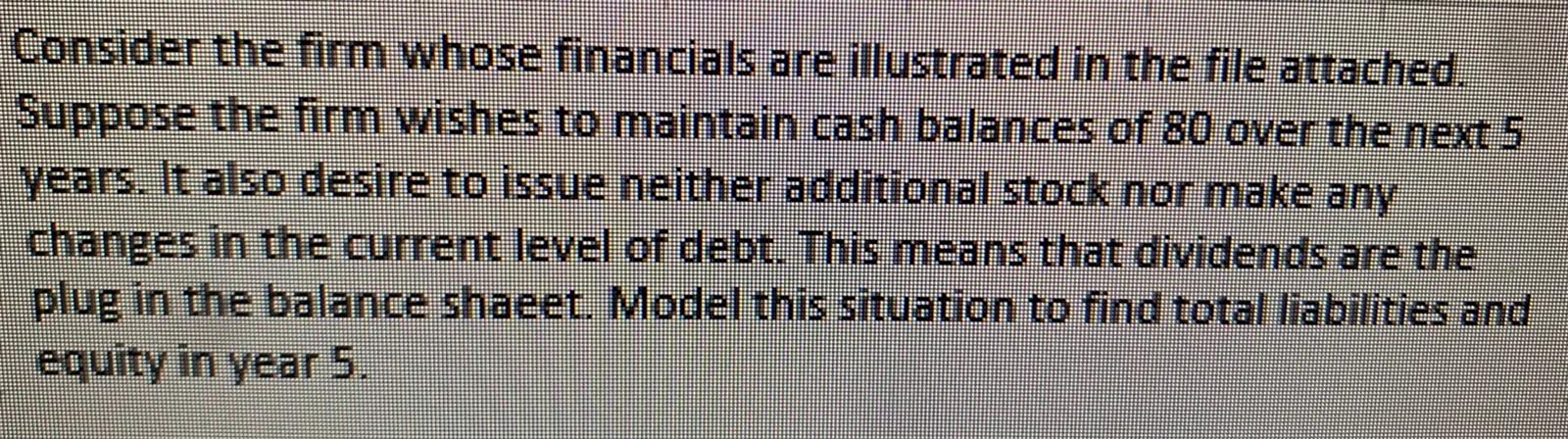

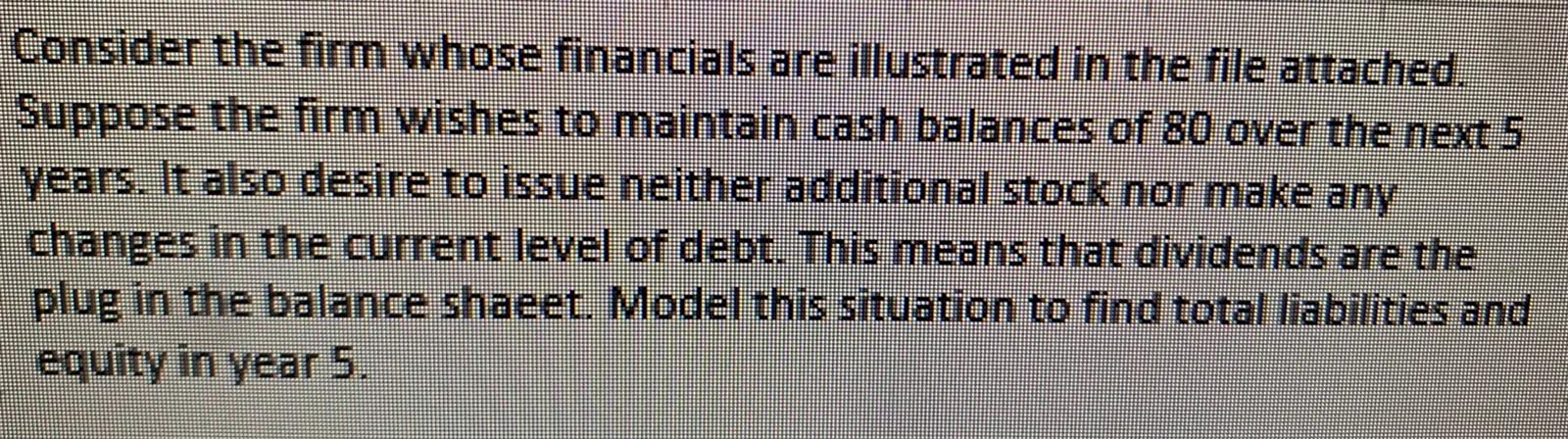

Consider the firm whose financials are illustrated in the file attached. Suppose the firm wishes to maintain cash balances of 80 over the next 5 years. It also desire to issue neither additional stock nor make any changes in the current level of debt. This means that dividends are the plug in the balance shaeet. Model this situation to find total liabilities and equity in year 5. E F G A B SUSTAINABLE DIVIDENDS--Template Bales growth 10% Current assets/Sales 15% Current liabilities/Sales 8% Vet fixed assets/Sales 77% Costs of goods sold'Sales 50% Depreciation rate 10% nterest rate on debt 10.00% Interest paid on cash & marketable securities 8.00% Tax rate 40% Consider the fir Suppose the firn years. It also des changes in the ce plug in the balan equity in year 5. 0 1 N 3 4 5 1,000 (500) 1,210 (605) 3 6 (1,331) 666 (0) 6 1,464 (732) Year Income statement Sales Costs of goods sold Interest payments on debt Interest earned on cash & marketable securities Depreciation Profit before tax Taxes Profit after tax Dividends Retained earnings (1,611) 805 (0) (32) 6 6 - (1,100) 550 (32) 6 (54) (629) 252 (377) (126) (503) 6 (100) 374 (150) 225 (90) 615 (246) 369 123 492 (659) 264 (396) (132) (528) 738 (295) 443 148 (799) 320 (479) (160) (639) 135 591 80 80 80 150 80 80 80 Balance sheet Cash and marketable securities Current assets Fixed assets 8 At cost Depreciation Net fixed assets Total assets 1,070 (300) 770 1,000 80 320 450 150 1,000 320 450 320 450 320 450 320 450 4 Current liabilities 5 Debt 6 Stock 7 Accumulated retained earnings E8 Total