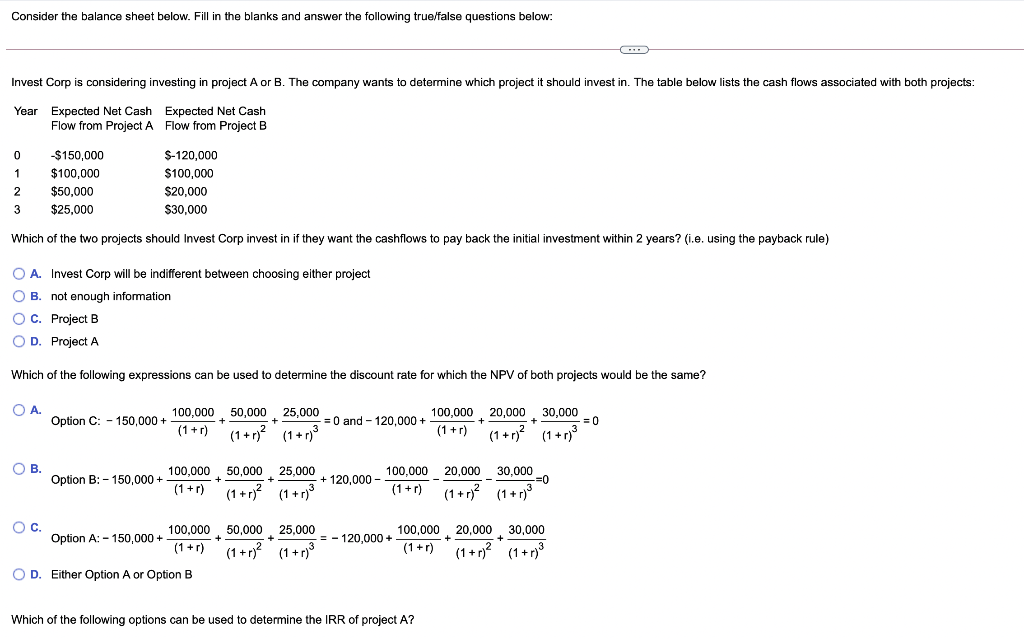

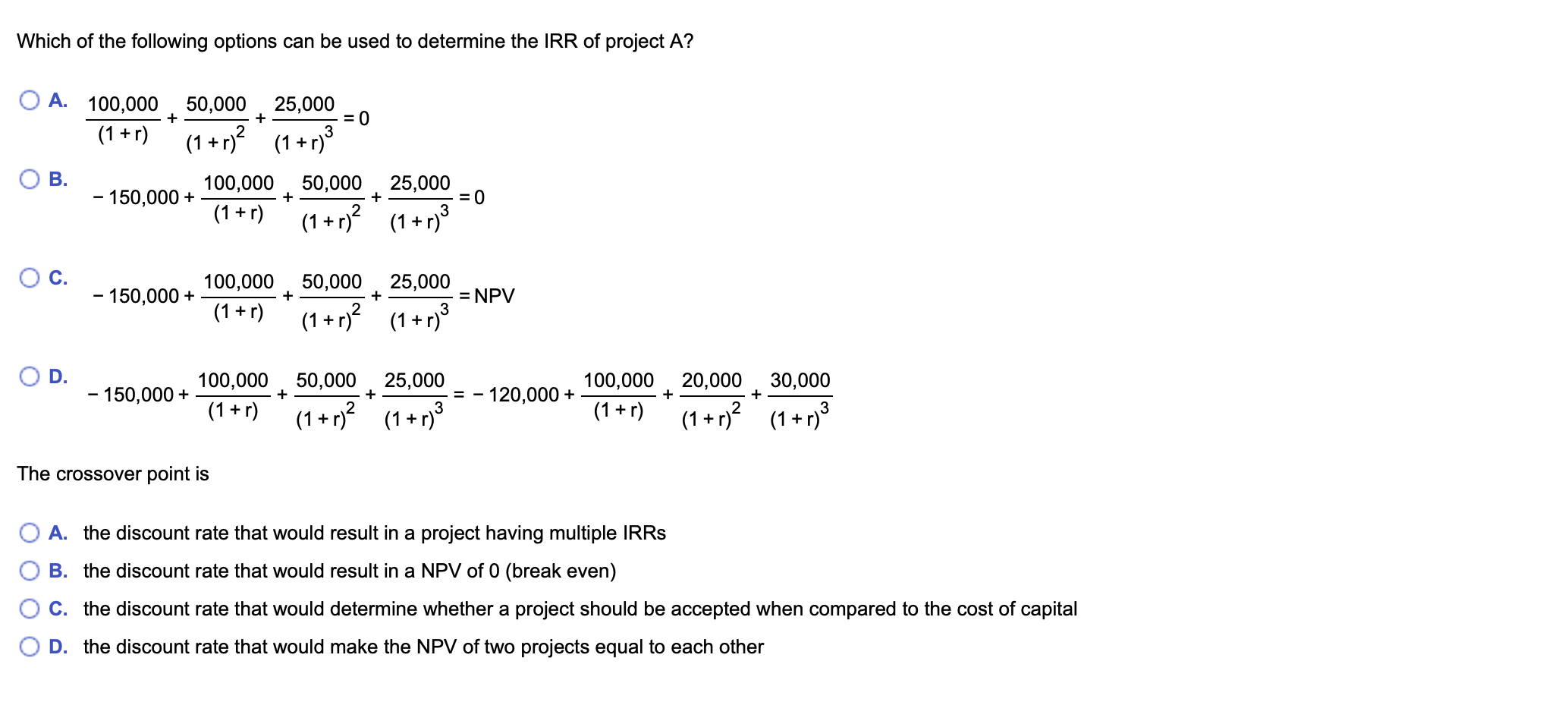

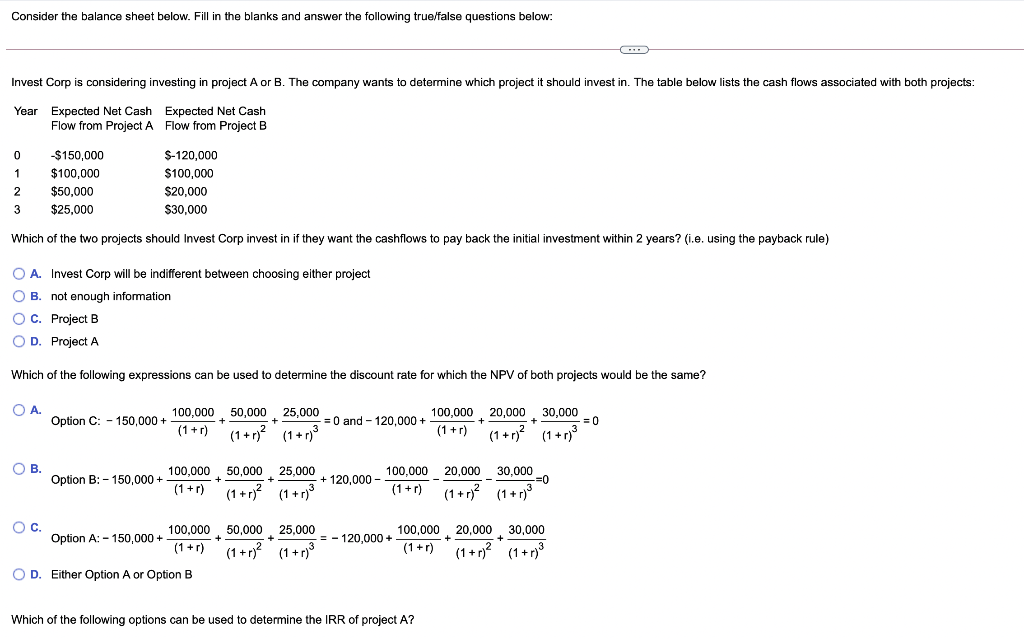

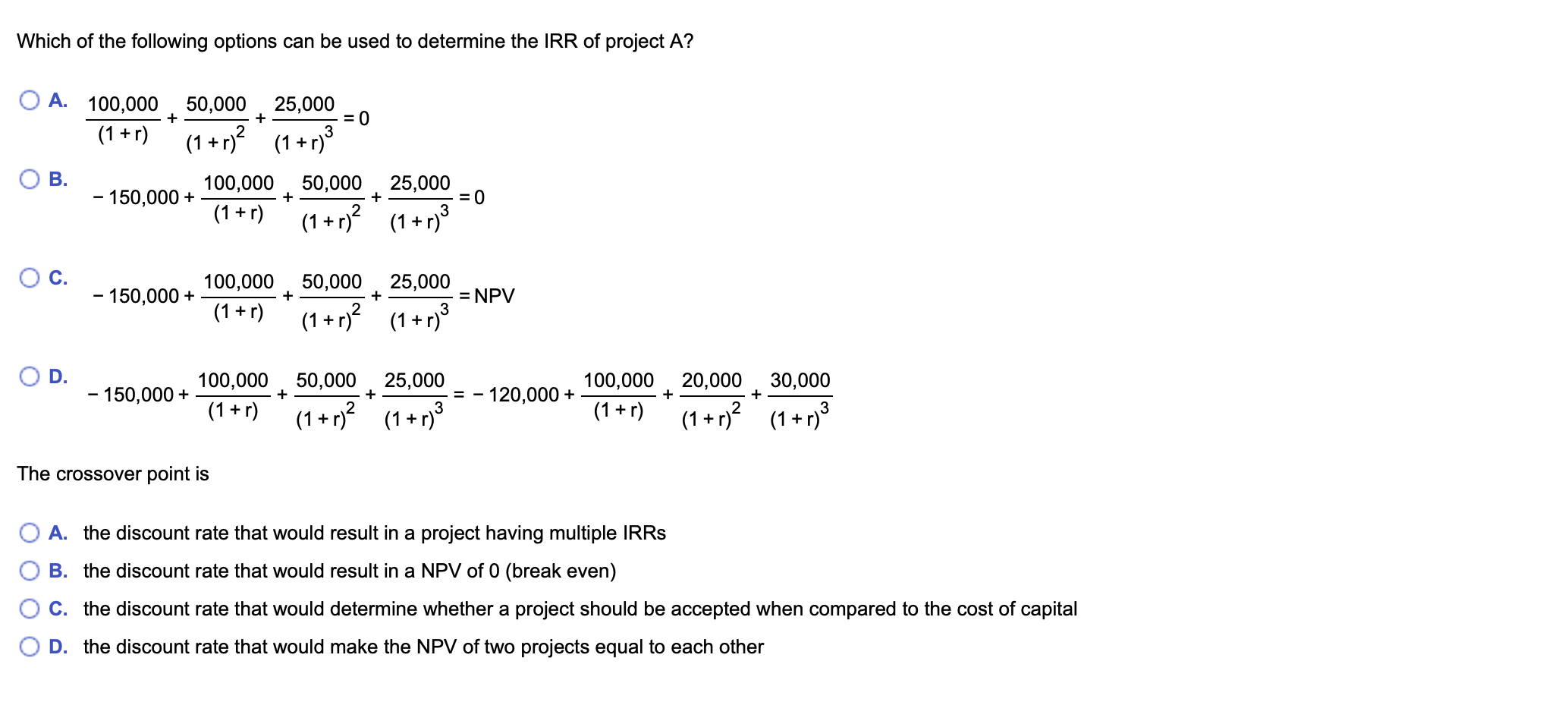

Consider the balance sheet below. Fill in the blanks and answer the following true/false questions below: Invest Corp is considering investing in project A or B. The company wants to determine which project it should invest in. The table below lists the cash flows associated with both projects: Year Expected Net Cash Expected Net Cash Flow from Project A Flow from Project B 0 1 2 3 $150,000 $100,000 $50,000 $25,000 $-120,000 $100,000 $ $20,000 $ $30,000 Which of the two projects should Invest Corp invest in if they want the cashflows to pay back the initial investment within 2 years? (i.e. using the