Answered step by step

Verified Expert Solution

Question

1 Approved Answer

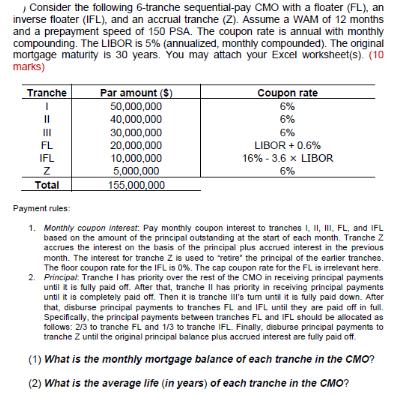

Consider the following 6-tranche sequential-pay CMO with a floater (FL), an inverse floater (IFL), and an accrual tranche (Z). Assume a WAM of 12

Consider the following 6-tranche sequential-pay CMO with a floater (FL), an inverse floater (IFL), and an accrual tranche (Z). Assume a WAM of 12 months and a prepayment speed of 150 PSA. The coupon rate is annual with monthly compounding. The LIBOR is 5% (annualized, monthly compounded). The original mortgage maturity is 30 years. You may attach your Excel worksheet(s). (10 marks) Tranche 1 || III FL IFL Z Total Par amount ($) 50,000,000 40,000,000 30,000,000 20,000,000 10,000,000 5,000,000 155,000,000 Coupon rate 6% 6% 6% LIBOR + 0.6% 16% -3.6 x LIBOR 6% Payment rules: 1. Monthly coupon Interest: Pay monthly coupon interest to tranches I, II, III, FL, and IFL based on the amount of the principal outstanding at the start of each month. Tranche Z accrues the interest on the basis of the principal plus accrued interest in the previous month. The interest for tranche Z is used to retire the principal of the earlier tranches. The floor coupon rate for the IFL is 0%. The cap coupon rate for the FL is irrelevant here. 2. Principal: Tranche I has priority over the rest of the CMO in receiving principal payments until it is fully paid off. After that, tranche II has priority in receiving principal payments until it is completely paid off. Then it is tranche ill's turn until it is fully paid down. After that, disburse principal payments to tranches FL and IFL until they are paid off in full. Specifically, the principal payments between tranches FL and IFL should be allocated as follows: 2/3 to tranche FL and 1/3 to tranche IFL. Finally, disburse principal payments to tranche Z until the original principal balance plus accrued interest are fully paid off. (1) What is the monthly mortgage balance of each tranche in the CMO? (2) What is the average life (in years) of each tranche in the CMO?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started