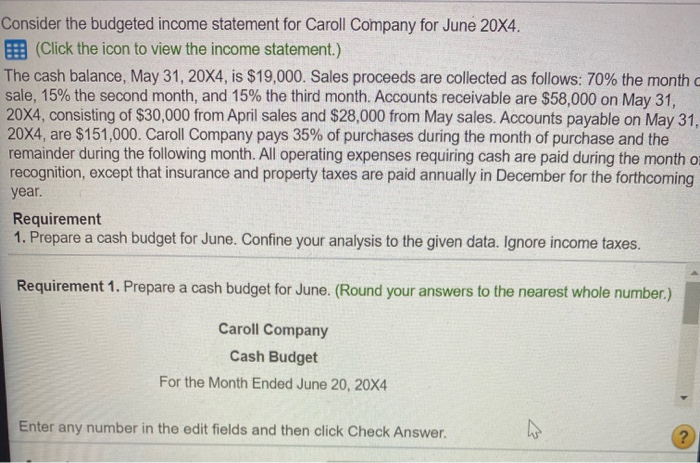

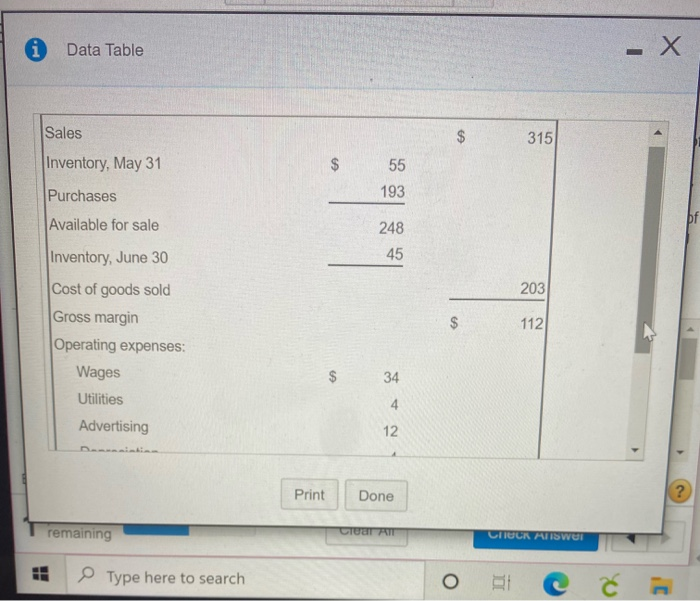

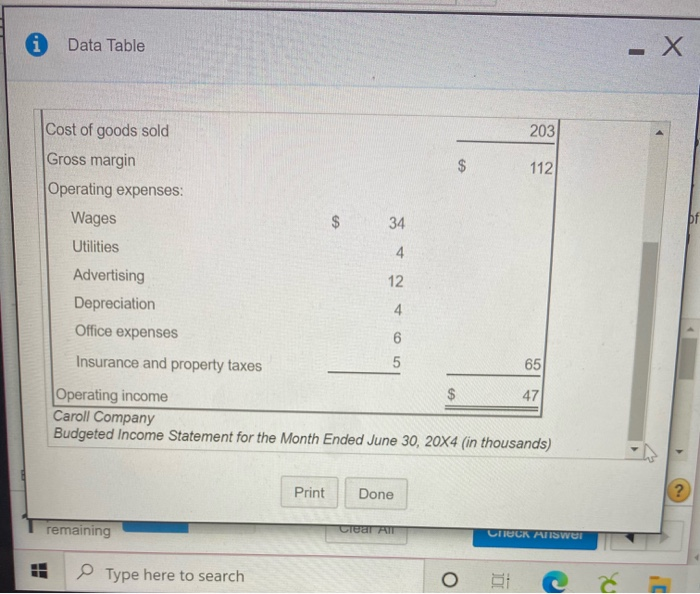

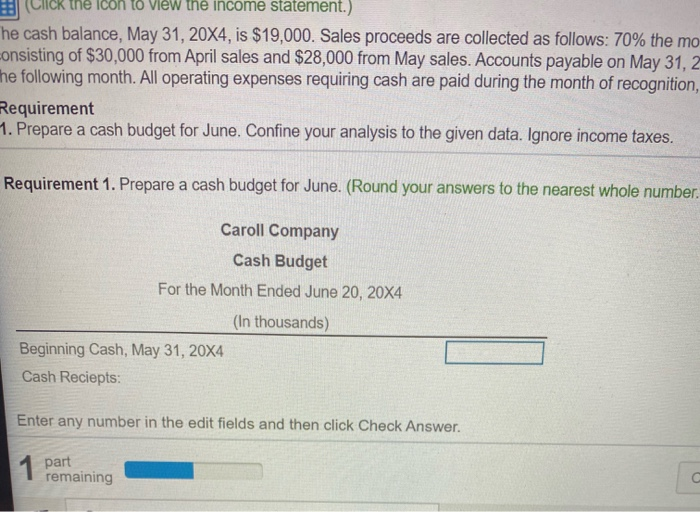

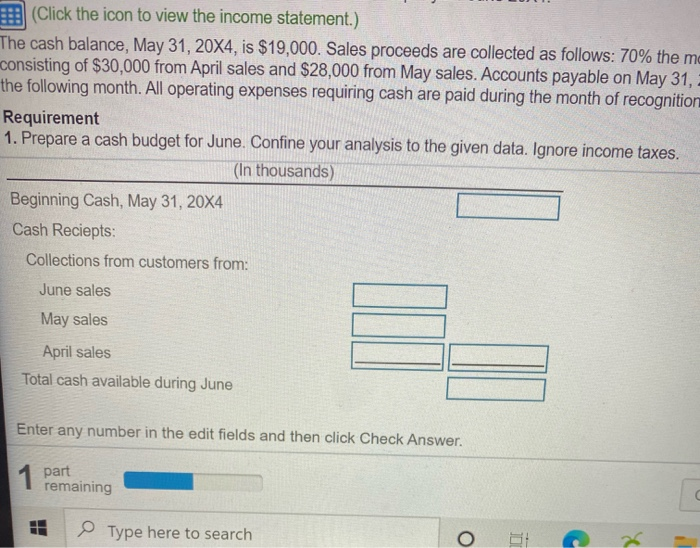

Consider the budgeted income statement for Caroll Company for June 20X4. E (Click the icon to view the income statement.) The cash balance, May 31, 20X4, is $19,000. Sales proceeds are collected as follows: 70% the month sale, 15% the second month, and 15% the third month. Accounts receivable are $58,000 on May 31, 20X4, consisting of $30,000 from April sales and $28,000 from May sales. Accounts payable on May 31, 20X4, are $151,000. Caroll Company pays 35% of purchases during the month of purchase and the remainder during the following month. All operating expenses requiring cash are paid during the month o recognition, except that insurance and property taxes are paid annually in December for the forthcoming year. Requirement 1. Prepare a cash budget for June. Confine your analysis to the given data. Ignore income taxes. Requirement 1. Prepare a cash budget for June. (Round your answers to the nearest whole number.) Caroll Company Cash Budget For the Month Ended June 20, 20X4 Enter any number in the edit fields and then click Check Answer. ? Data Table - X Sales $ 315 Inventory, May 31 $ 55 Purchases 193 Available for sale 248 45 Inventory, June 30 203 $ 112 Cost of goods sold Gross margin Operating expenses: Wages Utilities Advertising $ 34 4 12 Print Done remaining CIUTAT LUCK ATISWI Type here to search O i Data Table - pf 203 Cost of goods sold Gross margin $ 112 Operating expenses: Wages $ 34 Utilities 4 Advertising 12 Depreciation 4 