Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the financing decision of a new investment opportunity for the four firms. The new investment opportunity yields a return of Rs. 1.2 at the

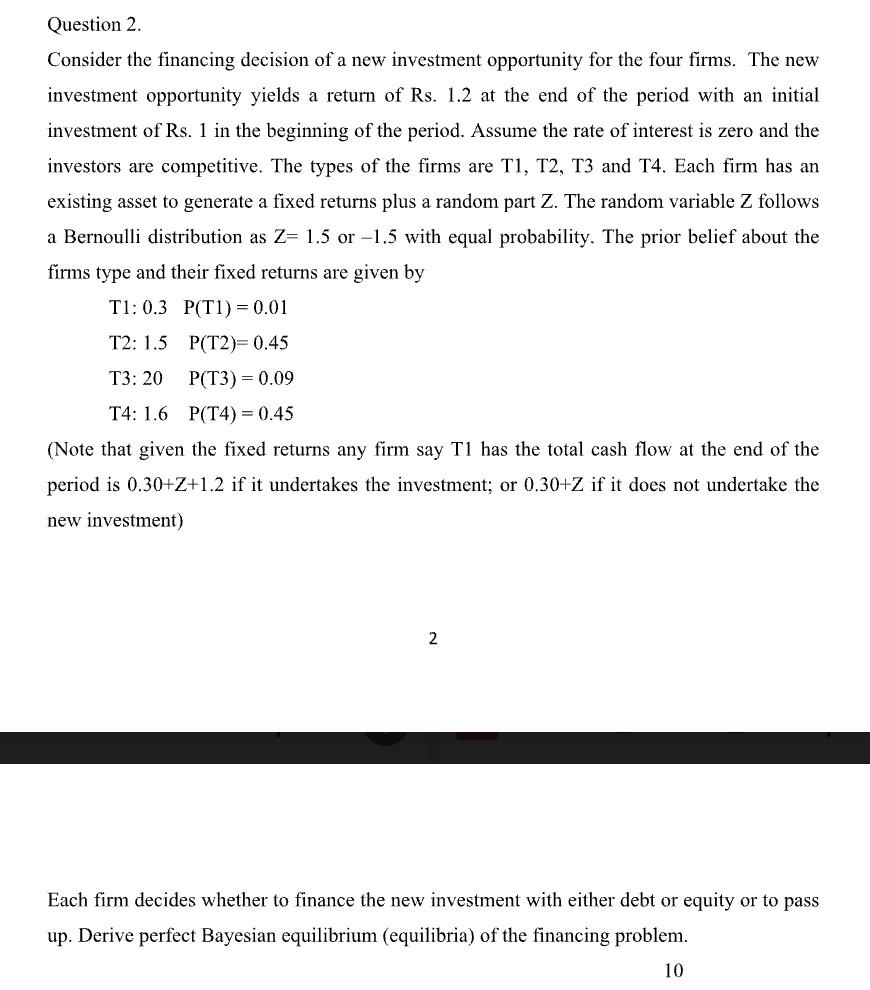

Consider the financing decision of a new investment opportunity for the four firms. The new investment opportunity yields a return of Rs. 1.2 at the end of the period with an initial investment of Rs. 1 in the beginning of the period. Assume the rate of interest is zero and the investors are competitive. The types of the firms are T1, T2, T3 and T4. Each firm has an existing asset to generate a fixed returns plus a random part Z. The random variable Z follows a Bernoulli distribution as Z=1.5 or -1.5 with equal probability. The prior belief about the firms type and their fixed returns are given by T1:0.3P(T1)=0.01 T2: 1.5P(T2)=0.45 T3:20P(T3)=0.09 T4: 1.6P(T4)=0.45 (Note that given the fixed returns any firm say T1 has the total cash flow at the end of the period is 0.30+Z+1.2 if it undertakes the investment; or 0.30+Z if it does not undertake the new investment) 2 Each firm decides whether to finance the new investment with either debt or equity or to pass up. Derive perfect Bayesian equilibrium (equilibria) of the financing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started