Question

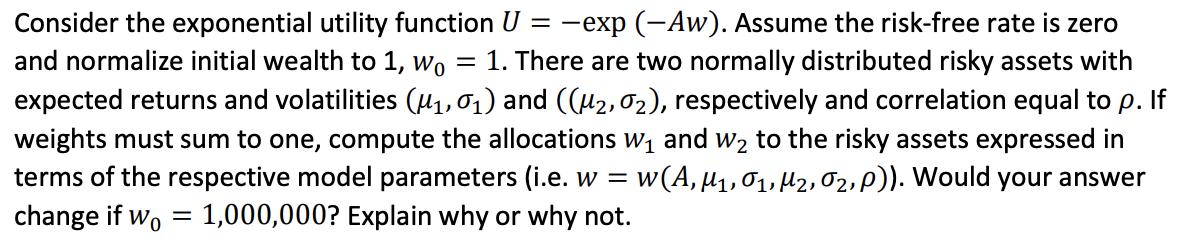

Consider the exponential utility function U = -exp (-Aw). Assume the risk-free rate is zero and normalize initial wealth to 1, Wo = 1.

Consider the exponential utility function U = -exp (-Aw). Assume the risk-free rate is zero and normalize initial wealth to 1, Wo = 1. There are two normally distributed risky assets with expected returns and volatilities (,0) and ((M2, 02), respectively and correlation equal to p. If weights must sum to one, compute the allocations w and W to the risky assets expressed in terms of the respective model parameters (i.e. w = w(A, M, 01, M2, 02, p)). Would your answer change if wo = 1,000,000? Explain why or why not.

Step by Step Solution

3.60 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

To compute the allocations w and w to the risky assets we need to maximize the exponential utility f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics An Intuitive Approach with Calculus

Authors: Thomas Nechyba

1st edition

538453257, 978-0538453257

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App