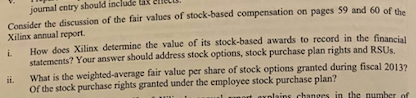

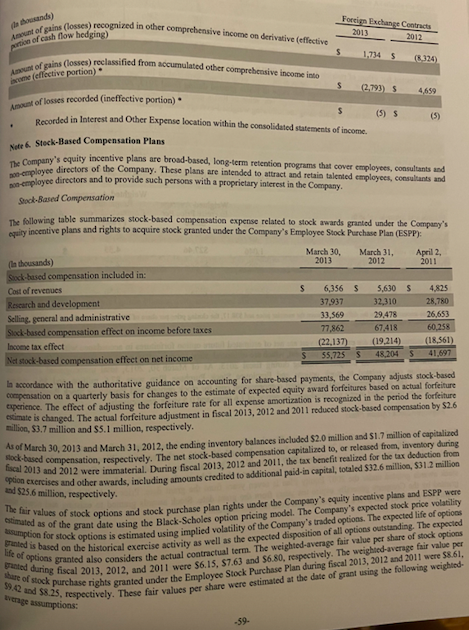

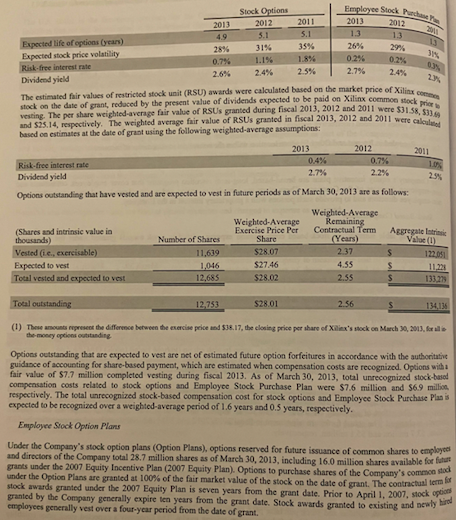

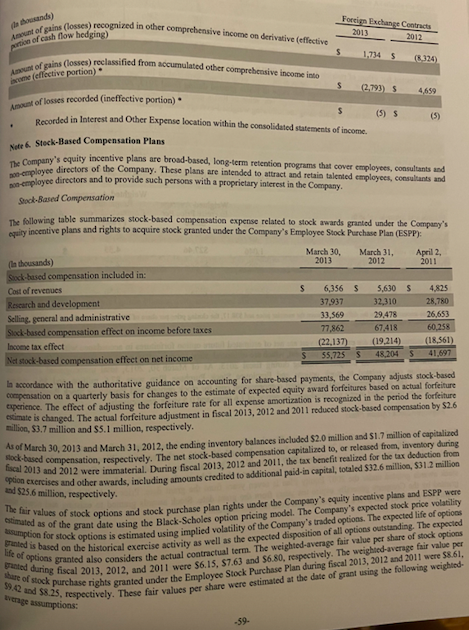

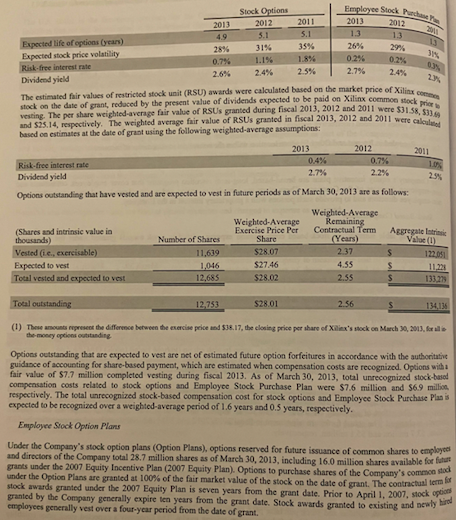

Consider the discussion of the fair values of stock-based compensation on pages 59 and 60 of the Xilin x annual report. i. How does Xilinx determine the value of its stock-based awards to record in the financial statements? Your answer should address stock options, stock purchase plan rights and RSUs. ii. What is the weighted-average fair value per share of stock options granted during fiscal 2013? Of the stock purchase rights granted under the employee stock purchase plan? Nete 6. Steck-Based Compensation Plans The Company's equity incentive plans are broad-based, long-term retention programs that cover employees, consultants and not-employee directors of the Company. These plans are intended to attract and retain talented employees, consultants and pan-employee directors and to provide such persons with a proprictary interest in the Company. Sock-Based Comperisation The following table summarizes stock-based compensation expense related to stock awards grantod under the Company's equily incentive plans and rights to acquire stock granted under the Company's Employee Stock Purchase Plan (ESPP): Wa acoordance with the authoritative guidance on accounting for share-based payments, the Company adjusts stock-bascd compensation on a quarterly basis for changes to the estimate of expected equity award forfeitures based on actual forfeiture experience. The effect of adjusting the forfeiture rate for all expense amortization is rocognized in the period the forfeiture eximate is changed. The actual forfeiture adjustment in fiscal 2013, 2012 and 2011 roduced stock-based compensation by $2.6 million, $3.7 million and $5.1 million, respectively. As of Mareh 30, 2013 and March 31, 2012, the ending inventory balances included $2.0 million and $1.7 million of capitalizod slock-based compensation, respectively. The net stock-based compensation capitaliaed to, of released froen, inventory daring fiscal 2013 and 2012 were immaterial. During fiscal 2013,2012 and 2011 , the tax benefit realized for the tax deduction from option exercises and other awards, including amounts credited to additional paid-in capital, tocaled $32.6 million, 531.2 million The fair values of stock options and stock purchase plan rights under the Conpany's cquity incentive plans and ESPP were and $25.6 million, respectively. entimated as of the grant date using the Black-Scholes option pricing model. The Company's expected stock price volatility arumption for stock options is estimated using implied volatility of the Company's traded options. The expected life of optiocs grinted is based on the historical exercise activity as well as the expected disposition of all options outstandiag. The experade ser share of stock options Erated during fiscal 2013,2012 , and 2011 were $6.15, $7.63 and $6.80, respectively. The weighted-average fair value per thure of stock purchase rights granted under the Employee Stock Purchase Plan during fiscal 2013,2012 and 2011 were $8.61, 59,42 and 58.25, respecti The estimated fair values of restricted stock unit (RSU) awards were calculated based on the market price of Xilinx cocmene vesting. The