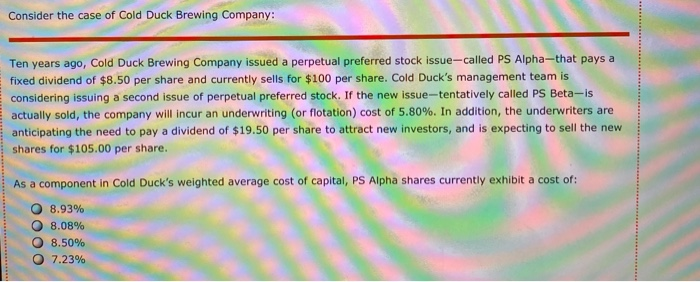

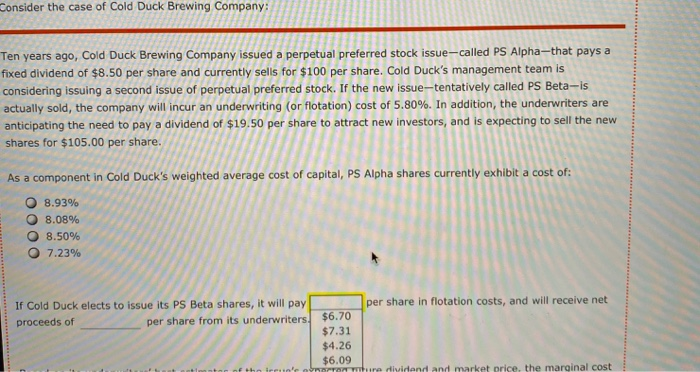

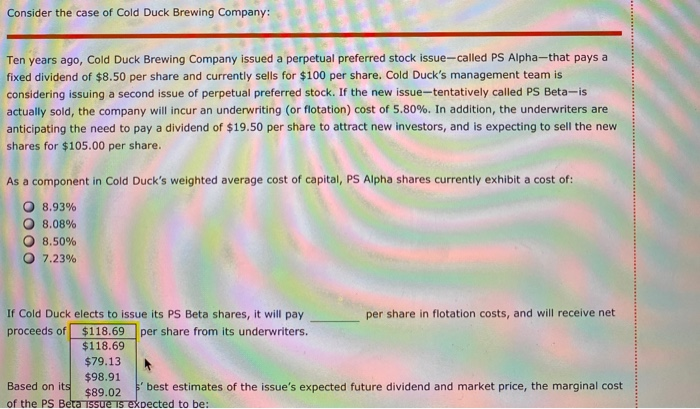

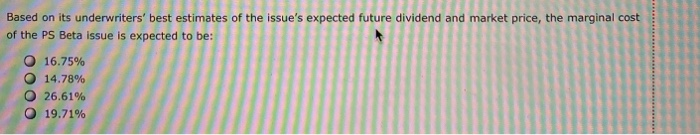

Consider the case of Cold Duck Brewing Company: Ten years ago, Cold Duck Brewing Company issued a perpetual preferred stock issue-called PS Alpha-that pays a fixed dividend of $8.50 per share and currently sells for $100 per share. Cold Duck's management team is considering issuing a second issue of perpetual preferred stock. If the new issue-tentatively called PS Beta-is actually sold, the company will incur an underwriting (or flotation) cost of 5.80%. In addition, the underwriters are anticipating the need to pay a dividend of $19.50 per share to attract new investors, and is expecting to sell the new shares for $105.00 per share. As a component in Cold Duck's weighted average cost of capital, PS Alpha shares currently exhibit a cost of: OO 8.93% 8.08% 8.50% 7.23% Consider the case of Cold Duck Brewing Company: Ten years ago, Cold Duck Brewing Company issued a perpetual preferred stock issue-called PS Alpha--that pays a fixed dividend of $8.50 per share and currently sells for $100 per share. Cold Duck's management team is considering issuing a second issue of perpetual preferred stock. If the new issue--tentatively called PS Beta-is actually sold, the company will incur an underwriting (or flotation) cost of 5.80%. In addition, the underwriters are anticipating the need to pay a dividend of $19.50 per share to attract new investors, and is expecting to sell the new shares for $105.00 per share. As a component in Cold Duck's weighted average cost of capital, PS Alpha shares currently exhibit a cost of: 8.93% 8.08% 8.50% 7.23% per share in flotation costs, and will receive net If Cold Duck elects to issue its PS Beta shares, it will pay proceeds of per share from its underwriters. $6.70 $7.31 $4.26 $6.09 hure dividend and market price, the marginal cost Consider the case of Cold Duck Brewing Company: Ten years ago, Cold Duck Brewing Company issued a perpetual preferred stock issue--called PS Alpha-that pays a fixed dividend of $8.50 per share and currently sells for $100 per share. Cold Duck's management team is considering issuing a second issue of perpetual preferred stock. If the new issue-tentatively called PS Beta-is actually sold, the company will incur an underwriting (or flotation) cost of 5.80%. In addition, the underwriters are anticipating the need to pay a dividend of $19.50 per share to attract new investors, and is expecting to sell the new shares for $105.00 per share. As a component in Cold Duck's weighted average cost of capital, PS Alpha shares currently exhibit a cost of: 8.93% 8.08% 8.50% 7.23% If Cold Duck elects to issue its PS Beta shares, it will pay per share in flotation costs, and will receive net proceeds of $118.69 per share from its underwriters. $118.69 $79.13 $98.91 Based on its $89.02 'best estimates of the issue's expected future dividend and market price, the marginal cost of the PS Beta issue is expected to be: Based on its underwriters' best estimates of the issue's expected future dividend and market price, the marginal cost of the PS Beta issue is expected to be: 16.75% 14.78% 26.61% 19.71% Companies preferred of should not should make tax adjustments when calculating the (after-tax) cost of preferred stock because tax deductible, so the company bears their full cost