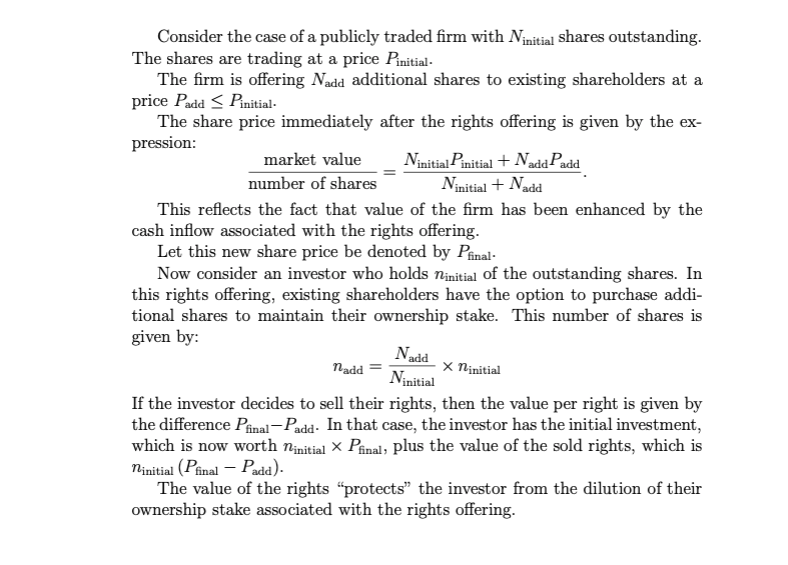

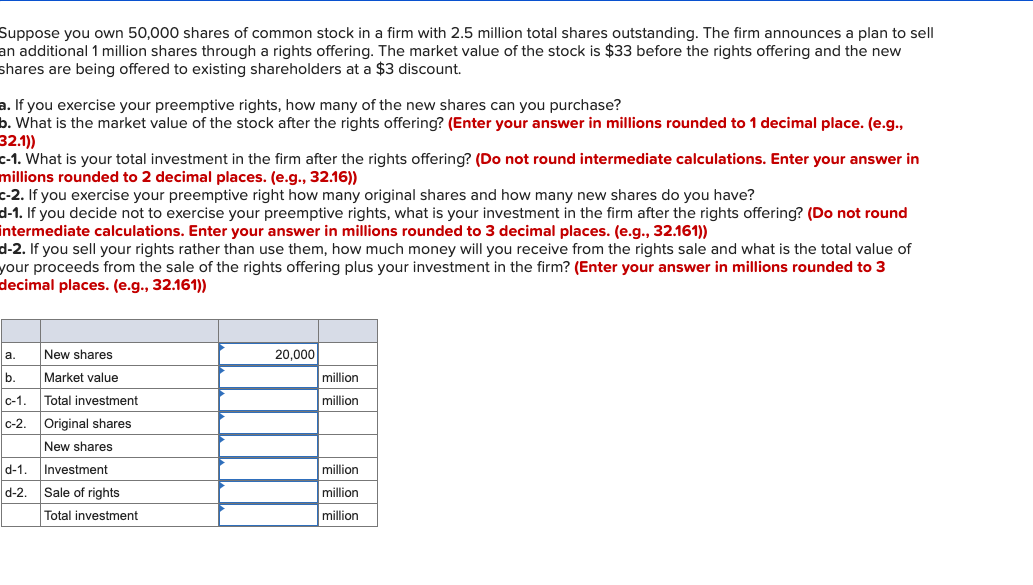

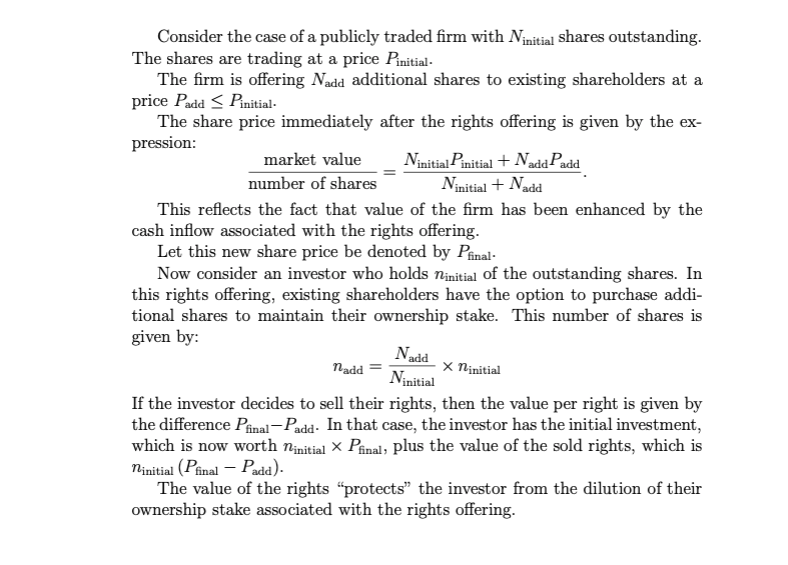

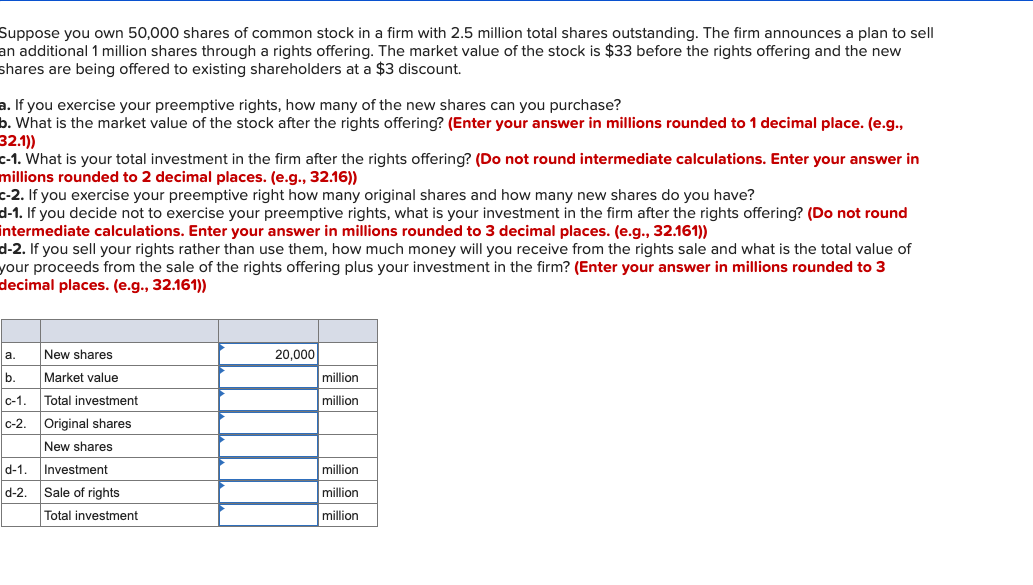

Consider the case of a publicly traded firm with Ninitial shares outstanding. The shares are trading at a price Pinitial. The firm is offering Nadd additional shares to existing shareholders at a price PaddPinitial. The share price immediately after the rights offering is given by the expression: numberofsharesmarketvalue=Ninitial+NaddNinitialPinitial+NaddPadd. This reflects the fact that value of the firm has been enhanced by the cash inflow associated with the rights offering. Let this new share price be denoted by Pfinal. Now consider an investor who holds ninitial of the outstanding shares. In this rights offering, existing shareholders have the option to purchase additional shares to maintain their ownership stake. This number of shares is given by: nadd=NinitialNaddninitial If the investor decides to sell their rights, then the value per right is given by the difference PfinalPadd. In that case, the investor has the initial investment, which is now worth ninitialPfinal, plus the value of the sold rights, which is ninitial(PfinalPadd). The value of the rights "protects" the investor from the dilution of their ownership stake associated with the rights offering. uppose you own 50,000 shares of common stock in a firm with 2.5 million total shares outstanding. The firm announces a plan to sell n additional 1 million shares through a rights offering. The market value of the stock is $33 before the rights offering and the new hares are being offered to existing shareholders at a $3 discount. . If you exercise your preemptive rights, how many of the new shares can you purchase? What is the market value of the stock after the rights offering? (Enter your answer in millions rounded to 1 decimal place. (e.g., 2.1)) -1. What is your total investment in the firm after the rights offering? (Do not round intermediate calculations. Enter your answer in iillions rounded to 2 decimal places. (e.g., 32.16)) -2. If you exercise your preemptive right how many original shares and how many new shares do you have? -1. If you decide not to exercise your preemptive rights, what is your investment in the firm after the rights offering? (Do not round itermediate calculations. Enter your answer in millions rounded to 3 decimal places. (e.g., 32.161)) -2. If you sell your rights rather than use them, how much money will you receive from the rights sale and what is the total value of our proceeds from the sale of the rights offering plus your investment in the firm? (Enter your answer in millions rounded to 3 ecimal places. (e.g., 32.161))