per share weighted-average fair value of RSUs granted durisg fiscal 2013, 2012 and 2011 wcte 53158 , 533 b.69 based on estimates at the date of grant using the following weighted-average assumptions: the mosery eptions cutatanding Options outstanding that are expected to vest are net of estimated future option forfeitures in accordance with the authoritativ guidnce of accounting for share-based payment, which are estimated when compensation costs are recognized. Options with a fair value of 57.7 million completed vesting during fiscal 2013. As of March 30, 2013, total unrecogmized stock-based compensation costs related to stock options and Employee Stock Purchase Plan were $7.6 million and 56.9 millioa respectively. The total unrecognized stock-based compensation cost for stock options and Employce Stock Purchase Plan is expected to be recognized over a weighted-average period of 1.6 years and 0.5 years, respectively. Employee Srock Option Plars Under the Company"s stock option plans (Option Plans), options reserved for future issuance of commoo shares to employted and dirtetors of the Company total 28.7 million shares as of March 30,2013 , including 16.0 million shares available for fitar grants under the 2007 Equity Incentive Plan (2007 Equity Plan). Options to purchase shares of the Company's common stod under the Optice Plans are granted at 100% of the fair market value of the stock on the date of grant. The contractual tern frr stock awadds granted under the 2007 Equity Plan is seven years from the grant date. Prior to April 1, 2007, slock optiop granted by the Company generally expire ten years from the grant date. Stock awards granted to existing and acwly hiod employees generally vest over a four-ycar period from the date of grant. Consider the discussion of the fair values of stock-based compensation on pages 59 and 60 of the Xilin x annual report. i. How does Xilinx determine the value of its stock-based awards to record in the financial statements? Your answer should address stock options, stock purchase plan rights and RSUs. ii. What is the weighted-average fair value per share of stock options granted during fiscal 2013? Of the stock purchase rights granted under the employee stock purchase plan? Nete 6. Steck-Based Compensation Plans The Company's equity incentive plans are broad-based, long-term retention programs that cover employees, consultants and not-employee directors of the Company. These plans are intended to attract and retain talented employees, consultants and pan-employee directors and to provide such persons with a proprictary interest in the Company. Sock-Based Comperisation The following table summarizes stock-based compensation expense related to stock awards grantod under the Company's equily incentive plans and rights to acquire stock granted under the Company's Employee Stock Purchase Plan (ESPP): Wa acoordance with the authoritative guidance on accounting for share-based payments, the Company adjusts stock-bascd compensation on a quarterly basis for changes to the estimate of expected equity award forfeitures based on actual forfeiture experience. The effect of adjusting the forfeiture rate for all expense amortization is rocognized in the period the forfeiture eximate is changed. The actual forfeiture adjustment in fiscal 2013, 2012 and 