Answered step by step

Verified Expert Solution

Question

1 Approved Answer

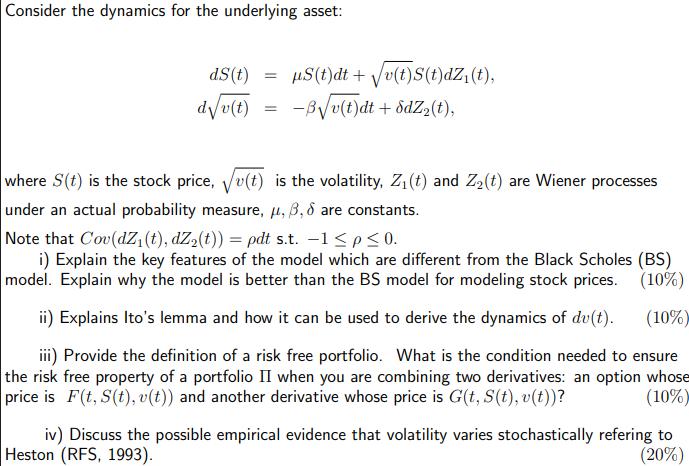

Consider the dynamics for the underlying asset: dS(t) = S(t)dt + v(t)S(t)dZ (t), dv(t) -Bv(t)dt + ddz(t), = where S(t) is the stock price,

Consider the dynamics for the underlying asset: dS(t) = S(t)dt + v(t)S(t)dZ (t), dv(t) -Bv(t)dt + ddz(t), = where S(t) is the stock price, v(t) is the volatility, Z(t) and Z(t) are Wiener processes under an actual probability measure, , 3,6 are constants. Note that Cov(dZ (t), dZ(t)) = pdt s.t. -1 < p < 0. i) Explain the key features of the model which are different from the Black Scholes (BS) model. Explain why the model is better than the BS model for modeling stock prices. (10%) ii) Explains Ito's lemma and how it can be used to derive the dynamics of dv(t). (10%) iii) Provide the definition of a risk free portfolio. What is the condition needed to ensure the risk free property of a portfolio II when you are combining two derivatives: an option whose price is F(t, S(t), v(t)) and another derivative whose price is G(t, S(t), v(t))? (10%) iv) Discuss the possible empirical evidence that volatility varies stochastically refering to Heston (RFS, 1993). (20%)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

i The key features of the model above that are different from the BlackScholes BS model include the stochastic volatility component represented by dvt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started