Question

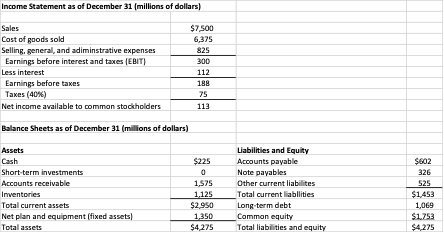

Consider the following 2022 financial statements for Rocket Inc. (21 points in total) Calculate the indicated ratio (see the table below) for Rocket Inc. Outline

- Consider the following 2022 financial statements for Rocket Inc. (21 points in total)

- Calculate the indicated ratio (see the table below) for Rocket Inc.

- Outline Rockets strengths and weakness as revealed your analysis

- Construct the extended Du Pont equation for both Rocket and the industry. Explain why did Rocket Inc. outperform (or underperform) the industry in ROE.

Ratio Rocky Industry Average

Current Ratio ______________________________ 2.00

Quick Ratio ______________________________ 1.00

Inventory turnover ______________________________ 6.7

Day sales outstanding ______________________________ 35 days

Fixed asset turnover.._______________________________ 12.1

Total assets turnover ______________________________ 3.0

Profit margin ______________________________ 1.2%

Time interest earned ratio ______________________________ 4.2

Debt-to assets ratio _________________________ 30.0%

Liabilities-to-assets ratio ____________________________ 60.0%

ROA ______________________________ 3.6%

ROE ______________________________ 9.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started