Question

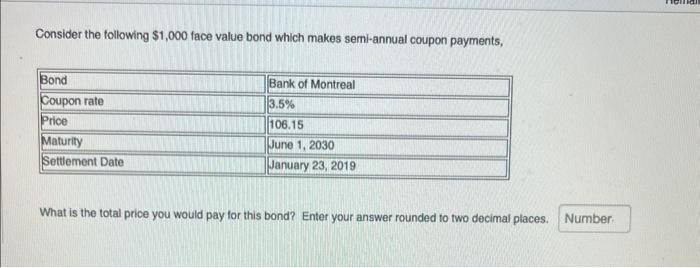

Consider the following $1,000 face value bond which makes semi-annual coupon payments, Bond Coupon rate Price Maturity Settlement Date Bank of Montreal 3.5% 106.15

Consider the following $1,000 face value bond which makes semi-annual coupon payments, Bond Coupon rate Price Maturity Settlement Date Bank of Montreal 3.5% 106.15 June 1, 2030 January 23, 2019 What is the total price you would pay for this bond? Enter your answer rounded to two decimal places. Number nollial

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total price of the bond we need to add the accrued interest to the quoted price The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Operations Research

Authors: Frederick S. Hillier, Gerald J. Lieberman

10th edition

978-0072535105, 72535105, 978-1259162985

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App