Answered step by step

Verified Expert Solution

Question

1 Approved Answer

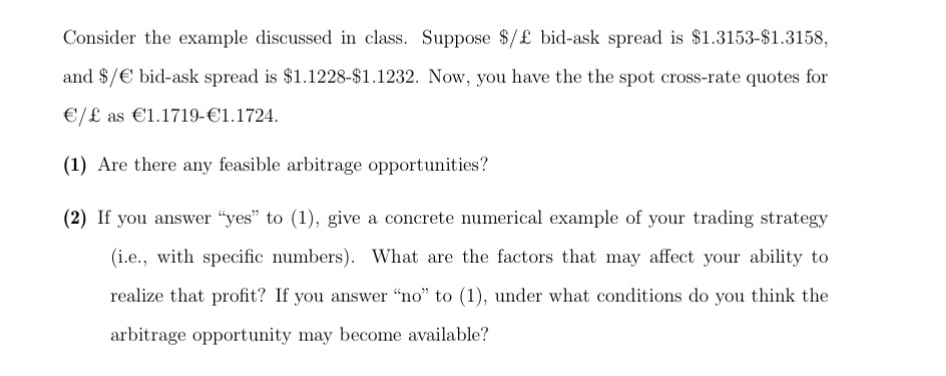

Consider the example discussed in class. Suppose $ bid - ask spread is $ 1 . 3 1 5 3 - $ 1 . 3

Consider the example discussed in class. Suppose bidask spread is $ $

and bidask spread is $ $ Now, you have the the spot crossrate quotes for

as

Are there any feasible arbitrage opportunities?

If you answer "yes" to give a concrete numerical example of your trading strategy

ie with specific numbers What are the factors that may affect your ability to

realize that profit? If you answer no to under what conditions do you think the

arbitrage opportunity may become available?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started