Answered step by step

Verified Expert Solution

Question

1 Approved Answer

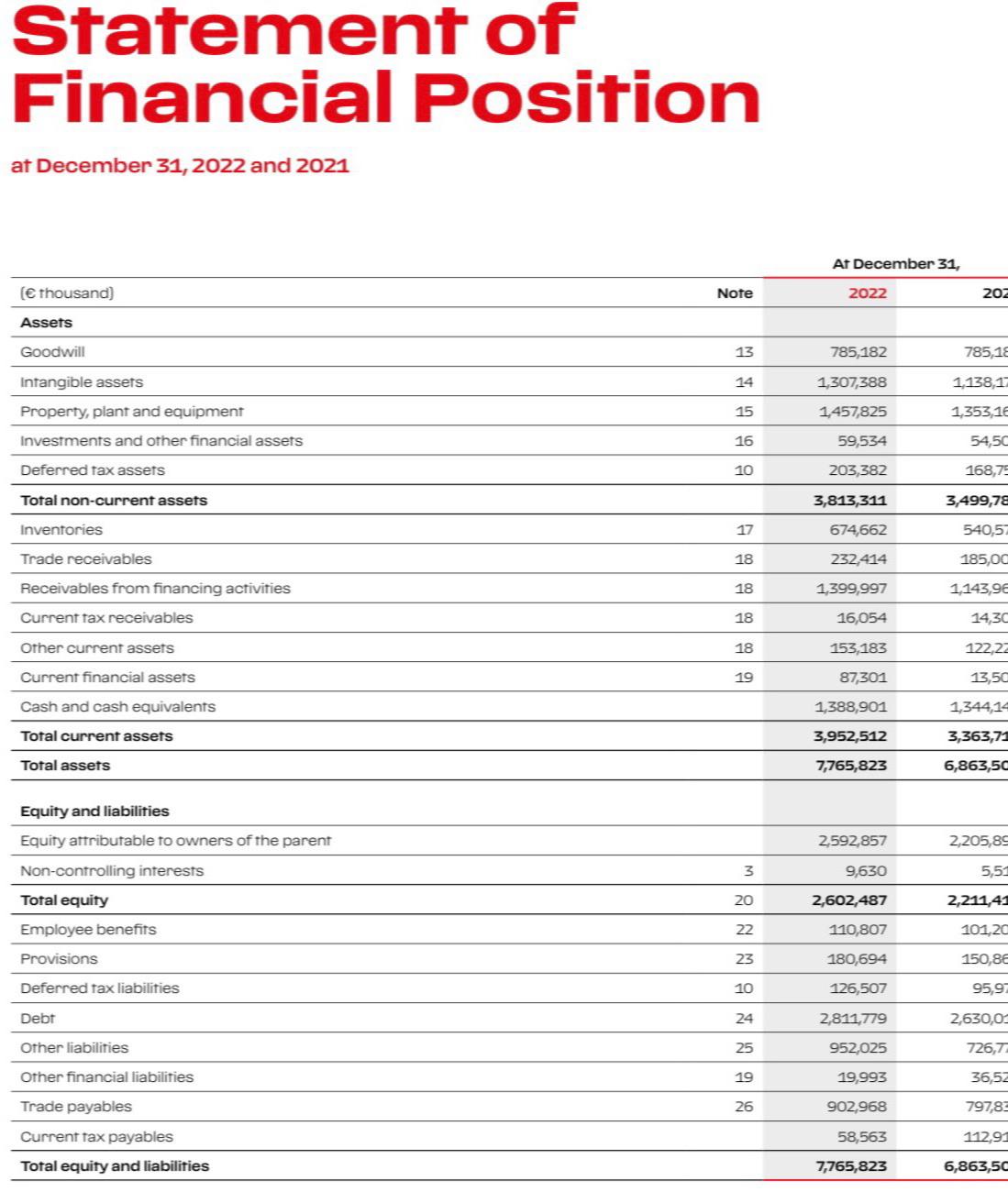

Consider the annual reports of Ferrari for 2 0 2 2 uploaded. Using financial ratios, you are required to compare them and answer the following

Consider the annual reports of Ferrari for uploaded. Using financial ratios, you are required to compare them and answer the following questions: Question : For the Balance sheet: What is the percentage change of total assets? Show calculations What is the percentage change of total Liabilities and total equity?

Statement of Financial Position at December 31, 2022 and 2021 ( thousand) Assets Goodwill Intangible assets Property, plant and equipment Investments and other financial assets Deferred tax assets Total non-current assets Inventories Trade receivables Receivables from financing activities Current tax receivables Other current assets Current financial assets Cash and cash equivalents Total current assets Total assets Equity and liabilities Equity attributable to owners of the parent Non-controlling interests Total equity Employee benefits Provisions Deferred tax liabilities Debt Other liabilities Other financial liabilities Trade payables Current tax payables Total equity and liabilities Note 13 14 15 16 10 17 18 18 18 18 19 3 20 22 23 10 24 25 19 26 At December 31, 2022 785,182 1,307,388 1,457,825 59,534 203,382 3,813,311 674,662 232,414 1,399,997 16,054 153,183 87,301 1,388,901 3,952,512 7,765,823 2,592,857 9,630 2,602,487 110,807 180,694 126,507 2,811,779 952,025 19,993 902,968 58,563 7,765,823 202 785,18 1,138,17 1,353,16 545C 168,75 3,499,78 540,57 185,00 1,143,96 14,30 122,22 13,50 1,344,14 3,363,71 6,863,50 2,205,89 5,51 2,211,41 101,20 150,86 95,97 2,630,00 726,77 36,52 797,83 112,91 6,863,50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer your question we need to compute the percentage change in total assets total liabilities a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started