Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the AS-AD model from lectures. Suppose that the economy of Zamunda, an imaginary country, starts in period 0 in long-run equilibrium. The marginal

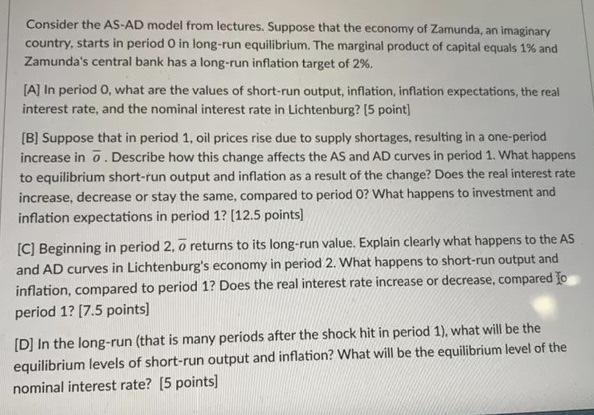

Consider the AS-AD model from lectures. Suppose that the economy of Zamunda, an imaginary country, starts in period 0 in long-run equilibrium. The marginal product of capital equals 1% and Zamunda's central bank has a long-run inflation target of 2%. [A] In period 0, what are the values of short-run output, inflation, inflation expectations, the real interest rate, and the nominal interest rate in Lichtenburg? [5 point] [B] Suppose that in period 1, oil prices rise due to supply shortages, resulting in a one-period increase in . Describe how this change affects the AS and AD curves in period 1. What happens to equilibrium short-run output and inflation as a result of the change? Does the real interest rate increase, decrease or stay the same, compared to period 0? What happens to investment and inflation expectations in period 1? [12.5 points] [C] Beginning in period 2, o returns to its long-run value. Explain clearly what happens to the AS and AD curves in Lichtenburg's economy in period 2. What happens to short-run output and inflation, compared to period 1? Does the real interest rate increase or decrease, compared to period 1? [7.5 points] [D] In the long-run (that is many periods after the shock hit in period 1), what will be the equilibrium levels of short-run output and inflation? What will be the equilibrium level of the nominal interest rate? [5 points]

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

A In period 0 what are the values of shortrun output inflation inflation expectations the real interest rate and the nominal interest rate in Lichtenburg 5 point ANSWER In period 0 shortrun output is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started