2011 roduced stock-based compensation by $2.6 million, $3.7 million and $5.1 million, respectively. As of Mareh 30, 2013 and March 31, 2012, the ending inventory balances included $2.0 million and $1.7 million of capitalizod slock-based compensation, respectively. The net stock-based compensation capitaliaed to, of released froen, inventory daring fiscal 2013 and 2012 were immaterial. During fiscal 2013,2012 and 2011 , the tax benefit realized for the tax deduction from option exercises and other awards, including amounts credited to additional paid-in capital, tocaled $32.6 million, 531.2 million The fair values of stock options and stock purchase plan rights under the Conpany's cquity incentive plans and ESPP were and $25.6 million, respectively. entimated as of the grant date using the Black-Scholes option pricing model. The Company's expected stock price volatility arumption for stock options is estimated using implied volatility of the Company's traded options. The expected life of optiocs grinted is based on the historical exercise activity as well as the expected disposition of all options outstandiag. The experade ser share of stock options Erated during fiscal 2013,2012 , and 2011 were $6.15, $7.63 and $6.80, respectively. The weighted-average fair value per thure of stock purchase rights granted under the Employee Stock Purchase Plan during fiscal 2013,2012 and 2011 were $8.61, 59,42 and 58.25, respecti The estimated fair values of restricted stock unit (RSU) awards were calculated based on the market price of Xilinx cocmene vesting. The per share weighted-average fair value of RSUs granted durisg fiscal 2013, 2012 and 2011 wcte 53158 , 533 b.69 based on estimates at the date of grant using the following weighted-average assumptions: the mosery eptions cutatanding Options outstanding that are expected to vest are net of estimated future option forfeitures in accordance with the authoritativ guidnce of accounting for share-based payment, which are estimated when compensation costs are recognized. Options with a fair value of 57.7 million completed vesting during fiscal 2013. As of March 30, 2013, total unrecogmized stock-based compensation costs related to stock options and Employee Stock Purchase Plan were $7.6 million and 56.9 millioa respectively. The total unrecognized stock-based compensation cost for stock options and Employce Stock Purchase Plan is expected to be recognized over a weighted-average period of 1.6 years and 0.5 years, respectively. Employee Srock Option Plars Under the Company"s stock option plans (Option Plans), options reserved for future issuance of commoo shares to employted and dirtetors of the Company total 28.7 million shares as of March 30,2013 , including 16.0 million shares available for fitar grants under the 2007 Equity Incentive Plan (2007 Equity Plan). Options to purchase shares of the Company's common stod under the Optice Plans are granted at 100% of the fair market value of the stock on the date of grant. The contractual tern frr stock awadds granted under the 2007 Equity Plan is seven years from the grant date. Prior to April 1, 2007, slock optiop granted by the Company generally expire ten years from the grant date. Stock awards granted to existing and acwly hiod employees generally vest over a four-ycar period from the date of grant