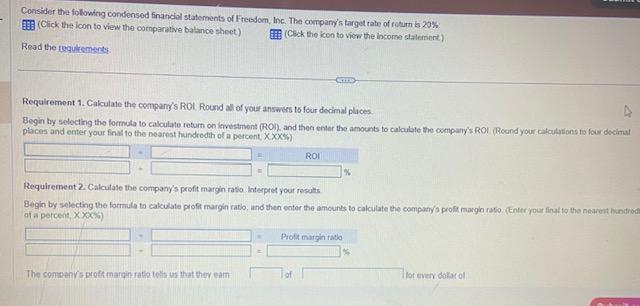

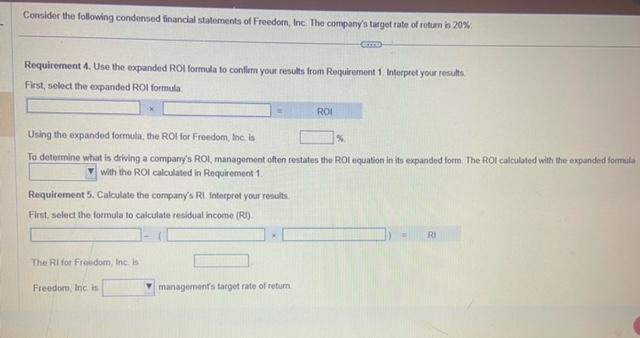

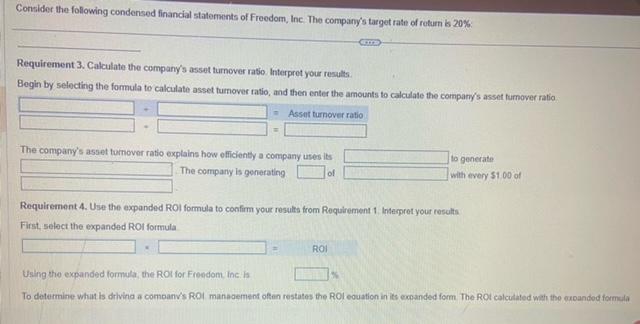

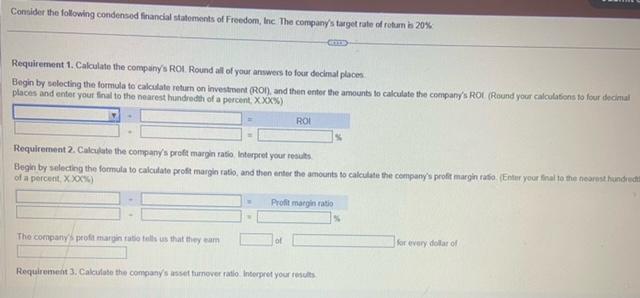

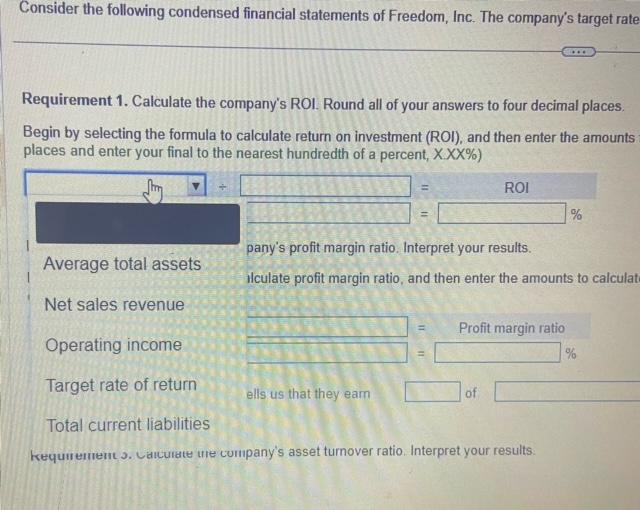

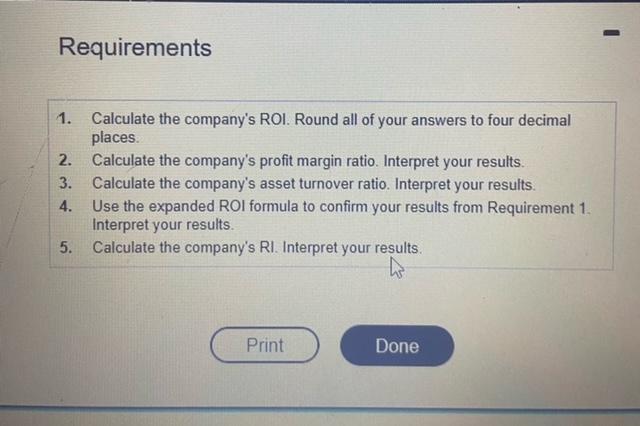

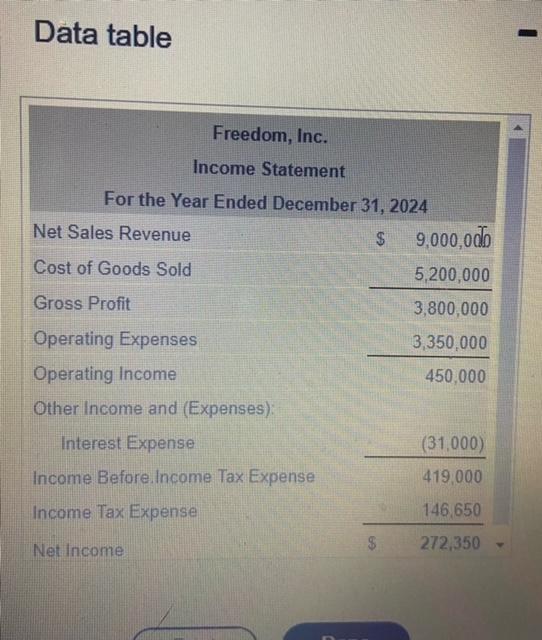

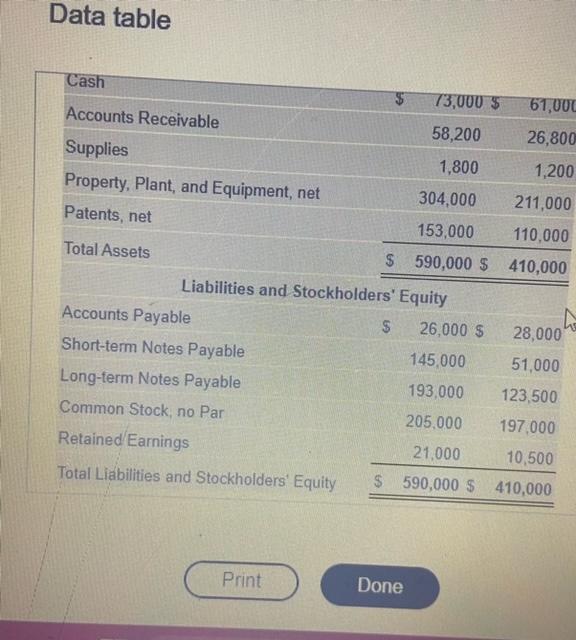

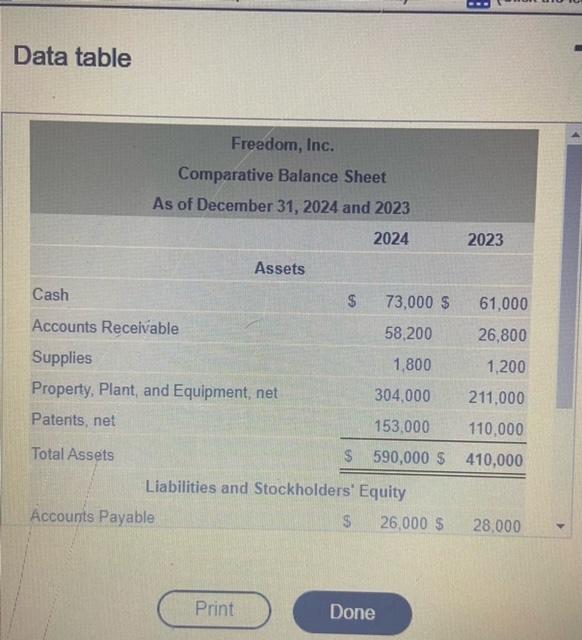

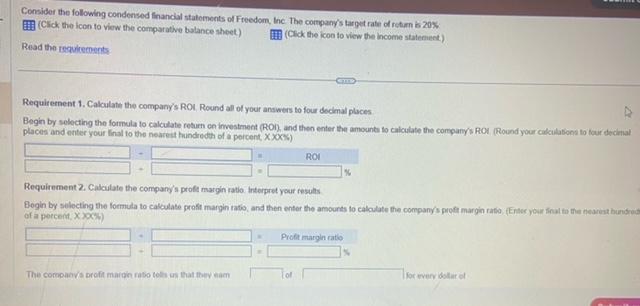

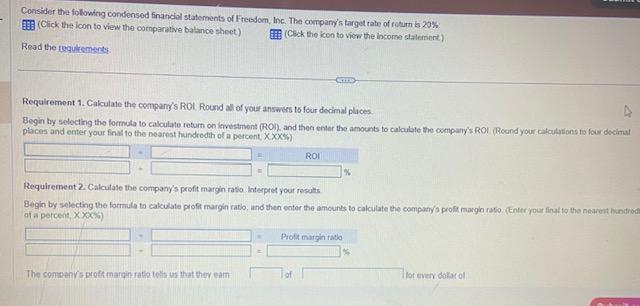

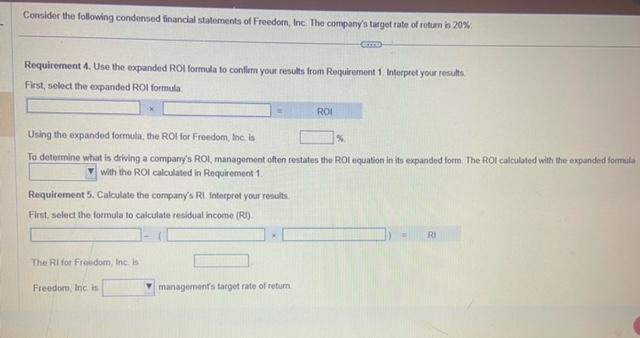

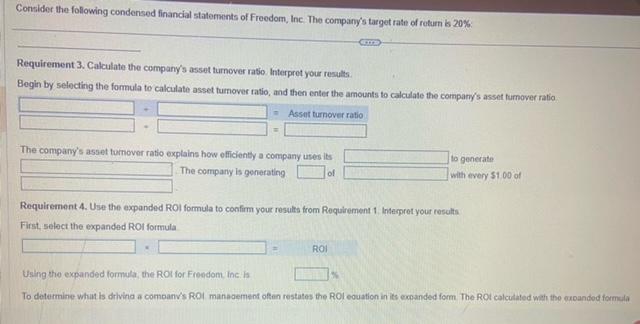

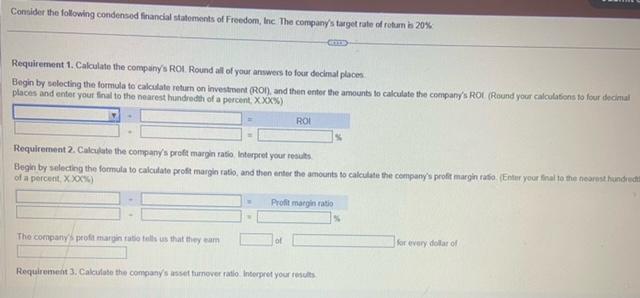

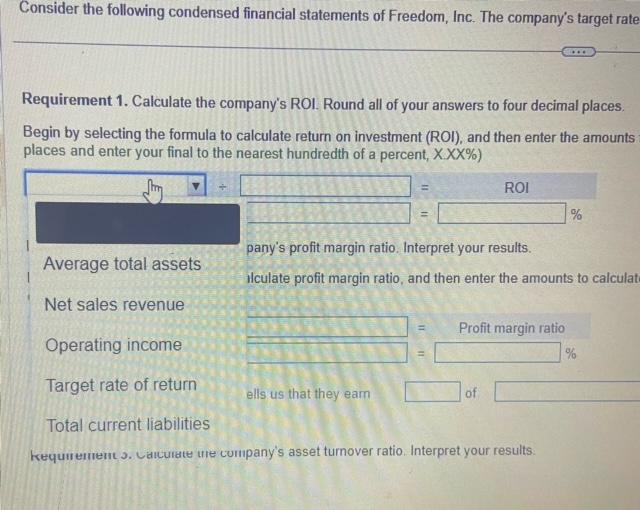

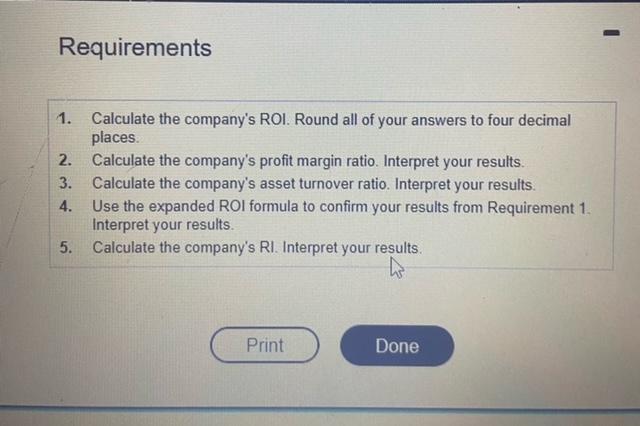

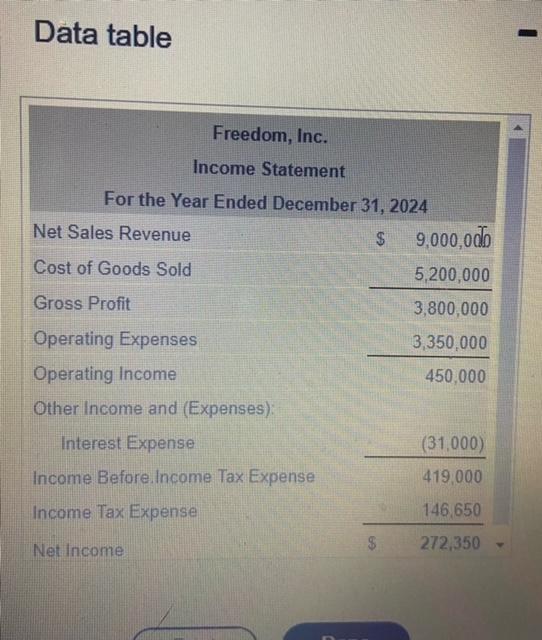

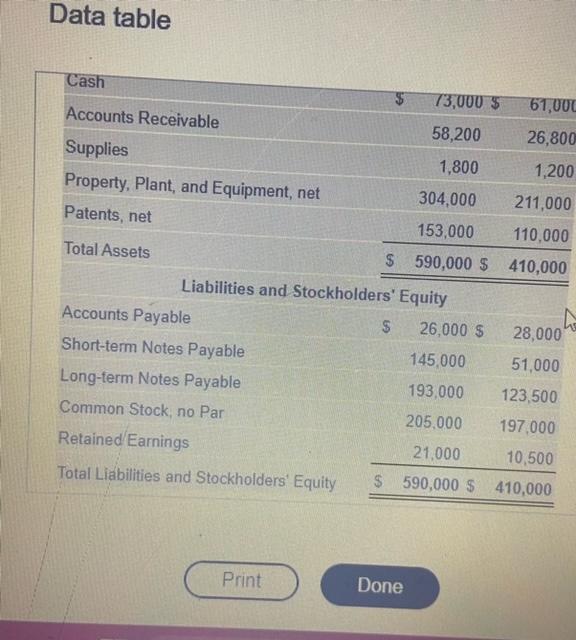

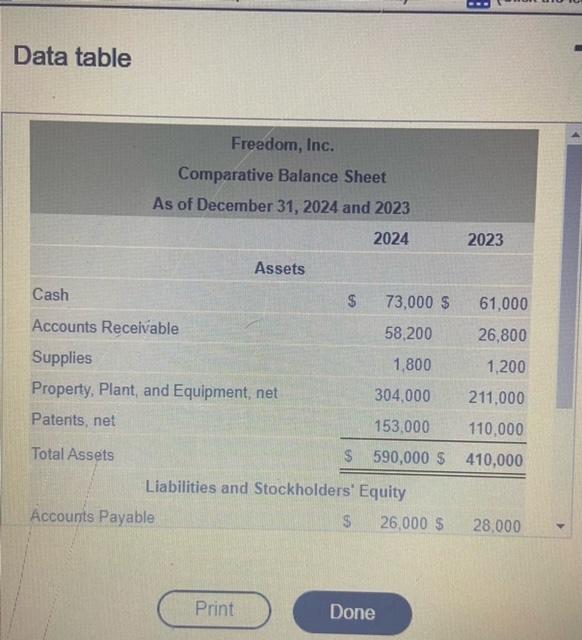

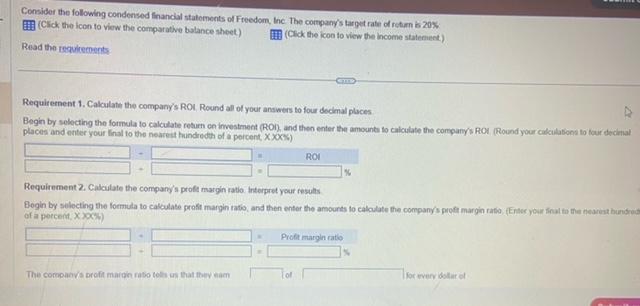

Consider tha folowirig condensed financial statements of Freedom, Inc. The company's target rate of rutarn bs 20 ? (Cick the icon to view the cornparative batince shect) CCek the icon to vior the income slalemnnt) Read the roquliements: Fequiremont 1. Cakculate the company's Rol. Round all