Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider Tech Fiber, a manufacturer of high-end ski jackets. Tech Fiber sells its jackets only through Ski Adventure stores. Each jacket costs $10 to

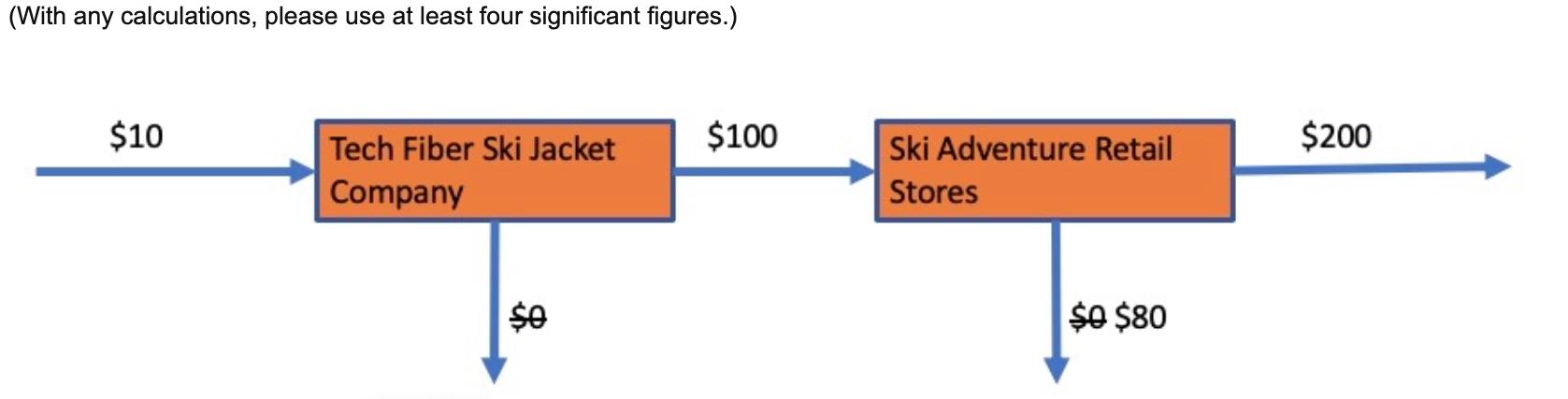

Consider Tech Fiber, a manufacturer of high-end ski jackets. Tech Fiber sells its jackets only through Ski Adventure stores. Each jacket costs $10 to produce, and Tech Fiber sells the jackets to Ski Adventure for $100 each. Ski Adventure sells each jacket at retail for $200. If Ski Adventure does not sell a jacket by the end of the season, they are disposed of for $0. Demand for the jackets throughout the winter season is normal with a mean of 7137 and a standard deviation of 1824. To give Ski Adventure incentive to order more magazines, it proposes a buyback contract system. Whichever jackets Ski Adventure fails to sell at retail price, Tech Fiber will buy back from Ski Adventure for $80. With this buyback agreement in place, what is the optimal order amount that will maximize Ski Adventure's expected profit? (With any calculations, please use at least four significant figures.) $10 Tech Fiber Ski Jacket Company $0 $100 Ski Adventure Retail Stores $0 $80 $200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the optimal order amount that maximizes Ski Adventures expected profit with the buyback ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started