payback rule) OA. Invest Corp will be indifferent between choosing either project OB. not enough information OC. Project B OD. Project A Which of the following expressions can be used to determine the discount rate for which the NPV of both projects would be the same? O A. Option C: - 150,000 + 100,000 50,000 25,000 + 100,000 20,000 30,000 = 0 and -120,000+ = 0 (1+r) (1 + r)? (1 + r) (1+r) (1 + r) (1+r) + + + OB. 100,000 Option B: - 150,000 + (1+r) + =0 50,000 25,000 100,000_20,000 30,000 + 120,000 - (1 +r)2 (1+r) (1+r) (1+r)2 (1+r) Oc. Option A - 150,000+ 100,000 (1 + r) + 50,000 25,000 100,000 20,000 30,000 = - 120,000+ 3 3 (1+r) (1 +r)2 (1+r) (1 + r)2 (1+r) + OD. Either Option A or Option B Which of the following options can be used to determine the IRR of project A? Which of the following options can be used to determine the IRR of project A? A. 100,000 (1 + r) + + 50,000 25,000 = 0 (1+r)2 (1+r) 3 3 B. + + 100,000 50,000 - 150,000+ 25,000 = 0 (1 + r) (1+r)2 (1 + r) 2 1 ) 3 + C. 100,000 - 150,000+ (1+r) + + 50,000 25,000 = NPV (1 + r)2 (1 + r) 3 ) 3 D. + + 100,000 120,000+ (1 + r) + 100,000 50,000 25,000 - 150,000+ (1 + r) (1 + r) 2 (1 + r)3 + 20,000 30,000 (1+r)2 (1 + r) 3 The crossover point is O A. the discount rate that would result in a project having multiple IRRs B. the discount rate that would result in a NPV of 0 (break even) C. the discount rate that would determine whether a project should be accepted when compared to the cost of capital D. the discount rate that would make the NPV of two projects equal to each other