Answered step by step

Verified Expert Solution

Question

1 Approved Answer

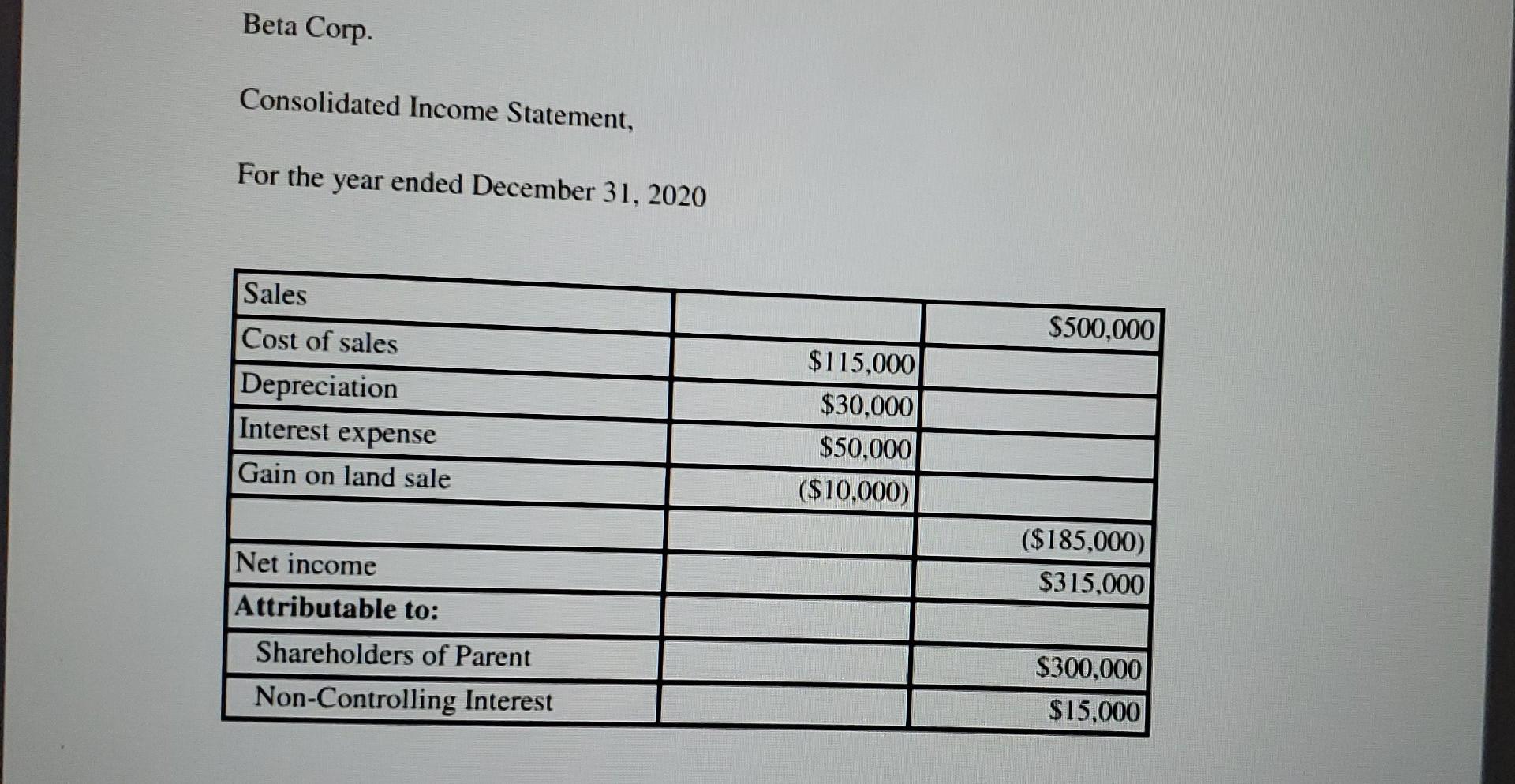

2) Beta Corp. owns 80% of Gamma Corp. The Consolidated Financial Statements 2) of Beta Corp. for 2019 and 2020 are shown below: Beta

2) Beta Corp. owns 80% of Gamma Corp. The Consolidated Financial Statements 2) of Beta Corp. for 2019 and 2020 are shown below: Beta Corp. Consolidated Balance Sheet Beta Corp. Consolidated Income Statement, For the year ended December 31, 2020 Sales Cost of sales Depreciation Interest expense Gain on land sale Net income Attributable to: Shareholders of Parent Non-Controlling Interest $115,000 $30,000 $50,000 ($10,000) $500,000 ($185,000) $315,000 $300,000 $15,000 Cash Accounts Receivable Inventory Land Plant and Equipment Accumulated Depreciation Goodwill Total Assets Accounts Payable Accrued Liabilities Bonds Payable Less Bond Discount Non-Controlling Interest Common Shares Retained Earnings Total Liabilities and Equity Beta Corp. Consolidated Income Statement, For the year ended December 31, 2020 2020 $180,000 $300,000 $400,000 $160,000 $1,650,000 ($800,000) $60,000 $1,950,000 $326,000 $350,000 $400,000 ($40,000) $214,000 $350,000 $350,000 $1,950,000 2019 $40,000 $100,000 $100,000 $200,000 $1,170,000 ($770,000) $60,000 $900,000 $40,000 $140,000 $100,000 ($50,000) $200,000 $350,000 $120,000 $900,000 Other Information: Beta purchased its interest in Gamma on January 1, 2016 for $360,000 when the company's net assets were valued at $300,000. The acquisition differential was allocated equally between goodwill and equipment, which was estimated to have a remaining useful life of ten years from the acquisition date. Gamma reported a net income of $75,000 and paid dividends of $5,000 during 2020. Beta issued $300,000 in bonds during the year. Beta reported an equity method net Income of $300,000 and paid $70,000 in dividends to its shareholders. Required: Prepare a Consolidated Statement of Cash Flows for Beta Corp. for 2020.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

solution Consolidated Statement of Cash Flows for Beta corp for 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started