of your answist to four decimal places. Begin by selocting the formula to calculate return on imestriont (ROI) and then enler the amounts to calablele the company's ROI (Round your calculationi to four decimal phaces and enter your final to the nearnst huindredth of a percent X.S.) Requirement 2. Calculate the company's profit margin ratia. Anterpret your mescels Begin by selecting the formula to calculate profit margin ratio, and then sater the amounts to calculate the company's profit margin ratio , (Enter your final fo the nearcit handroch af a percent xx+5) The comoenvis profimargit ratio tests us that thery eam Consider the following condonsed financial statements of Freedorn, Inc. The company's target rate of rotimn in 20% : Fequirement 4. Use the expanded ROI formula to confirm your results from Requirement 1 Interpretyour results First, solect the expanded RoI formula Using the expanded formula, the ROI for Freedom, inc is To determine what is dreving a company's ROI, managernent otten restates the ROI equation in its expanded form The ROI calculated with the expanded formula What the ROI calculated in Requirement 1 Requirement 5. Calculate the company's Ri: Intecpret your results First, select the foemula to calculate residual income (Rd) The fil fon fireedom. Inc. is Fredodom, Inc is managemenfs target rate of return Consider the folowing condensed financial statersents of freedom, Inc. The company's target rate of retum is 20% : Requirement 3. Calculate the company's asset tumover ratio Interpret your resulls. Begin by selecting the formula to calculate asset tumover ratio, and then enter the amounts to calculate the company's asset tumover ratio The company's asset tumover ratio explains how efficienty a company uses its to generate The company is generating whth every 5100 of Requirement 4. Use the expanded ROl formula to confirm your results from Roquirement 1 . Interpret your results First, select the expanded ROl formula Using the expanded formula, the Rot for Froedom, inc is To determine what is driving a comoanv's ROl manaoement often restates the Rol eouation in its exanded form The Rot calculated wath tho moandod: Consider the following condensed finandal statoments of Freedom, the The conquanys