Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the American call options with price CA(S+, t; K,T) where S is the spot price at time t 0), and the un- derlying

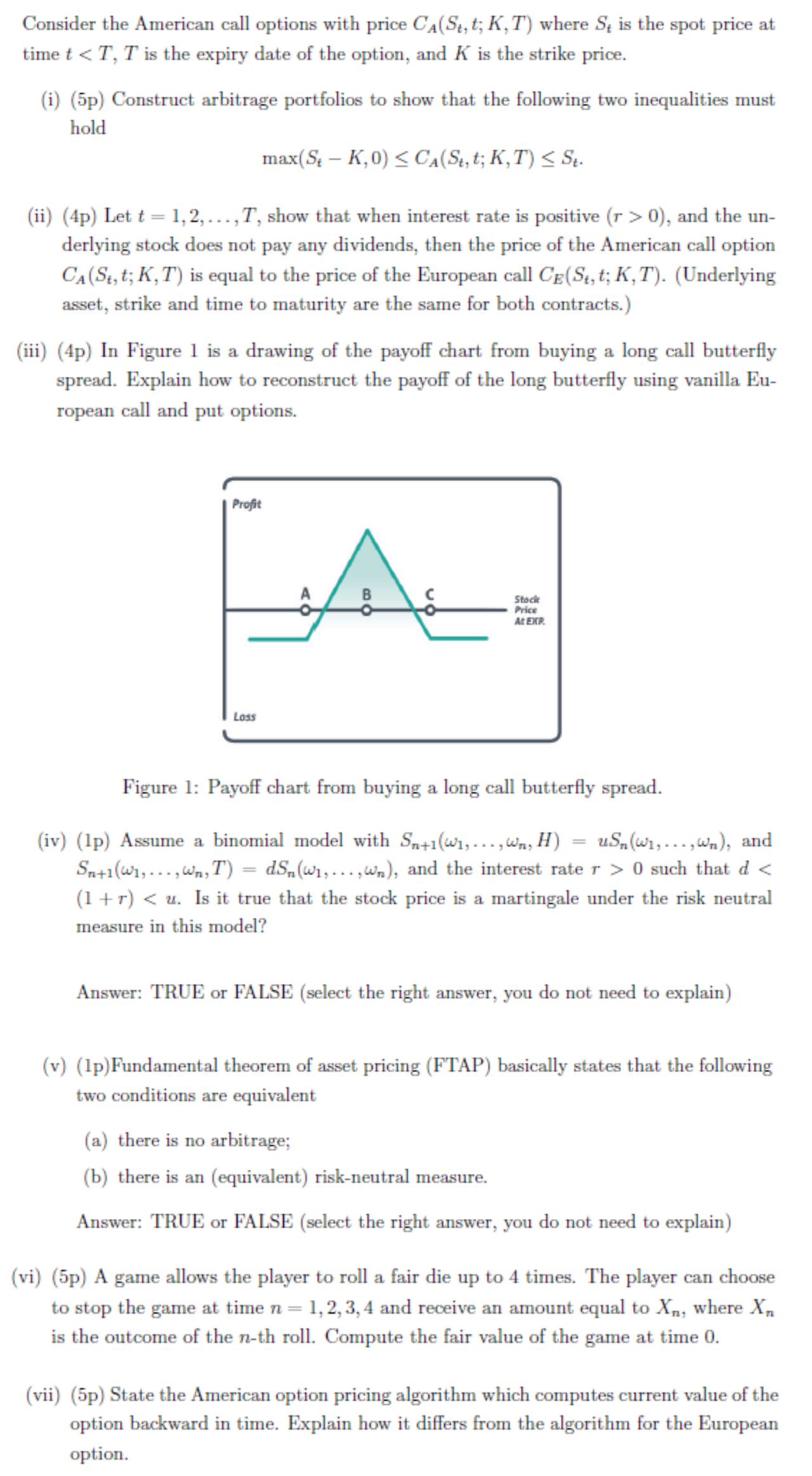

Consider the American call options with price CA(S+, t; K,T) where S is the spot price at time t 0), and the un- derlying stock does not pay any dividends, then the price of the American call option CA (St, t; K,T) is equal to the price of the European call CE(S, t; K,T). (Underlying asset, strike and time to maturity are the same for both contracts.) (iii) (4p) In Figure 1 is a drawing of the payoff chart from buying a long call butterfly spread. Explain how to reconstruct the payoff of the long butterfly using vanilla Eu- ropean call and put options. Profit Loss BO Stock Price At EXP Figure 1: Payoff chart from buying a long call butterfly spread. (iv) (1p) Assume a binomial model with Sn+1(w1,..., Wn, H) = US(w,..., wn), and Sn+1(W1,...,W,T) = dSn(w,...,wn), and the interest rate r> 0 such that d < (1+r) < u. Is it true that the stock price is a martingale under the risk neutral measure in this model? Answer: TRUE or FALSE (select the right answer, you do not need to explain) (v) (1p) Fundamental theorem of asset pricing (FTAP) basically states that the following two conditions are equivalent (a) there is no arbitrage; (b) there is an (equivalent) risk-neutral measure. Answer: TRUE or FALSE (select the right answer, you do not need to explain) (vi) (5p) A game allows the player to roll a fair die up to 4 times. The player can choose to stop the game at time n = 1,2,3,4 and receive an amount equal to X, where X, is the outcome of the n-th roll. Compute the fair value of the game at time 0. (vii) (5p) State the American option pricing algorithm which computes current value of the option backward in time. Explain how it differs from the algorithm for the European option.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started