Question

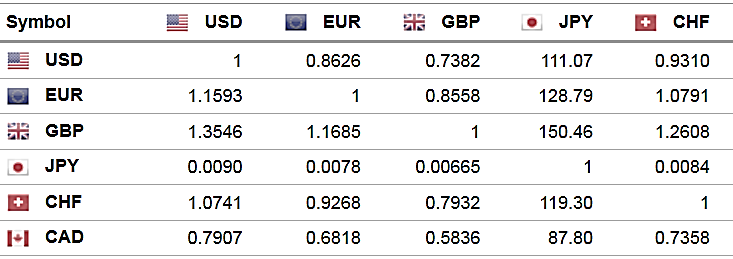

Consider the exchange rates shown in the table (current for today) for these six currencies the U.S. dollar, the Euro, the British pound, the Japanese

Consider the exchange rates shown in the table (current for today) for these six currencies the U.S. dollar, the Euro, the British pound, the Japanese yen, the Swiss franc, and the Canadian dollar (partial). The numbers in the table show the amount of the currency heading that column it takes to buy one unit of the currency heading that row. For example, in the first column we can see that it takes 1.3546 U.S. dollars to buy 1 British pound. Likewise, in the third column we can see that it takes 0.7382 British pounds to buy 1 U.S. dollar. Of course these numbers are reciprocals of one another, i.e., 1/(1.3546) = 0.7382. Use this table to answer the following questions.

Nine fill-in questions @ variable credit for 20 points total.

1. As of today, what is the exchange rate between the U.S. dollar and the Swiss franc, from the perspective of the U.S.? [To 3 decimal place.]

1.074

2. As of today, what is the exchange rate between the British pound and the Euro, from the British perspective? [To 4 decimal place.]

1.1685

3. As of today, what is the exchange rate between the Canadian dollar and the Swiss franc, from the Canadian perspective? [To 3 decimal place.]

4. Suppose that the market expects that the exchange rate between the yen and the franc will rise by 5%, from the Japanese perspective. If so, what will be this expected future exchange rate, from the Japanese perspective? [To 3 decimal place.]

5. Suppose that the market expects that the exchange rate between the yen and the franc will rise by 5%, from the Japanese perspective. If so, what will be this expected future exchange rate, from the Swiss perspective? [To 5 decimal place.]

6. Over the last three years, the increased British preference for American goods has caused the exchange rate to change by 5.5% (from the British perspective) to the value shown in the table. From the British perspective, what must have been the exchange rate three years ago? [To 4 decimal place.]

7. Over the last three years, the increased British preference for American goods has caused the exchange rate to change by 5.5% (from the British perspective) to the value shown in the table. From the American perspective, what must have been the exchange rate three years ago? [To 3 decimal place.]

8. Today the Canadians decided to impose tariffs on goods shipped there from Europe. Consequently the euro is expected to depreciate by 7.5% (from the European perspective) over the next two years. If this happens, what will be the exchange rate in 2023 from the Canadian perspective? [To 4 decimal place.]

9. Suppose that the market expects that the exchange rate between euros and yen will fall to 83.22 yen per euro in one year. If the nominal rate of interest for a one year bond in Europe is currently 5.5%, and if the interest parity condition holds, what is the nominal interest rate on a one year bond sold in Japan? [To 3 decimal place and include %.]

Symbol USD EUR 13 GBP JPY CHF USD 1 0.8626 0.7382 111.07 0.9310 EUR 1.1593 1 0.8558 128.79 1.0791 GBP 1.3546 1.1685 1 150.46 1.2608 JPY 0.0090 0.0078 0.00665 1 0.0084 + CHF 1.0741 0.9268 0.7932 119.30 1 CAD 0.7907 0.6818 0.5836 87.80 0.7358 Symbol USD EUR 13 GBP JPY CHF USD 1 0.8626 0.7382 111.07 0.9310 EUR 1.1593 1 0.8558 128.79 1.0791 GBP 1.3546 1.1685 1 150.46 1.2608 JPY 0.0090 0.0078 0.00665 1 0.0084 + CHF 1.0741 0.9268 0.7932 119.30 1 CAD 0.7907 0.6818 0.5836 87.80 0.7358Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started