Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the case of the following annuities, and the need to compute either their expected rate of return or duration. Ryan needed money for

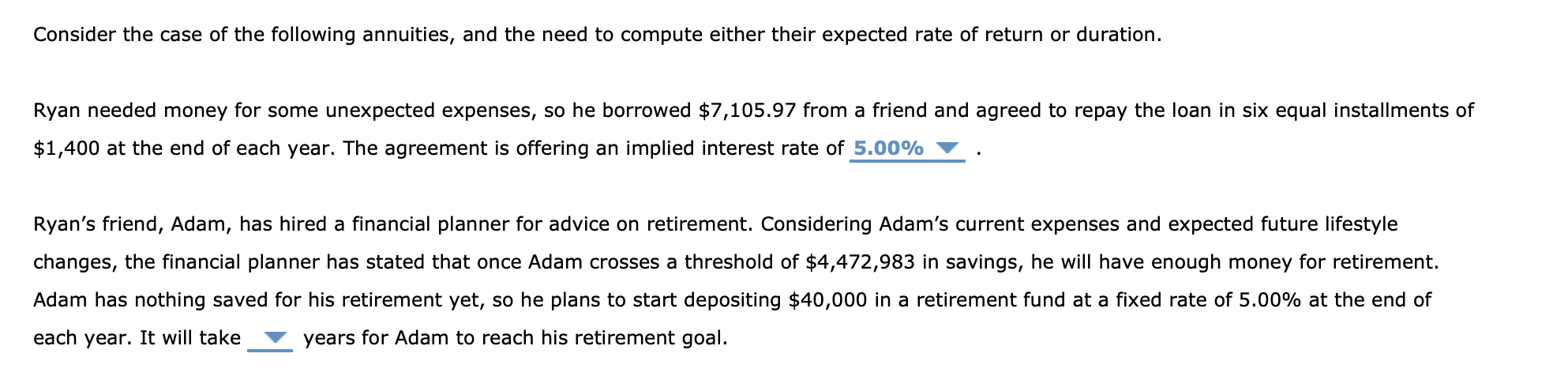

Consider the case of the following annuities, and the need to compute either their expected rate of return or duration. Ryan needed money for some unexpected expenses, so he borrowed $7,105.97 from a friend and agreed to repay the loan in six equal installments of $1,400 at the end of each year. The agreement is offering an implied interest rate of 5.00% Ryan's friend, Adam, has hired a financial planner for advice on retirement. Considering Adam's current expenses and expected future lifestyle changes, the financial planner has stated that once Adam crosses a threshold of $4,472,983 in savings, he will have enough money for retirement. Adam has nothing saved for his retirement yet, so he plans to start depositing $40,000 in a retirement fund at a fixed rate of 5.00% at the end of each year. It will take years for Adam to reach his retirement goal.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

For Ryans loan Given Principal P 710597 Number of payments n 6 Payment amount A 1400 Inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started