liabilities and equity 39 10 11 320 450 Consider the firm whose financials are illustrated in the file attached. Suppose the firm wishes to maintain cash balances of 80 over the next 5 years. It also desire to issue neither additional stock nor make any changes in the current level of debt. This means that dividends are the plug in the balance shaeet. Model this situation to find total liabilities and equity in year 5. E F G A B SUSTAINABLE DIVIDENDS--Template Bales growth 10% Current assets/Sales 15% Current liabilities/Sales 8% Vet fixed assets/Sales 77% Costs of goods sold'Sales 50% Depreciation rate 10% nterest rate on debt 10.00% Interest paid on cash & marketable securities 8.00% Tax rate 40% Consider the fir Suppose the firn years. It also des changes in the ce plug in the balan equity in year 5. 0 1 N 3 4 5 1,000 (500) 1,210 (605) 3 6 (1,331) 666 (0) 6 1,464 (732) Year Income statement Sales Costs of goods sold Interest payments on debt Interest earned on cash & marketable securities Depreciation Profit before tax Taxes Profit after tax Dividends Retained earnings (1,611) 805 (0) (32) 6 6 - (1,100) 550 (32) 6 (54) (629) 252 (377) (126) (503) 6 (100) 374 (150) 225 (90) 615 (246) 369 123 492 (659) 264 (396) (132) (528) 738 (295) 443 148 (799) 320 (479) (160) (639) 135 591 80 80 80 150 80 80 80 Balance sheet Cash and marketable securities Current assets Fixed assets 8 At cost Depreciation Net fixed assets Total assets 1,070 (300) 770 1,000 80 320 450 150 1,000 320 450 320 450 320 450 320 450 4 Current liabilities 5 Debt 6 Stock 7 Accumulated retained earnings E8 Total liabilities and equity 39 10 11 320 450