Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the annual reports of Ferrari for 2 0 2 2 uploaded. Using financial ratios, you are required to compare them and answer the following

Consider the annual reports of Ferrari for uploaded. Using financial ratios, you are required to compare them and answer the following questions:

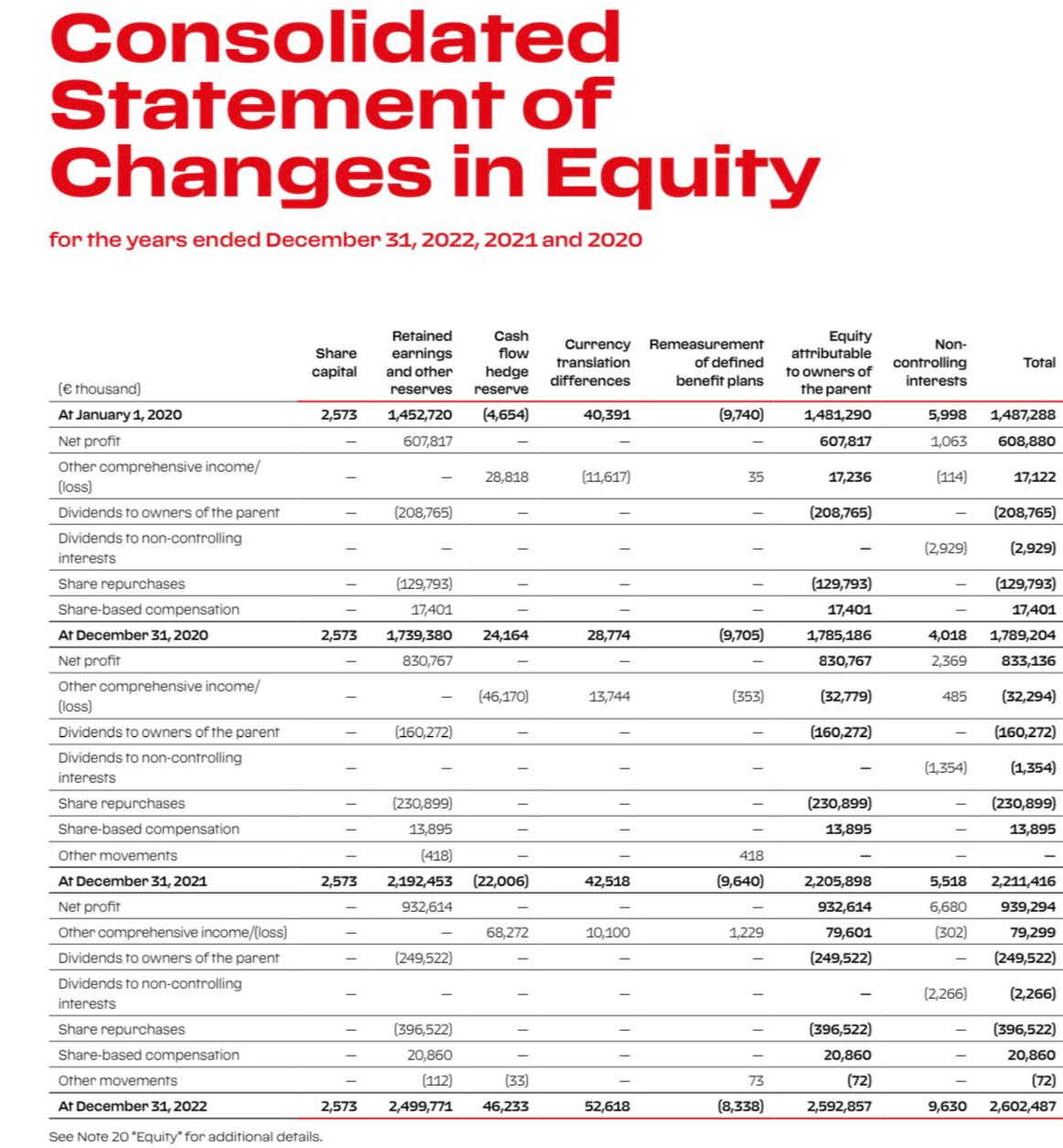

Consolidated Statement of Changes in Equity for the years ended December 31, 2022, 2021 and 2020 ( thousand) At January 1, 2020 Net profit Other comprehensive income/ (loss) Dividends to owners of the parent Dividends to non-controlling interests Share repurchases Share-based compensation At December 31, 2020 Net profit Other comprehensive income/ (loss) Dividends to owners of the parent Dividends to non-controlling interests Share repurchases Share-based compensation Other movements At December 31, 2021 Net profit Other comprehensive income/(loss) Dividends to owners of the parent Dividends to non-controlling interests Share repurchases Share-based compensation Share capital 2,573 Retained earnings and other reserves 1,452,720 607,817 Other movements At December 31, 2022 See Note 20 "Equity" for additional details. (208,765) 2,573 (129,793) 17,401 2,573 1,739,380 24,164 830,767 (160,272) (230,899) 13,895 (418) Cash flow hedge reserve (4,654) 28,818 2,573 2,192,453 (22,006) 932,614 (249,522) (46,170) 68,272 (396,522) 20,860 (33) (112) 2,499,771 46,233 Currency Remeasurement translation of defined benefit plans differences (9,740) 40,391 (11,617) 28,774 13,744 42,518 10,100 52,618 35 (9,705) (353) 418 (9,640) 1,229 73 (8,338) Equity attributable to owners of the parent 1,481,290 607,817 17,236 (208,765) (129,793) 17,401 1,785,186 830,767 (32,779) (160,272) (230,899) 13,895 2,205,898 932,614 79,601 (249,522) (396,522) 20,860 (72) 2,592,857 Non- controlling interests 5,998 1,487,288 1,063 608,880 (114) (2,929) (208,765) (2,929) (129,793) 17,401 4,018 1,789,204 2,369 833,136 485 Total (1,354) 17,122 (2,266) (32,294) (160,272) (1,354) (230,899) 13,895 5,518 2,211,416 6,680 939,294 (302) 79,299 (249,522) (2,266) (396,522) 20,860 (72) 9,630 2,602,487

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the percentage change of total assets total liabilities and total equity we would typic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started