Office expenses 6 Insurance and property taxes 5 65 $ 47 Operating income Caroll Company Budgeted Income Statement for the Month Ended June 30, 20X4 (in thousands) Print Done ? remaining Clear AT LUCK ANSWE Type here to search O the icon to view the income statement.) he cash balance, May 31, 20X4, is $19,000. Sales proceeds are collected as follows: 70% the mo consisting of $30,000 from April sales and $28,000 from May sales. Accounts payable on May 31, 2 the following month. All operating expenses requiring cash are paid during the month of recognition, Requirement 1. Prepare a cash budget for June. Confine your analysis to the given data. Ignore income taxes. Requirement 1. Prepare a cash budget for June. (Round your answers to the nearest whole number Caroll Company Cash Budget For the Month Ended June 20, 20X4 (In thousands) Beginning Cash, May 31, 20X4 Cash Reciepts: Enter any number in the edit fields and then click Check Answer. 1 part remaining (Click the icon to view the income statement.) The cash balance, May 31, 20X4, is $19,000. Sales proceeds are collected as follows: 70% the me consisting of $30,000 from April sales and $28,000 from May sales. Accounts payable on May 31, the following month. All operating expenses requiring cash are paid during the month of recognition Requirement 1. Prepare a cash budget for June. Confine your analysis to the given data. Ignore income taxes. (In thousands) Beginning Cash, May 31, 20X4 Cash Reciepts: Collections from customers from: June sales May sales April sales Total cash available during June Enter any number in the edit fields and then click Check Answer. 1 part remaining Type here to search O TO