target rate di rotum b 20% Requirement 1. Calculate the compuny's ROA. Round all of your answess to four decinal places places and enter your final to the nearest hundrecth of a peroent. XXX6) Requirement 2. Calculate the conpany's proti margh rato loteppet your results of a percent, x>0C ) The companys peoft margh rase talli us that thio eam of fer even dolar of Consider the following condensed financial statements of Freedom, Inc. The company's target rate Requirement 1. Calculate the company's ROI. Round all of your answers to four decimal places. Begin by selecting the formula to calculate return on investment (ROI), and then enter the amounts places and enter your final to the nearest hundredth of a percent, XXX% ) pany's profit margin ratio. Interpret your results. Average total assets Ilculate profit margin ratio, and then enter the amounts to calculat Net sales revenue Operating income Target rate of return ells us that they eam Total current liabilities Kequir ement S. Lalcurate the cumpany's asset turnover ratio. Interpret your results Requirements 1. Calculate the company's ROI. Round all of your answers to four decimal places. 2. Calculate the company's profit margin ratio. Interpret your results. 3. Calculate the company's asset turnover ratio. Interpret your results. 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. 5. Calculate the company's RI. Interpret your results. Data table Data table Data table Freedom, Inc. Comparative Balance Sheet As of December 31, 2024 and 2023 20242023 Assets Liabilities and Stockholders' Equity Accounts Payable $26,000$28,000 Consider the following condensed finandal statements of Freedom. Inc. The company's tarpet rate of retirn is zo?s. FH3 (Click the icon to view the comparative balance shoet) [Click the icon to view the income statement.] Risad the requitecoents Requirernent 1. Calculatie the company's ROU Round all of your anawers to four declenal places Begin by selecting the formula to calculate resum ce investment (ROi) and then enter the amount to calculate the corspany's ROA (Round your calcidabond to bour decinal places and etter your linal to the nearest hundrecth of a percent in Requirement 2. Cadcilate the company's proft margin ratio. Interpret your fesults