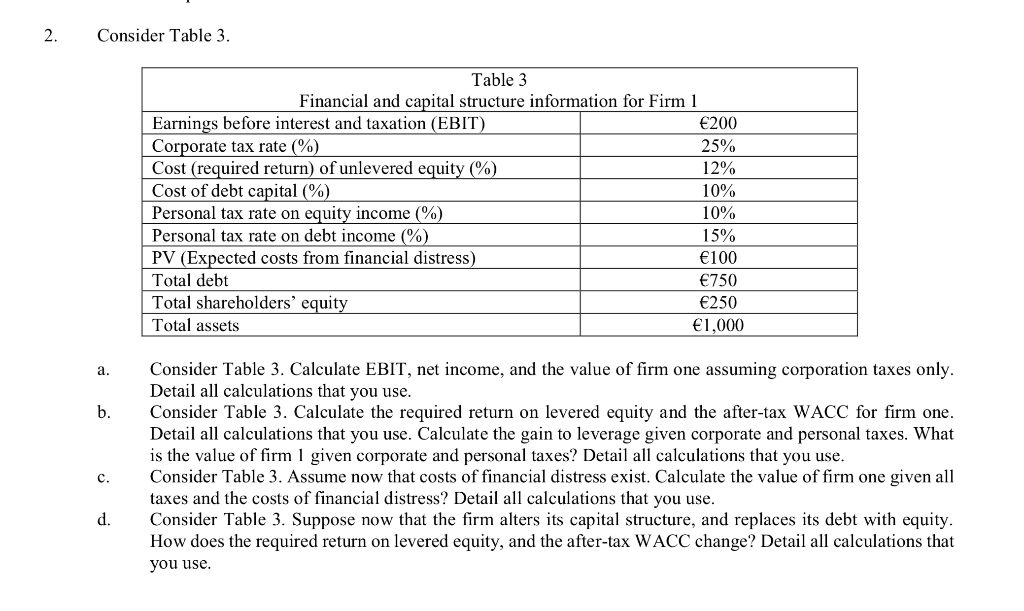

Consider Table 3. 2. Table 3 Financial and capital structure information for Firm 1 Earnings before interest and taxation (EBIT) Corporate tax rate (%) Cost (required return) of unlevered equity (% Cost of debt capital (%) Personal tax rate on equity income (%) Personal tax rate on debt income (%) PV (Expected costs from financial distress) 200 25% 12% 10% 10% 15% 100 Total debt 750 Total shareholders' equity 250 Total assets 1,000 Consider Table 3. Calculate EBIT, net income, and the value of firm one assuming corporation taxes only Detail all calculations that you use Consider Table 3. Calculate the required return on levered equity and the after-tax WACC for firm one Detail all calculations that you use. Calculate the gain to leverage given corporate and personal taxes. What is the value of firm 1 given corporate and personal taxes? Detail all calculations that you use Consider Table 3. Assume now that costs of financial distress exist. Calculate the value of firm one given all taxes and the costs of financial distress? Detail all calculations that you use. Consider Table 3. Suppose now that the firm alters its capital structure, and replaces its debt with equity How does the required return on levered equity, and the after-tax WACC change? Detail all calculations that you use a. C. d Consider Table 3. 2. Table 3 Financial and capital structure information for Firm 1 Earnings before interest and taxation (EBIT) Corporate tax rate (%) Cost (required return) of unlevered equity (% Cost of debt capital (%) Personal tax rate on equity income (%) Personal tax rate on debt income (%) PV (Expected costs from financial distress) 200 25% 12% 10% 10% 15% 100 Total debt 750 Total shareholders' equity 250 Total assets 1,000 Consider Table 3. Calculate EBIT, net income, and the value of firm one assuming corporation taxes only Detail all calculations that you use Consider Table 3. Calculate the required return on levered equity and the after-tax WACC for firm one Detail all calculations that you use. Calculate the gain to leverage given corporate and personal taxes. What is the value of firm 1 given corporate and personal taxes? Detail all calculations that you use Consider Table 3. Assume now that costs of financial distress exist. Calculate the value of firm one given all taxes and the costs of financial distress? Detail all calculations that you use. Consider Table 3. Suppose now that the firm alters its capital structure, and replaces its debt with equity How does the required return on levered equity, and the after-tax WACC change? Detail all calculations that you use a. C. d