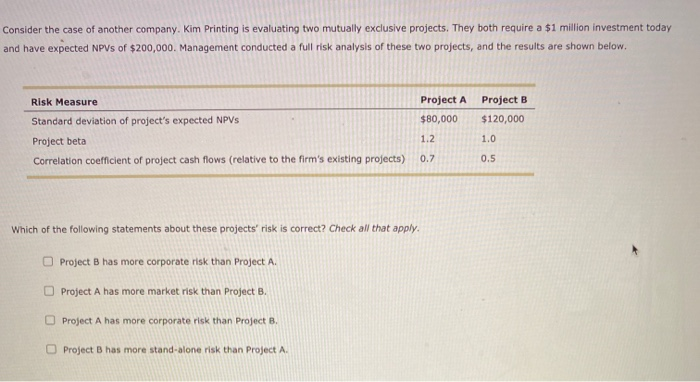

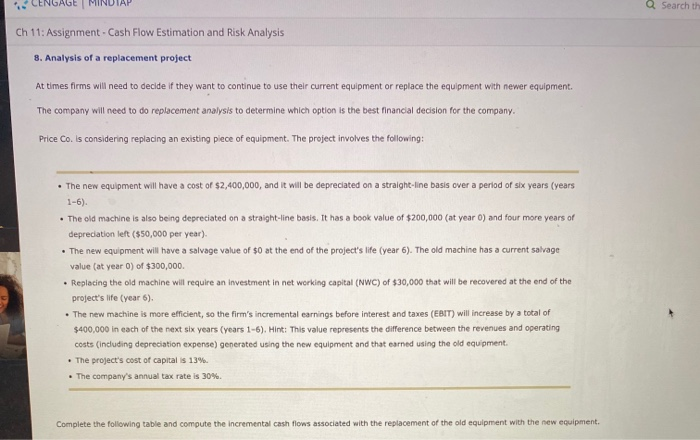

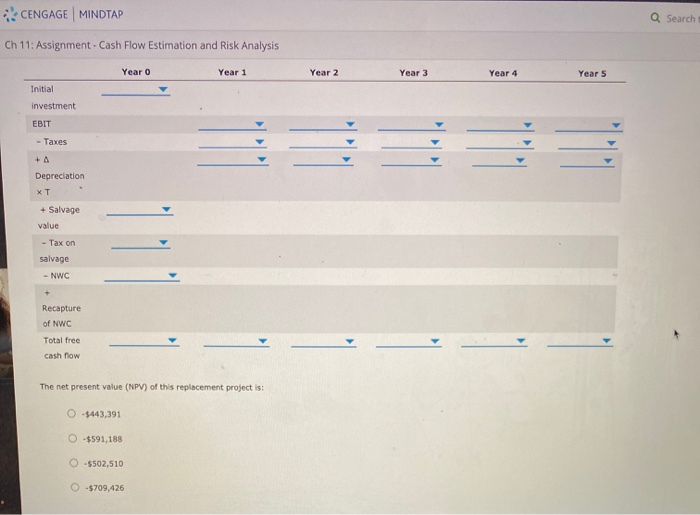

Consider the case of another company. Kim Printing is evaluating two mutually exclusive projects. They both require a $1 million investment today and have expected NPVS of $200,000. Management conducted a full risk analysis of these two projects, and the results are shown below. Project A $80,000 Project B $120,000 Risk Measure Standard deviation of project's expected NPVS Project beta Correlation coefficient of project cash flows (relative to the firm's existing projects) 1.2 1.0 0.7 0.5 Which of the following statements about these projects' risk is correct? Check all that apply. Project B has more corporate risk than Project A. Project A has more market risk than Project B. Project A has more corporate risk than Project B. Project B has more stand-alone risk than Project A. a Search the Ch 11: Assignment - Cash Flow Estimation and Risk Analysis 8. Analysis of a replacement project At times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. The company will need to do replacement analysis to determine which option is the best financial decision for the company. Price Co. is considering replacing an existing piece of equipment. The project involves the following: The new equipment will have a cost of $2,400,000, and it will be depreciated on a straight-line basis over a period of six years (years 1-6) The old machine is also being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and four more years of depreciation left ($50,000 per year). The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage value (at year c) of $300,000 Replacing the old machine will require an investment in net working capital (NWC) of $30,000 that will be recovered at the end of the project's life (year 6). The new machine is more efficient, so the firm's incremental earnings before interest and taxes (EBIT) will increase by a total of $400,000 in each of the next six years (Years 1-6). Hint: This value represents the difference between the revenues and operating costs (including depreciation expense) generated using the new equipment and that earned using the old equipment. The project's cost of capital is 13%. The company's annual tax rate is 30%. Complete the following table and compute the incremental cash flows associated with the replacement of the old equipment with the new equipment. CENGAGE MINDTAP Q Search Ch 11: Assignment - Cash Flow Estimation and Risk Analysis Year o Year 1 Year 2 Year 3 Year 4 Year 5 Initial investment EBIT - Taxes Depreciation XT + Salvage value - Tax on salvage -NWC Recapture of NWC Total free cash flow The net present value (NPV) of this replacement project is: O $443,391 -$591,188 O-$502,510 -$709,426 Consider the case of another company. Kim Printing is evaluating two mutually exclusive projects. They both require a $1 million investment today and have expected NPVS of $200,000. Management conducted a full risk analysis of these two projects, and the results are shown below. Project A $80,000 Project B $120,000 Risk Measure Standard deviation of project's expected NPVS Project beta Correlation coefficient of project cash flows (relative to the firm's existing projects) 1.2 1.0 0.7 0.5 Which of the following statements about these projects' risk is correct? Check all that apply. Project B has more corporate risk than Project A. Project A has more market risk than Project B. Project A has more corporate risk than Project B. Project B has more stand-alone risk than Project A. a Search the Ch 11: Assignment - Cash Flow Estimation and Risk Analysis 8. Analysis of a replacement project At times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. The company will need to do replacement analysis to determine which option is the best financial decision for the company. Price Co. is considering replacing an existing piece of equipment. The project involves the following: The new equipment will have a cost of $2,400,000, and it will be depreciated on a straight-line basis over a period of six years (years 1-6) The old machine is also being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and four more years of depreciation left ($50,000 per year). The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage value (at year c) of $300,000 Replacing the old machine will require an investment in net working capital (NWC) of $30,000 that will be recovered at the end of the project's life (year 6). The new machine is more efficient, so the firm's incremental earnings before interest and taxes (EBIT) will increase by a total of $400,000 in each of the next six years (Years 1-6). Hint: This value represents the difference between the revenues and operating costs (including depreciation expense) generated using the new equipment and that earned using the old equipment. The project's cost of capital is 13%. The company's annual tax rate is 30%. Complete the following table and compute the incremental cash flows associated with the replacement of the old equipment with the new equipment. CENGAGE MINDTAP Q Search Ch 11: Assignment - Cash Flow Estimation and Risk Analysis Year o Year 1 Year 2 Year 3 Year 4 Year 5 Initial investment EBIT - Taxes Depreciation XT + Salvage value - Tax on salvage -NWC Recapture of NWC Total free cash flow The net present value (NPV) of this replacement project is: O $443,391 -$591,188 O-$502,510 -$709,426