Question: Consider the decision problem of a representative household optimally choosing a sequence of consumption (c) and asset holdings (+1) over an infinite horizon, taking

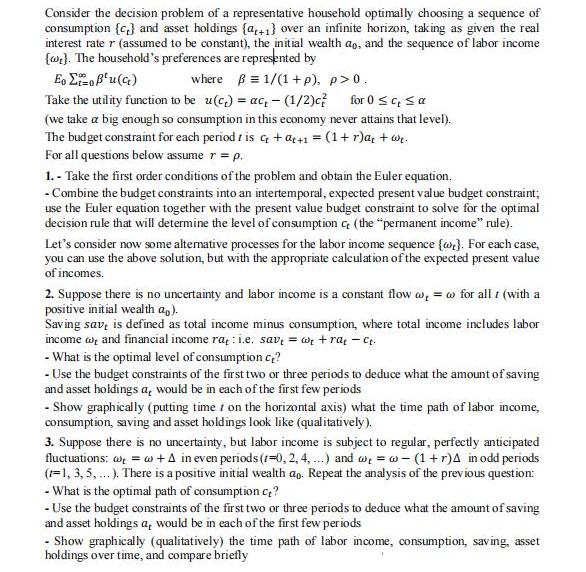

Consider the decision problem of a representative household optimally choosing a sequence of consumption (c) and asset holdings (+1) over an infinite horizon, taking as given the real interest rate r (assumed to be constant), the initial wealth ao, and the sequence of labor income [w). The household's preferences are represented by Eo Et=0Bu(at) Take the utility function to be u(c) = ac, - (1/2)c for 0 c, s a (we take a big enough so consumption in this economy never attains that level). The budget constraint for each period tis c+at+1 = (1 + r)a + we. For all questions below assume r = p. where = 1/(1+p), p>0. 1.- Take the first order conditions of the problem and obtain the Euler equation. - Combine the budget constraints into an intertemporal, expected present value budget constraint; use the Euler equation together with the present value budget constraint to solve for the optimal decision rule that will determine the level of consumption c (the "permanent income" rule). Let's consider now some alternative processes for the labor income sequence (w). For each case, you can use the above solution, but with the appropriate calculation of the expected present value of incomes. 2. Suppose there is no uncertainty and labor income is a constant flow w, w for all 1 (with a positive initial wealth a.). Saving sav, is defined as total income minus consumption, where total income includes labor income w, and financial income ra: i.e. sav = a + rat -ct. - What is the optimal level of consumption ce? - Use the budget constraints of the first two or three periods to deduce what the amount of saving and asset holdings a, would be in each of the first few periods - Show graphically (putting time t on the horizontal axis) what the time path of labor income, consumption, saving and asset holdings look like (qualitatively). 3. Suppose there is no uncertainty, but labor income is subject to regular, perfectly anticipated fluctuations: @= @ + A in even periods (1-0, 2, 4, ...) and w=w-(1+r)A in odd periods (1=1, 3, 5,...). There is a positive initial wealth ao. Repeat the analysis of the previous question: - What is the optimal path of consumption c? - Use the budget constraints of the first two or three periods to deduce what the amount of saving and asset holdings a, would be in each of the first few periods - Show graphically (qualitatively) the time path of labor income, consumption, saving, asset holdings over time, and compare briefly

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

1 a The firstorder conditions are uct 1 rEuct1 Taking the derivative of the utility function gives u... View full answer

Get step-by-step solutions from verified subject matter experts