Answered step by step

Verified Expert Solution

Question

1 Approved Answer

= 100, Consider the Black-Scholes model and its European call option pricing formula. Fix So K = 100, T = 1, r = 3%,

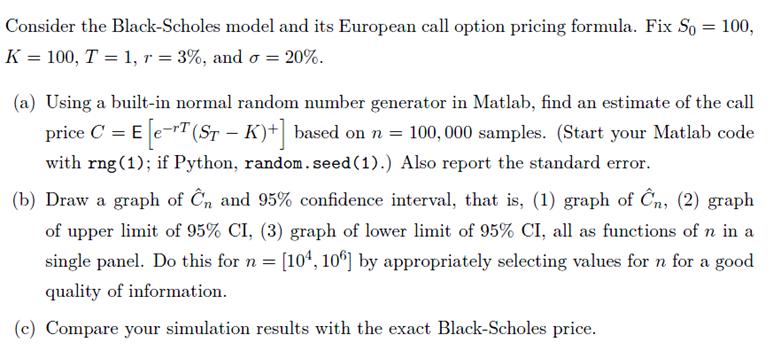

= 100, Consider the Black-Scholes model and its European call option pricing formula. Fix So K = 100, T = 1, r = 3%, and o = 20%. (a) Using a built-in normal random number generator in Matlab, find an estimate of the call price C = E [e-T (ST - K)+] based on n = 100,000 samples. (Start your Matlab code with rng (1); if Python, random. seed (1).) Also report the standard error. (b) Draw a graph of n and 95% confidence interval, that is, (1) graph of n, (2) graph of upper limit of 95% CI, (3) graph of lower limit of 95% CI, all as functions of n in a single panel. Do this for n = [104, 106] by appropriately selecting values for n for a good quality of information. (c) Compare your simulation results with the exact Black-Scholes price.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Using a builtin normal random number generator in Matlab find an estimate of the call price C EeT ST K based on n 100000 samples Start your Matlab c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started