Question

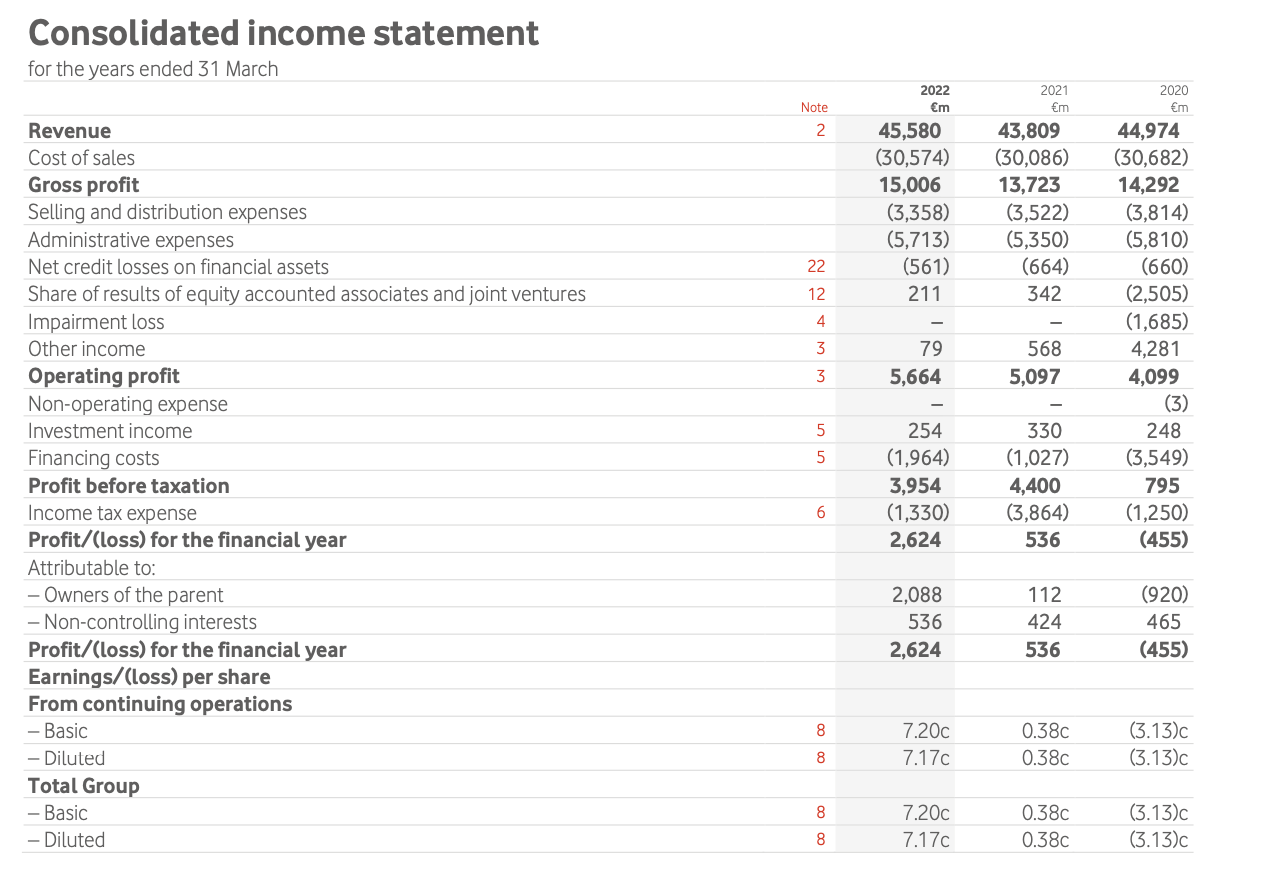

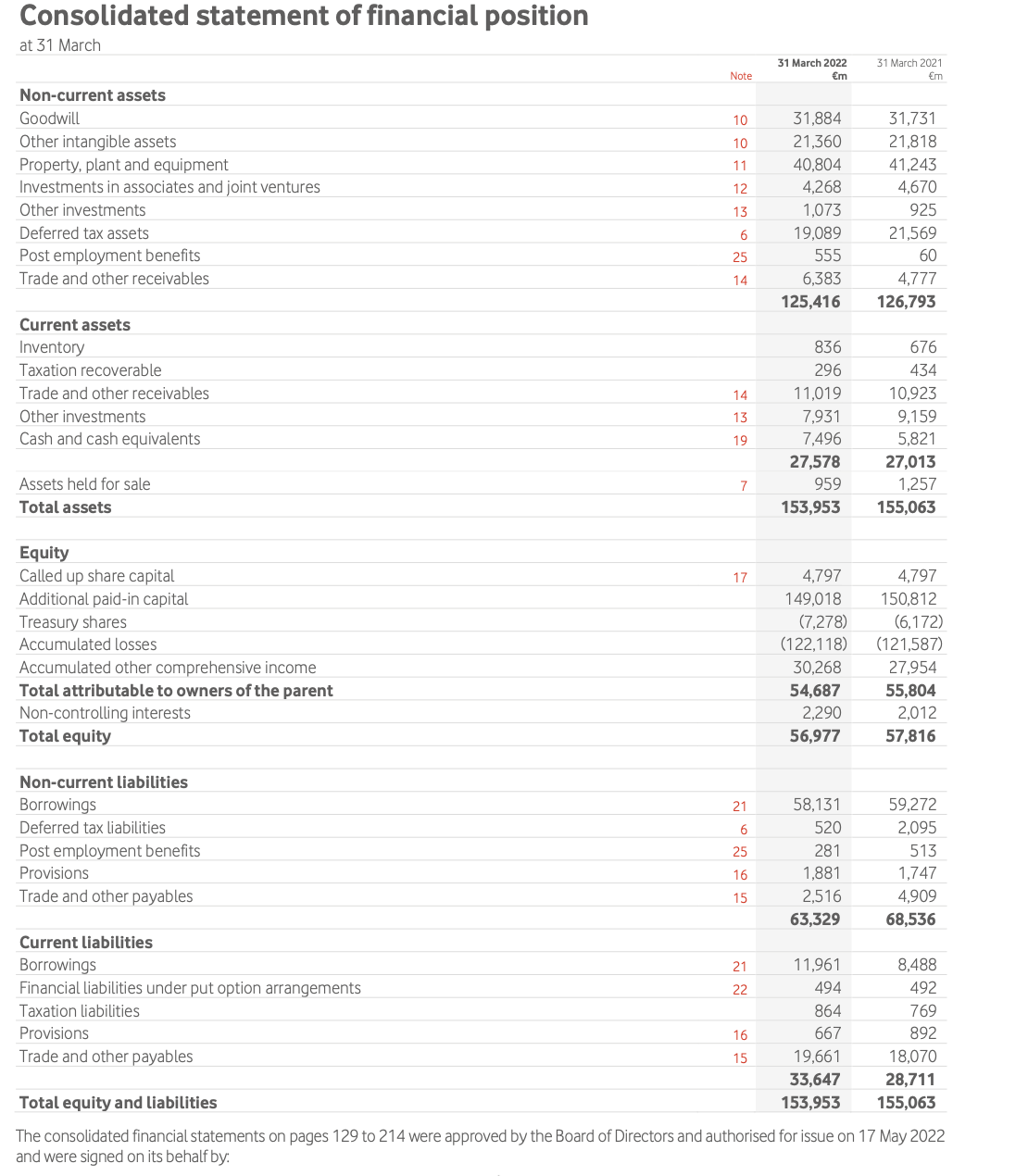

Consider the annual reports of Vodafone for 2021 and 2022. Using the financial ratios, presented below, you are required to 1) critically evaluate the financial

Consider the annual reports of Vodafone for 2021 and 2022. Using the financial ratios, presented below, you are required to 1) critically evaluate the financial statements individually across the 2-year period and cross-sectionally (i.e. company by company) and identify their main strengths and weaknesses, and 2) make recommendations for future improvement.

Note: Students are expected to comment on the change of company financial performance (income statement) and position (balance sheet) during the 2-year period of examination by looking at the main accounts and how they have changed (information may be taken from the notes to the accounts).

| Profitability Ratios | |

| Return on capital employed | Net profit before interest and taxation x 100 Share capital + Reserves + Long-term loans |

| Efficiency Ratios | |

| Average settlement period for debtors | Trade debtors x 365 Credit sales |

| Average settlement period for creditors | Trade creditors x 365 Credit purchases |

| Liquidity Ratios | |

| Current ratio | Current assets Current liabilities (creditors due within one year) |

| Gearing Ratios | |

| Gearing ratio | Long-term liabilities x 100 Share capital + Reserves + Long-term liabilities |

| Investment Ratios | |

| Dividend yield ratio | Dividend per share x 100 Market value per share |

| Price/earnings ratio (P/E) | Market value per share Earnings per share |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started